Top VC Moves And Following Capital Flows

The year 2024 marked a seismic shift in the venture capital (VC) landscape, characterized by increased mobility, the rise of independent funds, and a growing focus on specialized sectors like AI and climate tech. The traditionally stable world of VC saw heightened movement among seasoned professionals, reflecting a broader transformation in the industry.

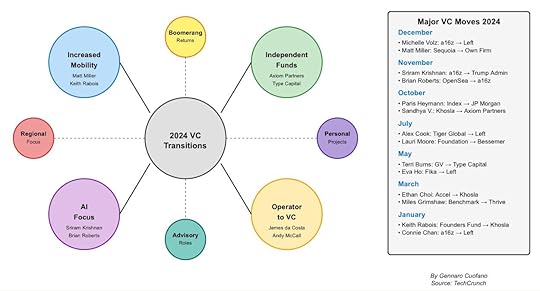

Increased Mobility: A New Era for Senior VCsIn a notable departure from the norm, senior VCs displayed unprecedented mobility in 2024. Traditionally defined by long tenures at established firms, the industry witnessed high-profile transitions, including Matt Miller leaving Sequoia to start his own firm and Keith Rabois moving from Founders Fund to Khosla Ventures. These shifts underscore a growing trend of VCs seeking greater independence and opportunities to shape their investment strategies.

The Rise of Independent FundsOne of the most striking trends in 2024 was the surge in VCs leaving established firms to launch their own specialized funds. Firms like Axiom Partners and Type Capital emerged as key players, targeting niche markets with tailored investment approaches. These funds are focusing on high-growth sectors, particularly AI, climate tech, and early-stage startups. This shift highlights the evolving nature of venture capital as a craft business, where smaller, specialized funds can thrive by addressing specific market needs.

The move toward independence reflects a desire among VCs to operate without the constraints of larger, traditional organizations. This autonomy allows them to target emerging sectors and capitalize on new opportunities more effectively.

AI’s Influence on VC TransitionsThe booming AI sector played a significant role in shaping VC transitions in 2024. Key figures like Sriram Krishnan (formerly of a16z) and Brian Roberts (formerly of OpenSea) shifted their focus to AI, driving the creation of funds dedicated to machine learning and related technologies. These moves align with the broader surge in generative AI spending, which has attracted unprecedented attention from investors.

Boomerang Moves and Advisory RolesAnother emerging trend in 2024 was the rise of boomerang moves, with professionals returning to firms they had previously left. Advisory roles also gained prominence as seasoned VCs transitioned to guiding younger startups and funds. These roles underscore the value of experience in navigating a rapidly evolving industry.

Regional Focus: Europe Gains MomentumRegional investment strategies gained traction, with Europe emerging as a key focus area for many firms. This shift reflects the growing opportunities in European markets, particularly in sectors like fintech, renewable energy, and AI. The increased attention to regional dynamics highlights the global nature of venture capital in 2024.

A Transformative Year for Venture CapitalThe transitions and trends of 2024 signal a fundamental evolution in the VC industry. Increased mobility, the rise of independent funds, and a focus on specialized sectors like AI and climate tech underscore the dynamic nature of the industry. As VCs embrace greater independence and target emerging opportunities, the venture capital landscape is poised for continued innovation and growth in the years ahead.

The post Top VC Moves And Following Capital Flows appeared first on FourWeekMBA.