2023 State Tax-Exempt Treasury Interest from Funds and ETFs

[Updated on January 30, 2024 for 2023 tax filing.]

When you earn interest from U.S. Treasuries in a taxable account, the interest is exempt from state and local taxes. How the interest is reported on tax forms depends on whether you hold Treasuries directly or through mutual funds and ETFs.

Table of ContentsInterest from Treasury Bills and NotesTreasuries in Mutual Funds and ETFsGovernment % from Fund ManagersVanguardFidelityCharles SchwabiSharesCA, NY, and CT ResidentsTax SoftwareTurboTaxH&R BlockFreeTaxUSAInterest from Treasury Bills and NotesWhen you buy individual Treasuries in a taxable brokerage account — see How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market — you’ll see the interest reported on a 1099-INT form and/or a 1099-OID form (for TIPS).

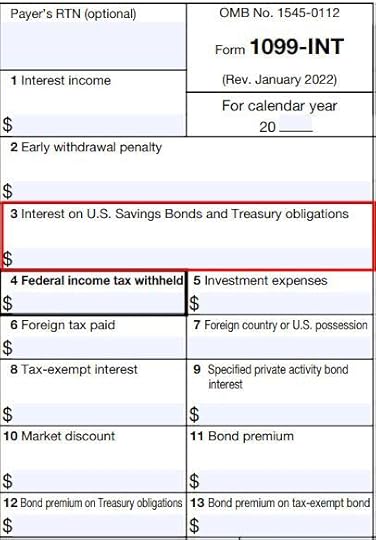

Interest from Treasuries is reported separately in Box 3 on a 1099-INT form.

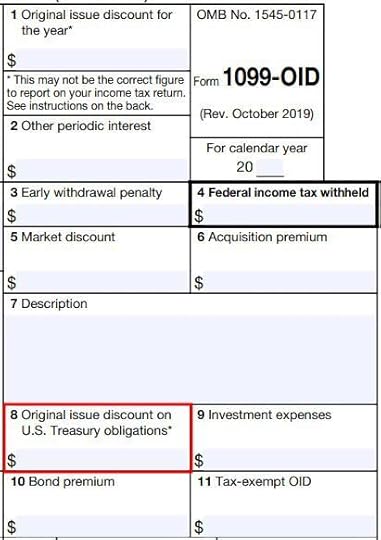

Inflation adjustment for TIPS is reported separately in Box 8 on a 1099-OID form.

Your tax software knows about these special boxes in the tax forms. Whether you import the tax forms from your broker or enter them manually, the software will automatically mark the interest as exempt from your state income tax.

Treasuries in Mutual Funds and ETFsMany money market funds, bond funds, and bond ETFs hold Treasuries. If you have these funds in a taxable brokerage account, a good part of the funds’ dividends may have come from Treasuries. The portion of fund dividends attributed to interest from Treasuries isn’t qualified dividends. It’s taxed at normal tax rates for federal income tax but it’s still exempt from state and local taxes.

When you have multiple mutual funds or ETFs in a taxable brokerage account, the broker reports dividends received from all sources on one 1099-DIV form. The 1099-DIV form doesn’t have a special box broken out for dividends attributed to Treasuries. Your tax software won’t know how much of the dividends were from Treasuries only by the numbers on the 1099-DIV form.

The broker supplies a breakdown of the dividends by source. It’s up to you to determine how much of the dividends from each source came from Treasuries. Suppose you own four funds in a taxable brokerage account that paid $6,500 in total dividends. Your goal is to fill out a table like this with the percentage of dividends from Treasuries for each fund and calculate your total dividends attributed to Treasuries:

FundTotal Dividend% from TreasuriesDividend from TreasuriesFund A$5000%$0Fund B$1,00065%$650Fund C$2,00010%$200Fund D$3,00090%$2,700Total$6,500$3,550When you give the result to your tax software, it then knows to exempt that portion of the dividends from state and local taxes.

Government % from Fund ManagersAlthough the 1099-DIV form and the dividend breakdown by funds are provided by the broker, you’ll have to get the number for the “% from Treasuries” column from the managers of your mutual funds and ETFs.

If you own Vanguard mutual funds or ETFs in a Fidelity brokerage account, you get this information from Vanguard, not from Fidelity. Similarly, if you own iShares ETFs in a Charles Schwab brokerage account, you get the information from iShares, not from Charles Schwab.

Google “[name of fund management company] tax center” to find the information from the fund manager.

VanguardVanguard publishes the information in its Tax Season Calendar. Look for “U.S. government obligations information.”

FidelityFidelity publishes the information in Fidelity Mutual Fund Tax Information. Look for “Percentage of Income From U.S. government securities.” It’s expected to be available in early February.

Charles SchwabCharles Schwab Asset Management publishes the information in its Distributions and Tax Center. Look for “2023 Supplementary Tax Information.”

iSharesiShares publishes the information in its Tax Library. Look for “2023 U.S. Government Source Income Information.”

CA, NY, and CT ResidentsCalifornia, New York, and Connecticut have additional requirements for exempting fund dividends earned from Treasuries. The fund management company will note in its published information whether a fund met the requirements of CA, NY, and CT. If a fund didn’t meet the requirements, the Treasuries percentage is treated as 0% for CA, NY, and CT residents.

For example, Vanguard Federal Money Market Fund earned 49.37% of its income from U.S. government obligations in 2023. Because it didn’t meet the requirements of CA, NY, and CT, investors in these three states must still pay state income tax on 100% of this fund’s dividends. People in other states pay state income tax on only 50.63% of this fund’s dividends.

Tax SoftwareYou need to give the result to your tax software after you get the “% from Treasuries” for each fund and calculate your dividend from Treasuries with a table like this:

FundTotal Dividend% from TreasuriesDividend from TreasuriesFund A$5000%$0Fund B$1,00065%$650Fund C$2,00010%$200Fund D$3,00090%$2,700Total$6,500$3,550It’s easy to miss the entry point for this input unless you really look for it.

TurboTax

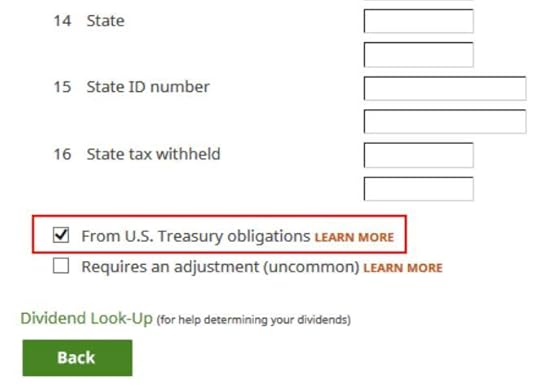

After you import or enter the 1099-DIV form in TurboTax download software, you need to check a box to say that a portion of the dividends is U.S. Government interest. It’s easy to miss because TurboTax says it’s uncommon, which isn’t true.

Now you enter the amount you calculated in your table.

H&R Block

H&R Block download software shows a checkbox at the bottom of the 1099-DIV entries. This field doesn’t come in the import. It’s easy to miss because it’s at the bottom of a long form. You have to really look for it.

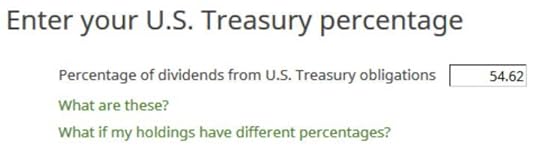

Instead of asking for a dollar amount, H&R Block goes by percentage. It forces you to do a bit of math. In our example, $3,550 from Treasuries divided by $6,500 total ordinary dividends is 54.62%. So we enter 54.62.

FreeTaxUSA

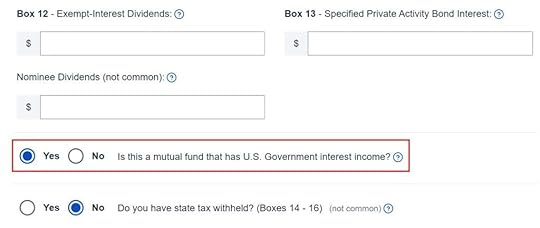

FreeTaxUSA has a radio button at the bottom of the 1099-DIV entries. It’s easy to miss because it’s at the bottom of a long form. You have to really look for it. The question “Is this a mutual fund … ?” isn’t accurate. It should be “Does this include … ?”

Now you give the dollar amount from your table.

***

Most of the work in calculating the amount of the fund dividends exempt from state and local taxes is in hunting down the percentage of income from Treasuries for each fund and ETF in your taxable brokerage account. You need to give the calculated amount to your tax software, which doesn’t make it obvious where the number should go.

A similar process also applies to muni bond funds and ETFs. A portion of the fund dividends is exempt from both federal income tax and state income tax (“double tax-free”). I cover that topic in a separate post State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 State Tax-Exempt Treasury Interest from Funds and ETFs appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower