AI for Financial Advisors

Artificial intelligence (AI) for financial advisors has evolved beyond just automating tasks to becoming a strategic asset. And it is especially relevant in the context of the Great Wealth Transfer.

AI-powered tools are transforming various facets of advisory businesses, including client engagement, portfolio management, compliance, and more.

Still relying on manual processes for client communication, research, or scheduling? It’s time to consider how AI can streamline your workflow, enhance decision-making, and free up more time for high-value client relationships.

Financial advisors who stay ahead of this growing trend stand to attract the lion’s share of clients due, in part, to their increased efficiency and capacity—which allows them to serve their clients better. On the other hand, advisors who fall behind stand to lose big.

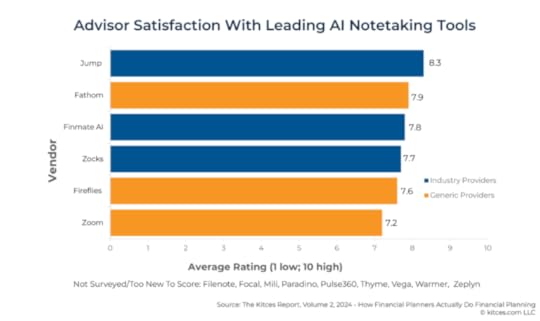

You may be wondering if these AI tools for financial advisors are just more shiny objects unfocused advisors like playing with. But here’s a chart that tells a different story:

This chart can be found in Michael Kitces’ article about AI tools.

Now let’s take a look at some of the most important AI tools for financial advisors you should consider to boost your competitive advantage, win more clients, and deliver better service and results.

AI Tools for Financial Advisors to Streamline Your BusinessClient Engagement & Workflow AutomationJump AI: Automates client communication, meeting summaries, and follow-ups.Zocks: An AI-driven CRM and client engagement platform.Advisor360 + Parrot AI: Transcribes, summarizes, and stores client meetings in CRM systems.Morgan Stanley’s AI @ Morgan Stanley Debrief: Assists advisors in dictating and summarizing meetingsMerrill’s AI-Powered Scheduler: Reduces appointment setup time by 18 minutes per clientPortfolio & Market AnalysisMorningstar Direct Advisory Suite: AI-powered research, portfolio analysis, and client proposal generationTIFIN @ Work: Provides AI-driven insights for wealth managers to identify client needsBlack Ore’s Tax Autopilot: Delivers AI-supported tax preparation and wealth management insightsAI-Enhanced Client Review ProcessesZeplyn: Developed AI-powered tools that significantly streamline the client review process. By reducing meeting preparation and documentation time from an hour to just 5-10 minutes, advisors can allocate more time to personalized client interactions and strategic planning. AI-Powered Meeting AssistantsJocks and Jung: Offers AI-driven meeting assistants that automate tasks like note-taking and follow-ups. For instance, Cambridge Investment Research reported saving over 40,000 hours for their advisors by integrating these assistants—highlighting major strides in efficiency when adopting AI. AI-Driven Marketing PlatformsCatchlight: Utilizes AI to analyze and enrich lead data, helping financial advisors focus on prospects with the highest conversion potential. By integrating with existing CRM systems, it provides actionable insights to prioritize outreach efforts effectively. Saifr: Offers AI-assisted content creation tools designed to ensure compliance with financial regulations. It helps advisors draft marketing materials that adhere to industry standards, reducing the time spent on compliance reviews. SmartAsset’s SmartAdvisor: A lead-generation platform connecting financial advisors with potential clients. It uses AI to match advisors with prospects based on specific criteria, streamlining the client acquisition process. LeadGenius: Combines AI with human intelligence to identify and communicate with targeted sales leads. It gathers data from various sources to build comprehensive lead profiles, aiding advisors in personalized marketing efforts. Conversica: Provides AI-driven virtual assistants that engage with leads through email, chat, and SMS. These assistants automate initial outreach and follow-ups, ensuring timely and personalized communication with prospects. Content Creation & MarketingJasper.ai: An AI-powered writing assistant that generates compliant, brand-aligned contentMicrosoft Copilot: An AI writing and analysis assistant for financial planning in Word, Excel, and CRM integrationsFinancial Planning & ComplianceFP Alpha TAX: Provides AI-driven tax projections and Roth conversion strategies CogniCor’s AI Solutions: Offers a virtual assistant that automates compliance tasks and client inquiriesChatGPT (Enterprise): Used by advisors for research, document drafting, and financial plan generation Download Your Free Compliance Best Practices Guide for Financial Advisor Blogs How AI Helps You Prepare for the Great Wealth TransferThe $84 trillion Great Wealth Transfer is happening now. Over the next two decades, trillions will shift from Boomers to Millennials and Gen Z. To stay competitive, advisors need to:

Optimize client communication: AI-powered CRMs and chatbots ensure seamless, personalized client engagement.Improve investment decisions: AI-driven market analysis helps identify trends and tailor data-backed investment strategies.Simplify compliance & reporting: AI tools help document decisions and automate compliance workflows.Scale advisory services: AI automates time-consuming tasks so you can serve more clients without sacrificing quality.Start Leveraging AI for Financial Advisors TodayYou don’t have to overhaul your entire tech stack overnight. Start with one AI tool that addresses your biggest bottleneck—whether it’s scheduling, client research, or portfolio analysis.

Want to see how AI for financial advisors can transform your business?

Learn more about Indigo Marketing Agency. We focus ONLY on helping financial advisors manage their messaging and implement comprehensive marketing strategies that generate high-quality leads and clients.

Explore the different levels of service offered with our Total Marketing Packages to get help implementing powerful marketing while freeing up your time to focus on clients.

Let’s talk. Book a strategy session today.

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content  How Advisors Can Use Video To Stand Out (Webinar)

How Advisors Can Use Video To Stand Out (Webinar) Whether you’re a beginner or looking to improve your existing video marketing efforts, this webinar is designed to provide actionable insights and practical tips to make your videos a success.

Register The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential

The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential At Indigo Marketing Agency, we help financial advisors embrace the evolving marketing landscape by utilizing custom video content. Read on for three reasons why you should incorporate video into your marketing strategy and how the Indigo team can help.

READ MORE Redefine Your Newsletter & Unleash Your Potential With Video

Redefine Your Newsletter & Unleash Your Potential With Video Connecting with your clients is of the utmost importance. But it can be really challenging in today’s digital age with all the noise. How are you supposed to stand out from the crowd?

READ MORE FAQs How can AI improve client engagement for financial advisors?AI-powered tools for financial advisors streamline client communication by automating meeting summaries, follow-ups, and CRM updates. This ensures timely and personalized interactions, helping advisors build stronger relationships while saving time.

What are the best AI tools for workflow automation in financial advisory firms?include Jump AI for automating client communication, Zocks for AI-driven CRM management, and Merrill’s AI-Powered Scheduler, which reduces appointment setup time. These tools help advisors manage tasks efficiently and focus on high-value client interactions.

How does AI assist in portfolio management and market analysis?AI-driven platforms like Morningstar Direct Advisory Suite and TIFIN @ Work analyze market trends and provide actionable investment insights. These tools help financial advisors make data-backed decisions and tailor investment strategies for their clients.

Can AI help financial advisors with compliance and documentation?Yes, AI tools like CogniCor’s AI Solutions and Saifr automate compliance tasks, ensuring financial materials adhere to industry regulations. AI also helps with document drafting and reporting, reducing manual work and minimizing compliance risks.

How does AI support financial advisors in preparing for the Great Wealth Transfer?AI optimizes client communication, enhances investment decision-making, simplifies compliance, and enables advisors to scale their services. By leveraging AI tools, financial advisors can efficiently manage the increasing demand for wealth management services from younger generations.

Sourceshttps://wealthtechtoday.com/2025/03/10/the-great-ai-awakening-7-technology-trends-from-the-t3-2025-conference/ https://www.financial-planning.com/list/favorite-ai-tools-in-wealth-managementhttps://www.investmentnews.com/wealth... https://www.financial-planning.com/news/merrill-morgan-stanley-on-simple-ai-tools-for-every-financial-advisorhttps://www.thinkadvisor.com/2025/02/...https://www.businesswire.com/news/home/20250305091906/en/Jump-Selected-as-an-Official-Technology-Provider-for-Osaic%E2s-Network-of-Financial-Professionalshttps://osaic.com/articles/osaic-forms-strategic-relationship-with-zocks-to-provide-their-financial-professionals-access-to-an-ai-driven-edge-in-productivity

The post AI for Financial Advisors appeared first on Indigo Marketing Agency.