Self-Publishing Statistics

Two sources of statistics appeared this week that provide some insight into the overall success rate of self-published authors. Both provide some Infographics to illustrate their findings, so I'll embed those below. Unfortunately, neither provide particularly rosy or optimistic outlooks for the average author, even as the self-pub movement expands rapidly and ebook adoption explodes.

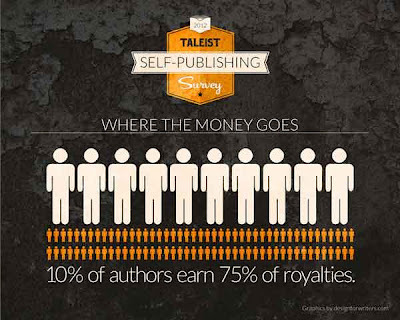

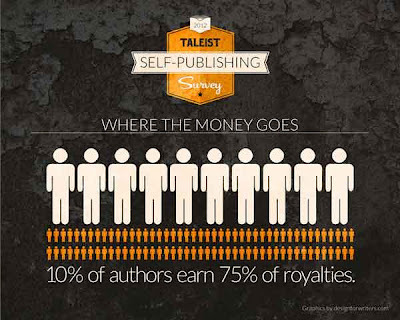

The first of these was a survey by Taleist, an Australian publisher/author services provider, who compiled responses to 61 questions from 1007 self-published authors. The report, titled Not a Gold Rush, found among other things that 10% of self-pubbed authors reap 75% of the rewards.

This is hardly surprising, and not altogether different than the traditional publishing route, and I would hazard a guess that 10% is being generous. If, for example, one of those 1007 authors happened to be John Locke the statistics might look very different. 1007 is a very small sample for a field in which 2.75 million books were self-published in 2010 alone. The fact is that the vast majority of those likely sold only a handful of copies, while a handful of authors sold the lion's share, making the ratio something closer to 5% of authors earn 90% of the royalties.

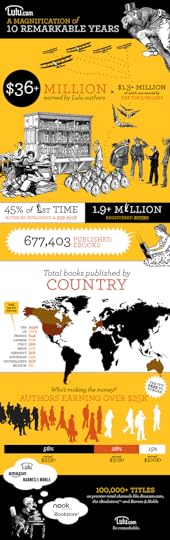

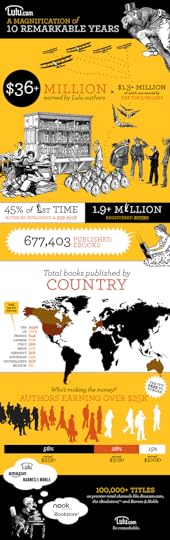

You can see this at work in the Infographic provided by Lulu.com, who are ostensibly celebrating "10 remarkable years" of success for self-published authors by proudly proclaiming that Lulu authors have earned $36 million during that time. They also go on to state that $1.3 million of that went to just five sellers (though not necessarily for just five books, I would point out), leaving $34.7 million for the remaining sellers to divvy up. But with a total of 1,441,000 books published during that time in just the top ten countries, the average total per title royalty is less than $25 ($36 million / 1,441,000 books = $24.98). And that's including the $1.3 million that those top five authors earned. This means that the vast majority of titles likely brought in less than ten or fifteen bucks total for their labors. And Lulu are celebrating this as an achievement!

To add more clouds to this already hazy forecast, Lulu's graphic confusingly provides a breakdown that makes it appear as if 56% of their authors are earning over $56k, when in fact the breakdown only applies to the authors making over that amount, so that it should read "Of authors earning over $25k, 56% earned $25k+..." Of course, they neglect to mention what percentage of their total authorship that represents, but I doubt it's anything like the Taleist's 10%.

If that were the case, then 75% of the $36 million in total earnings would be $27 million, leaving only $9 mil to divide among the remaining 90% of authors. Assuming an even distribution of books among those authors, that would leave a pool of 1,296,900 books to share 9 million bucks, for an average income of just $6.94 per book for the bottom 90%, while the top 10% earn an average of $187.37 per title, which is a damned far cry from $25k. What we're looking at is something more like 1% earned over $25k, while 99% earned next to nothing.

By comparison, Taleist found that half of their respondents brought in less than $500 last year from selling their wares, while the average income was $10,000. Again, this shows how skewed the numbers are toward the top few authors, with just those top 10% of respondents (97 out of 1007) saying that they make enough to live off their book sales alone. Meanwhile, 25% said they did not earn enough to cover the cost of producing their book. 53% had published for the first time in 2011, producing 2.8 books on average during the year, while another 20% debuted in 2010.

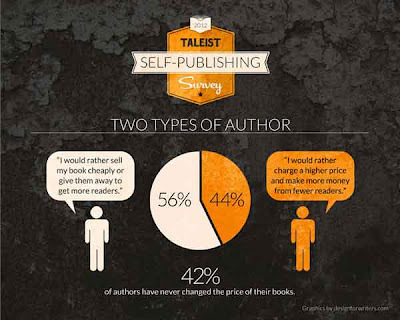

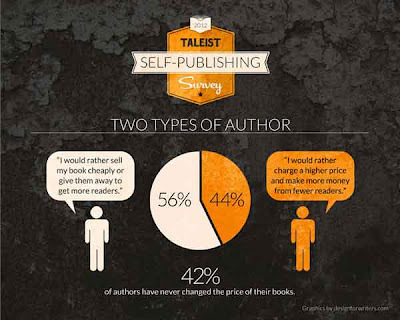

Another interesting statistic is this division in the pricing strategy of self-pubbed authors, where somewhat more than half (56%) prefer the volume sales model while the remaining minority (of 44%) think selling at a higher price is the way to go. Unfortunately, the survey did not elaborate on these points, which would have been highly enlightening, since there are many reasons for (and against) both views. It would be useful to know, for example, which of these models was the more successful, and if a higher retail price with fewer sales equated to more or less income, and more or less satisfied readers, with higher or lower average reader ratings.

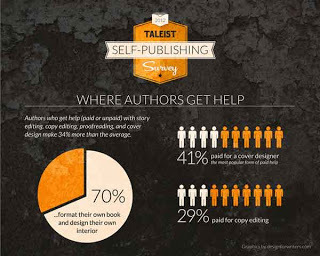

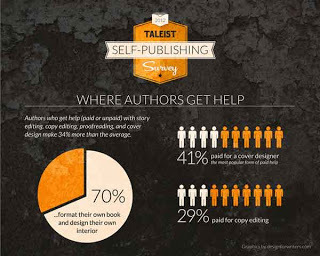

And finally, the Taleist report concluded that authors who got outside help with issues such as editing and cover design earned 34% more than the average, although 70% of respondents did not do so. Apparently more authors feel that books are judged more by their cover than their content, as 41% invested in a professional cover design, while only 29% shelled out for copy editing.

Surveys such as this are only snapshots of a segment of the industry, but they can shed some light on what is happening and how to make the best of it. You can buy the full report on Amazon for five bucks.

The first of these was a survey by Taleist, an Australian publisher/author services provider, who compiled responses to 61 questions from 1007 self-published authors. The report, titled Not a Gold Rush, found among other things that 10% of self-pubbed authors reap 75% of the rewards.

This is hardly surprising, and not altogether different than the traditional publishing route, and I would hazard a guess that 10% is being generous. If, for example, one of those 1007 authors happened to be John Locke the statistics might look very different. 1007 is a very small sample for a field in which 2.75 million books were self-published in 2010 alone. The fact is that the vast majority of those likely sold only a handful of copies, while a handful of authors sold the lion's share, making the ratio something closer to 5% of authors earn 90% of the royalties.

You can see this at work in the Infographic provided by Lulu.com, who are ostensibly celebrating "10 remarkable years" of success for self-published authors by proudly proclaiming that Lulu authors have earned $36 million during that time. They also go on to state that $1.3 million of that went to just five sellers (though not necessarily for just five books, I would point out), leaving $34.7 million for the remaining sellers to divvy up. But with a total of 1,441,000 books published during that time in just the top ten countries, the average total per title royalty is less than $25 ($36 million / 1,441,000 books = $24.98). And that's including the $1.3 million that those top five authors earned. This means that the vast majority of titles likely brought in less than ten or fifteen bucks total for their labors. And Lulu are celebrating this as an achievement!

To add more clouds to this already hazy forecast, Lulu's graphic confusingly provides a breakdown that makes it appear as if 56% of their authors are earning over $56k, when in fact the breakdown only applies to the authors making over that amount, so that it should read "Of authors earning over $25k, 56% earned $25k+..." Of course, they neglect to mention what percentage of their total authorship that represents, but I doubt it's anything like the Taleist's 10%.

If that were the case, then 75% of the $36 million in total earnings would be $27 million, leaving only $9 mil to divide among the remaining 90% of authors. Assuming an even distribution of books among those authors, that would leave a pool of 1,296,900 books to share 9 million bucks, for an average income of just $6.94 per book for the bottom 90%, while the top 10% earn an average of $187.37 per title, which is a damned far cry from $25k. What we're looking at is something more like 1% earned over $25k, while 99% earned next to nothing.

By comparison, Taleist found that half of their respondents brought in less than $500 last year from selling their wares, while the average income was $10,000. Again, this shows how skewed the numbers are toward the top few authors, with just those top 10% of respondents (97 out of 1007) saying that they make enough to live off their book sales alone. Meanwhile, 25% said they did not earn enough to cover the cost of producing their book. 53% had published for the first time in 2011, producing 2.8 books on average during the year, while another 20% debuted in 2010.

Another interesting statistic is this division in the pricing strategy of self-pubbed authors, where somewhat more than half (56%) prefer the volume sales model while the remaining minority (of 44%) think selling at a higher price is the way to go. Unfortunately, the survey did not elaborate on these points, which would have been highly enlightening, since there are many reasons for (and against) both views. It would be useful to know, for example, which of these models was the more successful, and if a higher retail price with fewer sales equated to more or less income, and more or less satisfied readers, with higher or lower average reader ratings.

And finally, the Taleist report concluded that authors who got outside help with issues such as editing and cover design earned 34% more than the average, although 70% of respondents did not do so. Apparently more authors feel that books are judged more by their cover than their content, as 41% invested in a professional cover design, while only 29% shelled out for copy editing.

Surveys such as this are only snapshots of a segment of the industry, but they can shed some light on what is happening and how to make the best of it. You can buy the full report on Amazon for five bucks.

Published on May 25, 2012 22:15

No comments have been added yet.