Insilico Medicine’s $1B Business Model: AI That Discovered a Real Drug in 18 Months (Big Pharma Takes 10 Years)

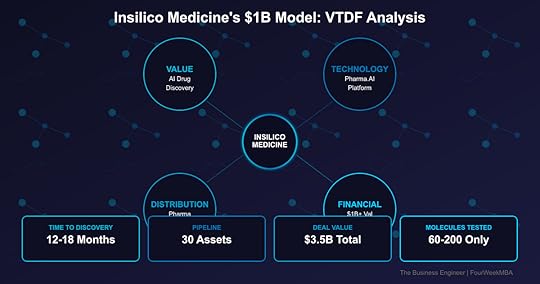

Insilico Medicine reached unicorn status with a $1B+ valuation by using AI to compress drug discovery from 10+ years to 18 months—and they have the clinical trials to prove it. Founded in 2014, Insilico’s Pharma.AI platform has generated 30 drug candidates with just 60-200 molecules tested per program (vs thousands traditionally). With $3.5B in pharma partnership deals including Sanofi and Fosun, they’re not just theorizing about AI drug discovery—they’re delivering real drugs entering human trials. The Hong Kong-based company just raised $110M to advance their lead drug for lung fibrosis into Phase 3.

Value Creation: Solving Pharma’s $2.6B ProblemThe Problem Insilico SolvesTraditional Drug Discovery Crisis:

10-15 years per drug$2.6B average cost90% failure rateThousands of molecules testedManual hypothesis generationLimited target identificationPharma Industry Pain:

Patent cliffs loomingR&D productivity decliningCosts unsustainableInnovation stagnatingCompetition from biosimilarsShareholder pressureInsilico’s Solution:

12-18 months to clinical candidate10x cost reductionAI-generated novel targets60-200 molecules onlyAutomated hypothesis generationSuccess rate improvingValue Proposition LayersFor Pharma Companies:

Accelerate pipeline developmentReduce R&D costs dramaticallyDiscover novel targetsDe-risk early developmentAccess AI capabilitiesMaintain competitive edgeFor Patients:

Faster access to treatmentsNovel therapies for rare diseasesLower drug costs eventuallyBetter targeted medicinesHope for untreatable conditionsPersonalized approachesFor Healthcare Systems:

Reduced drug development costsMore treatment optionsAddressing unmet needsInnovation accelerationCost-effectivenessGlobal health impactQuantified Impact:

Insilico discovered and developed ISM001-055 for idiopathic pulmonary fibrosis in 18 months for under $3M—a process that typically takes Pfizer or Roche 5+ years and $100M+.

1. PandaOmics: Target Discovery

Multi-omics data analysisNovel target identificationDisease pathway mappingBiomarker discoveryPatient stratificationLiterature mining2. Chemistry42: Molecule Generation

Generative chemistry modelsDe novo drug designProperty optimizationSynthesis predictionADMET optimizationLead optimization3. InClinico: Clinical Trial Prediction

Success probability modelingPatient response predictionAdverse event forecastingTrial design optimizationRegulatory strategyMarket modelingTechnical Differentiatorsvs. Traditional Pharma R&D:

Months vs years60 molecules vs 5,000AI-first vs hypothesis-drivenSystematic vs trial-and-errorPredictive vs reactiveIntegrated vs siloedvs. Other AI Drug Companies:

Full stack platformClinical validationRevenue generationRobotic automationGlobal presenceProven successKey Metrics:

Time to candidate: 12-18 monthsMolecules synthesized: 60-200Success rate: ImprovingPipeline assets: 30IND approvals: 10Clinical trials: MultipleDistribution Strategy: The Hybrid ModelBusiness Model InnovationThree Revenue Streams:

1. Internal Pipeline (60%)

Wholly-owned assetsFull value captureStrategic indicationsHigh-value targetsClinical developmentExit via licensing/M&A2. Partnerships (30%)

Co-development dealsPlatform accessMilestone paymentsRoyalty agreementsRisk sharingBig pharma validation3. Software Licensing (10%)

SaaS platform accessCustom deploymentsTraining servicesMaintenance contractsData partnershipsStrategic PartnershipsMajor Deals ($3.5B total):

Sanofi: Up to $1.2B dealFosun Pharma: Multiple programsExelixis: Oncology focusMenarini: Rare diseasesSaudi Aramco: Regional expansionGo-to-Market ExcellencePartnership Strategy:

Validate with big pharmaShare risk and rewardsAccess global infrastructureMaintain ownership optionsBuild credibilityScale efficientlyFinancial Model: The Biotech UnicornFunding JourneyTotal Raised: ~$600M+

Series E (March 2024):

Amount: $110MValuation: $1B+ (unicorn)Lead: Value PartnersUse: Phase 3 trials, expansionPrevious Rounds:

Series D: $95M (2022)Series C: $255M (2021)Earlier: ~$140MRevenue ModelCurrent Revenue Streams:

Partnership upfrontsMilestone paymentsSoftware licensesResearch collaborationsGovernment grantsFuture Value Creation:

Drug approvalsRoyalty streamsM&A exitsIPO potentialPlatform licensingDeal EconomicsPartnership Structure:

Upfront: $10-50MMilestones: $100-500MRoyalties: 5-15%Total value: $200M-1.2BRisk: SharedStrategic Analysis: The First AI Pharma SuccessFounder StoryAlex Zhavoronkov, PhD (CEO):

AI researcher turned biotech CEOPublished 200+ papersLongevity focusTechnical + businessGlobal visionExecution focusedWhy This Matters:

Unlike pure tech founders entering biotech, Zhavoronkov understands both AI and drug development—critical for navigating pharma’s complexities.

AI Drug Discovery:

Atomwise: Earlier stageBenevolentAI: StrugglingRecursion: Different approachGenerate: Protein focusInsilico: Clinical validationTraditional Pharma:

Slow to adopt AIInternal efforts limitedPartnership dependentCultural resistanceInsilico opportunityGeographic AdvantageHong Kong + Global:

Asian market accessLower costsGovernment supportGlobal talent poolRegulatory flexibilityEast-West bridgeFuture Projections: The AI-Native PharmaClinical Pipeline ProgressLead Program (ISM001-055):

Indication: Idiopathic pulmonary fibrosisStage: Entering Phase 3Market: $3B+Competition: Limited optionsTimeline: 2027 approval possiblePipeline Expansion:

30 programs active10 IND-approvedMultiple Phase 2sOncology focusRare diseasesCNS emergingPlatform EvolutionNext Generation:

Robotic lab automationBipedal robot scientistsClosed-loop discoveryReal-world data integrationPrecision medicineGlobal expansionExit ScenariosPotential Outcomes:

IPO (2025-2026): $5-10B valuationAcquisition: Big pharma buying AIPartnership: Mega-deal possibleIndependent: Build next-gen pharmaInvestment ThesisWhy Insilico Wins1. Clinical Validation

Real drugs in trialsNot just promisesData proving modelRegulatory successPatient impact2. Business Model

Multiple revenue streamsRisk mitigationValue captureSustainable growthPlatform leverage3. First Mover

Years aheadData accumulationPartnership validationTalent concentrationBrand recognitionKey RisksClinical:

Trial failuresSafety issuesRegulatory delaysCompetitionBusiness:

Pharma adoption speedPartnership dependenciesFunding needsMarket conditionsTechnical:

AI limitationsData qualityScaling challengesTalent retentionThe Bottom LineInsilico Medicine isn’t selling the dream of AI drug discovery—they’re delivering it. With 30 drug candidates, 10 INDs, and multiple clinical trials, they’ve proven AI can dramatically accelerate and improve drug development. Their $1B valuation reflects not potential but performance.

Key Insight: The pharmaceutical industry spends $200B annually on R&D with declining productivity. Insilico’s model shows AI can compress timelines by 10x and costs by 90% while improving success rates. They’re not disrupting pharma—they’re saving it. As their lead drug advances to Phase 3 and their platform scales, Insilico isn’t just another AI company claiming to revolutionize drug discovery. They’re the first to actually do it, with the clinical trials and pharma partnerships to prove it. In an industry where one approved drug can be worth $10B+, Insilico’s 30-asset pipeline makes their $1B valuation look conservative.

Three Key Metrics to WatchClinical Trial Success: ISM001-055 Phase 3 resultsPipeline Advancement: Programs entering clinicPartnership Expansion: Next $1B+ dealsVTDF Analysis Framework Applied

The Business Engineer | FourWeekMBA

The post Insilico Medicine’s $1B Business Model: AI That Discovered a Real Drug in 18 Months (Big Pharma Takes 10 Years) appeared first on FourWeekMBA.