How to Report 2024 Backdoor Roth in H&R Block Tax Software

Updated on January 28, 2025, with updated screenshots from H&R Block Deluxe download software for the 2024 tax year. If you use other tax software, see:

How To Report Backdoor Roth In TurboTaxHow to Report Backdoor Roth In FreeTaxUSAIf you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you need to report both the contribution and the conversion in the tax software. For more information on Backdoor Roth, please read Backdoor Roth: A Complete How-To and Make Backdoor Roth Easy On Your Tax Return.

Table of ContentsWhat To ReportUse H&R Block Download SoftwareConvert Traditional IRA to RothEnter 1099-RConverted to RothAdditional QuestionsNon-Deductible Contribution to Traditional IRAIRA ContributionConversion Isn’t RecharacterizationBasis From Previous YearPro-Rata RuleTaxable Income from Backdoor RothTroubleshootingFresh StartConversion Is TaxedSelf vs SpouseWhat To ReportYou report on the tax return your contribution to a traditional IRA *for* that year, and you report your conversion to Roth *during* that year.

For example, when you are doing your tax return for 2024, you report the contribution you made *for* 2024, whether you actually did it in 2024 or between January 1 and April 15, 2025. You also report your converting to Roth *during* 2024, whether the money was contributed for 2024, 2023, or any previous years.

Therefore a contribution made in 2025 for 2024 goes on the tax return for 2024. A conversion done during 2025 after you made a contribution for 2024 goes on the tax return for 2025.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finishing your conversion during the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2024 in 2024 and convert it during 2024. Contribute for 2025 in 2025 and convert it during 2025. This way everything is clean and neat.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2024 in 2025 or if you recharacterized a 2024 Roth contribution to Traditional in 2025, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If you contributed to a Traditional IRA for 2023 in 2024 and converted in 2024, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If you recharacterized a 2024 Roth contribution to Traditional in 2024 and converted in 2024, please follow Backdoor Roth in H&R Block: Recharacterized in the Same Year.

Use H&R Block Download SoftwareThe screenshots below are taken from H&R Block Deluxe downloaded software. The downloaded software is more powerful and less expensive than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

Here’s the scenario we’ll use as an example:

You contributed $7,000 to a Traditional IRA in 2024 for 2024. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2024, the value grew to $7,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you’ll have to make some adjustments to the screens shown here.

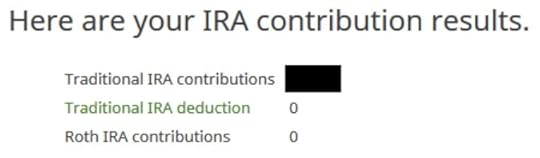

Before we start, suppose this is what H&R Block software shows:

We will compare the results after we enter the Backdoor Roth.

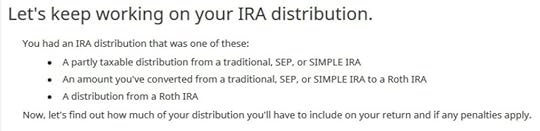

Convert Traditional IRA to RothIncome comes before deductions on the tax form. Tax software is also organized this way. Even though you contributed before you converted, the software makes you enter the income first.

Enter 1099-RWhen you convert the Traditional IRA to Roth, you receive a 1099-R form. Complete this section only if you converted *during* 2024. If you only converted in 2025, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth in H&R Block, 1st Year now and come back next year to follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If your conversion during 2024 was against a contribution you made for 2023 or a 2023 contribution you recharacterized in 2024, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year.

In this example, we assume by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

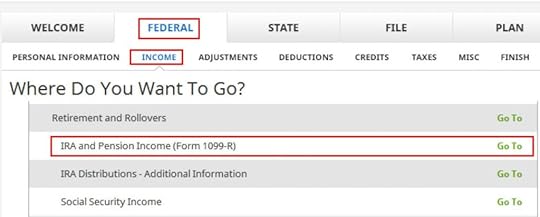

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on “Go To.”

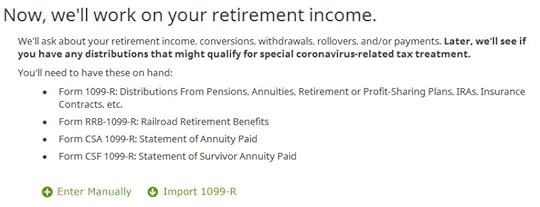

Click on Import 1099-R if you’d like. I show manual entries with “Enter Manually” here.

Just a regular 1099-R.

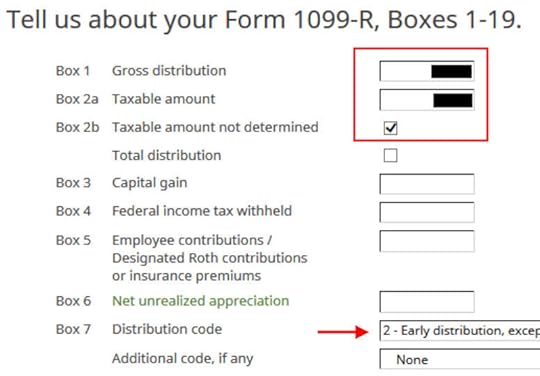

If you imported your 1099-R, double-check to make sure the import exactly matches the copy you received. If you enter your 1099-R manually, be sure to enter everything on the form exactly. Box 1 shows the amount converted to the Roth IRA. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. It should be code 2 when you’re under 59-1/2 and code 7 when you’re over 59-1/2.

My 1099-R had the IRA/SEP/SIMPLE box checked.

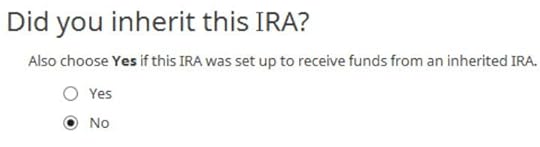

We didn’t inherit it.

Converted to Roth

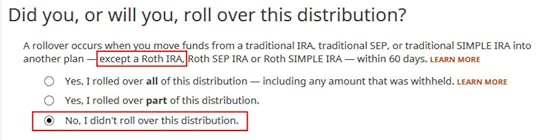

This is a very important question. Read carefully. Answer No, because you converted, not rolled over.

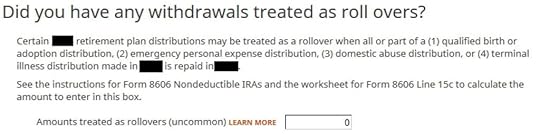

We didn’t have any of these withdrawals treated as rollovers.

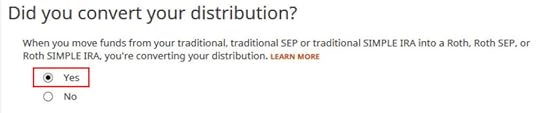

Now answer Yes, you converted.

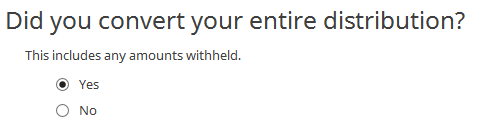

We converted all of it in our example.

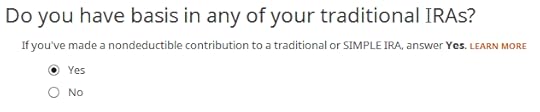

Answer Yes because you made a nondeductible contribution to a traditional IRA.

The refund in progress drops a lot at this point. We went from a $2,434 refund to $946. Don’t panic. It’s normal and only temporary. It will come back up after we complete the section for IRA contributions.

You are done with one 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse. Click on Finished when you are done with all the 1099-Rs.

Additional Questions

A few more questions.

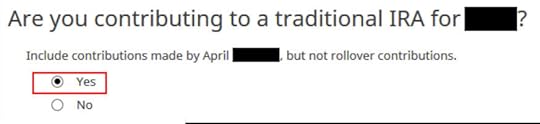

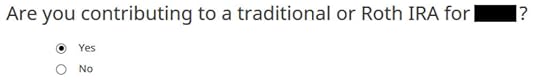

Answer Yes because you contributed to a Traditional IRA for the year.

We will wait.

Non-Deductible Contribution to Traditional IRANow we enter the non-deductible contribution to the Traditional IRA *for* 2024 in 2024.

If you contributed for 2024 between January 1 and April 15, 2025 or if you recharacterized a 2024 contribution in 2025, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If your contribution during 2024 was for 2023, make sure you entered it on the 2023 tax return. If not, fix your 2023 return first by following the steps in Split-Year Backdoor Roth in H&R Block, 1st Year.

IRA Contribution

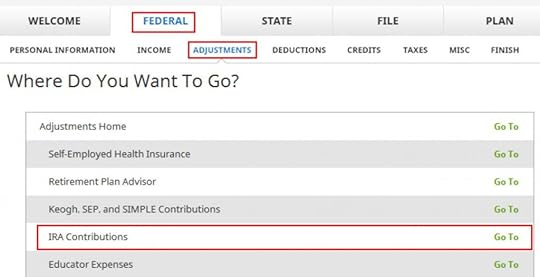

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

Wrong tense but answer “Yes” because you contributed to an IRA for the year in question.

Because we did a clean “planned” Backdoor Roth, we check the box for Traditional IRA.

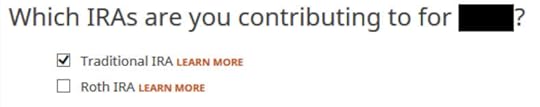

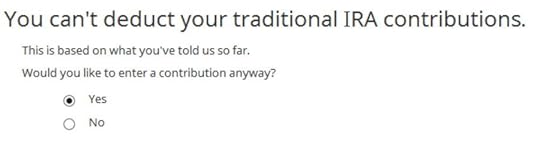

You know you don’t get a deduction due to income. Choose “Yes” and enter it anyway.

Enter your contribution amount. We contributed $7,000 in our example.

Conversion Isn’t Recharacterization

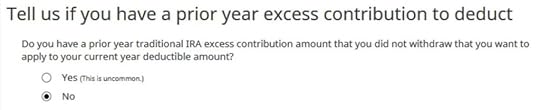

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

We don’t have any excess contribution.

Basis From Previous Year

If you did a clean “planned” backdoor Roth and you started fresh each year, enter zero. If you contributed non-deductible for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

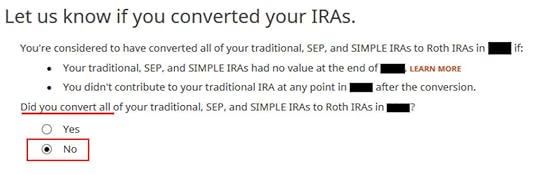

Pro-Rata Rule

This is another important question. If you are doing it the easy way as in our example, technically you can answer Yes and skip some questions. The safer bet is to answer No and go through the follow-up questions. If you’ve been going through these screens back and forth, you may have put in some incorrect answers in a previous round. You will have a chance to review and correct those answers only if you answer No.

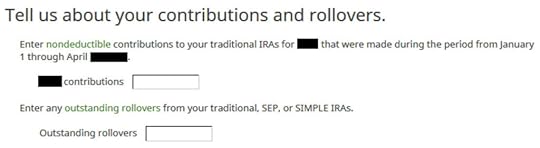

In a clean planned backdoor Roth, you contribute for 2024 during 2024. Leave the boxes blank.

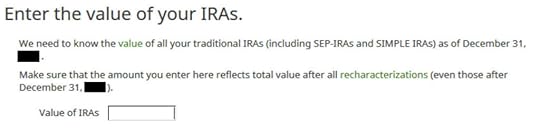

The box should be blank after you converted everything in your Traditional IRA to Roth before the end of the same year. If you have a small balance left because of interest, enter the value from your year-end statement here.

That’s great. We’re expecting it.

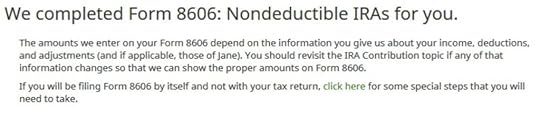

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you did a Backdoor Roth.

We are done entering the non-deductible contribution to the Traditional IRA. Now the refund meter should go back up. It was a refund of $2,434 when we first started. Now it’s a refund of $2,396. The difference of $38 is due to the tax on the extra $200 earned before the Roth conversion.

Taxable Income from Backdoor RothAfter going through all these, let’s confirm how you’re taxed on the Backdoor Roth.

Click on Forms on the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

It shows $7,200 in IRA distributions, $201 of which is taxable. The taxable income isn’t exactly $200 due to some rounding in the calculation. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You put money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You will pay tax on a small amount in earnings between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

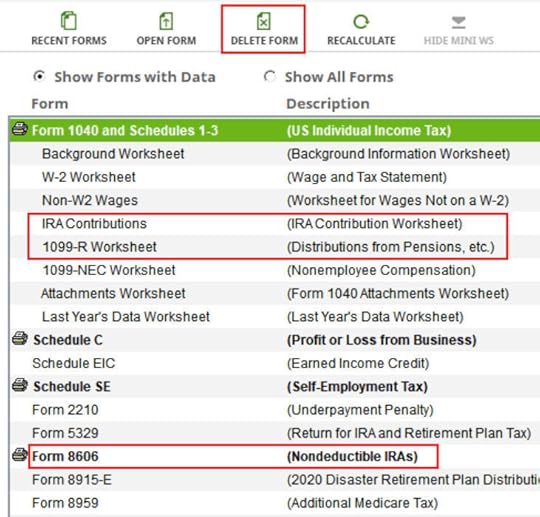

Fresh StartIt’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet, and Form 8606. Then start over by following the steps here.

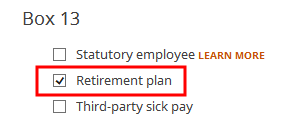

Conversion Is TaxedIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software will give you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

Taking this deduction also makes your Roth IRA conversion taxable. The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2. Maybe you forgot the check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Self vs Spouse

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Report 2024 Backdoor Roth in H&R Block Tax Software appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower