Roth IRA Withdrawal After 59-1/2 in TurboTax and H&R Block

Everyone knows the point of putting money into a Roth IRA is that withdrawals are tax-free. That’s true at a high level but it isn’t that simple when you go one level down into the details. Withdrawals from a Roth IRA follow a set of complex rules to determine how much of a withdrawal is tax-free and penalty-free.

Table of ContentsRoth IRA Withdrawal RulesRelief After 59-1/2H&R BlockTurboTaxNot Yet 59-1/2?Roth IRA Withdrawal RulesThe rules require that you understand normal contributions and conversions including backdoor Roth and mega backdoor Roth, rollovers from Roth 401k to Roth IRA, a 5-year clock on each conversion, the taxable and non-taxable amount in the conversion, and earnings in the Roth account, etc., etc. Gathering and keeping records to put dollar amounts into each bucket year by year requires another level of attention. See Maintain a Roth IRA Contributions and Withdrawals Spreadsheet.

Relief After 59-1/2The great news is that all these complexities go away when you’re 59-1/2. You only need to answer this one question when you withdraw from your Roth IRA after age 59-1/2:

Did you have a Roth IRA at least five years ago?

The answer is obviously “Yes” for most people. It’s the simplest way to make your Roth IRA withdrawal 100% tax-free. That’s the path I’m aiming for.

You’ll get a 1099-R from your Roth IRA custodian in the following year after you take a withdrawal. Let’s look at how it works on your tax return when you use tax software TurboTax and H&R Block.

H&R BlockI normally start with TurboTax when I do these tax software walkthroughs but I’m starting with H&R Block this time for reasons that will become apparent later.

The screenshots below are from H&R Block Deluxe downloaded software. The downloaded software is both less expensive and more powerful than the online version. You can buy H&R Block downloaded software from Amazon, Walmart, Newegg, Office Depot, and many other retailers.

I started the tax return with a 67-year-old single taxpayer.

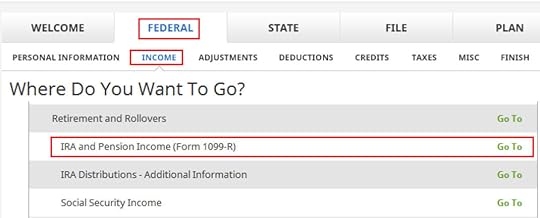

Go to Federal -> Income -> IRA and Pension Income (Form 1099-R). You can import the 1099-R or enter it manually. I’m showing manual entries.

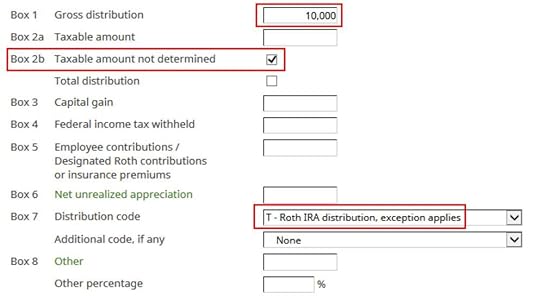

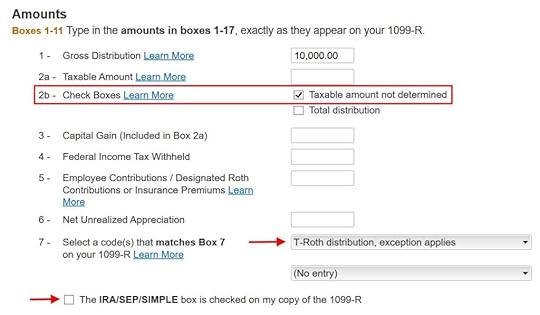

My test 1099-R is a normal 1099-R. Enter the numbers from your 1099-R as-is. It looks like this for a $10,000 withdrawal from the Roth IRA:

The amount of the withdrawal shows up in Box 1. Yours may have the same amount repeated in Box 2a and that’s OK too. It’s important to have a checkmark in Box 2b “Taxable amount not determined.” Your Roth IRA custodian isn’t determining whether your distribution is taxable. The box 7 distribution code is “T.”

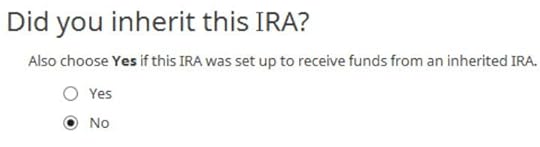

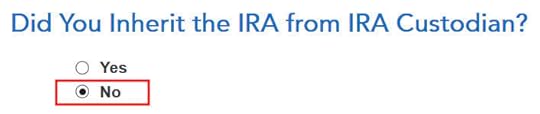

I didn’t inherit it.

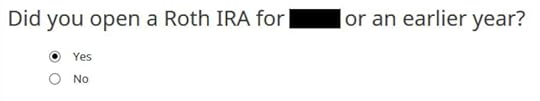

Here it’s asking whether I had my first Roth IRA at least five years ago. Of course I did.

That’s it. It’s tax-free after I answer just two simple questions. I didn’t have to give any detail for the past contributions, recharacterizations, conversions, rollovers, or distributions. It doesn’t matter how the money got into the Roth IRA or when.

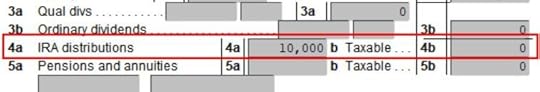

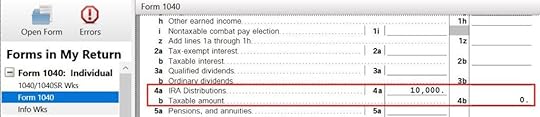

We can see how this shows up on the tax form. Click on Forms on the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

It shows the withdrawal on Line 4a and zero on Line 4b. Line 4b is the taxable amount. A zero there means it’s tax-free. If you have other IRA distributions such as RMDs on Lines 4a and 4b, this tax-free withdrawal from your Roth IRA adds to your other distributions on Line 4a but it doesn’t add to the taxable amount on Line 4b.

TurboTaxNow let’s look at how it works in TurboTax. The screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

I started the tax return with a 67-year-old single taxpayer.

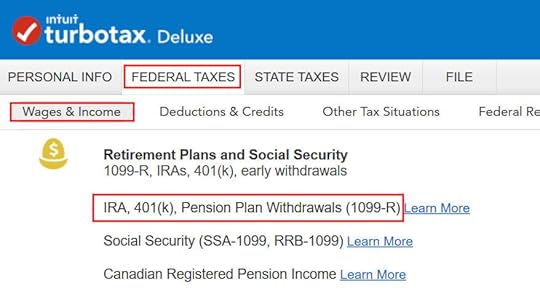

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R). Import the 1099-R if you’d like. I’m choosing to type it myself.

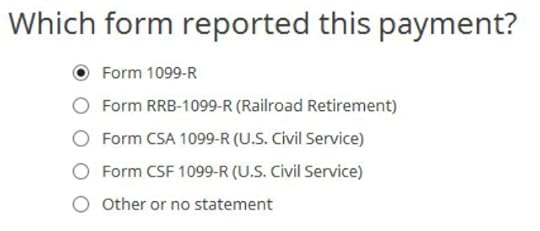

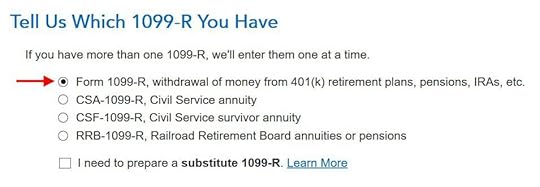

Just the regular 1099-R.

Box 1 shows the amount taken out of the Roth IRA. You may have the same amount copied as the taxable amount in Box 2a. That’s OK when Box 2b is checked saying “taxable amount not determined.” Pay attention to the code in Box 7. Make sure your entry matches your 1099-R exactly. I have a code “T” in my test 1099-R. The IRA/SEP/SIMPLE box is not checked because it’s from a Roth IRA.

I didn’t inherit it.

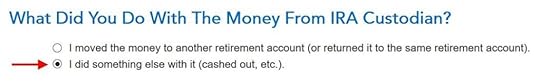

I didn’t move the money to another retirement account.

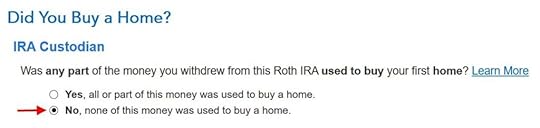

I didn’t buy a home.

It wasn’t due to a disaster. I took the money out and spent it.

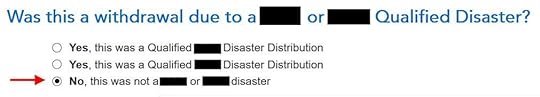

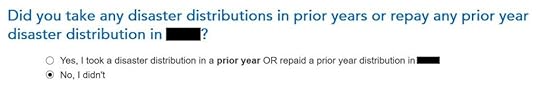

We come to this 1099-R summary but we’re not done yet. TurboTax will ask more follow-up questions.

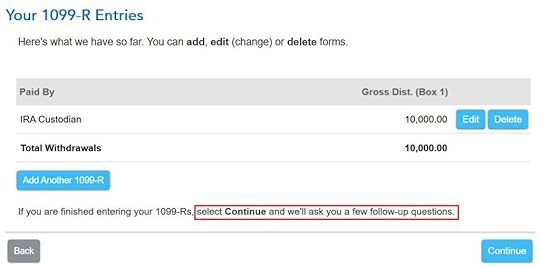

I didn’t take disaster distributions or repay them.

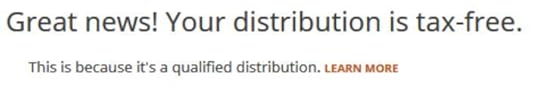

This is the most relevant question. Yes, I owned a Roth IRA for at least five years.

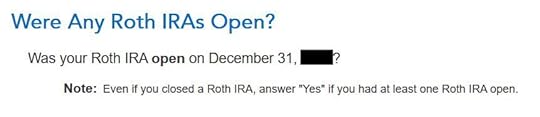

I don’t know why it matters whether I have an open Roth IRA but whatever.

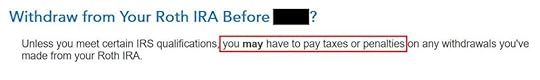

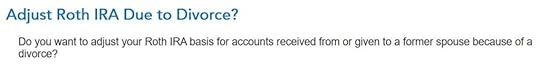

Now TurboTax is trying to scare us. Why does it matter? I’m already 59-1/2!

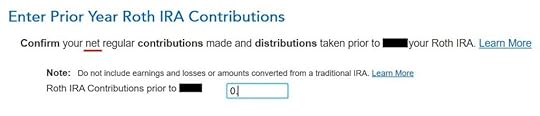

Now TurboTax will go through the rigmarole of Roth IRA distribution ordering rules, which are irrelevant when you’re already 59-1/2 and you had your Roth IRA for at least five years. I’m going to lie to TurboTax now because I know the answers just don’t matter at this point.

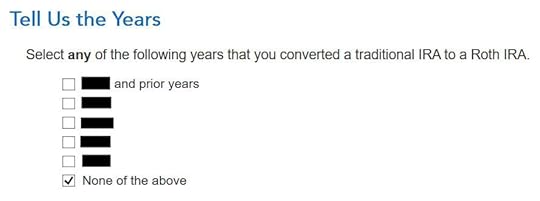

If you answer truthfully which year you did a Roth conversion, TurboTax will take you through the details of your prior conversions. You will waste time doing a lot of unnecessary work. So don’t cooperate.

Again, irrelevant.

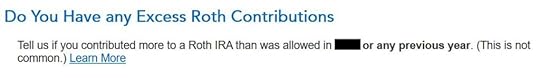

No excess contributions.

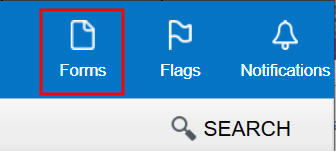

TurboTax is finally done with its irrelevant questions. Are you taxed on the withdrawal from your Roth IRA? Click on Forms on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b.

It shows the withdrawal amount on Line 4a and zero on Line 4b. A zero on Line 4b means it’s tax-free. If you have other IRA distributions such as RMDs on Lines 4a and 4b, this Roth IRA withdrawal adds to your other distributions on Line 4a but it doesn’t add to the taxable amount on Line 4b.

TurboTax arrives at the same results as H&R Block but it takes such a long and unnecessary journey. It uses a one-size-fits-all approach that doesn’t distinguish by whether you’re 59-1/2 or not.

Nothing matters when you’re already 59-1/2 and you had your first Roth IRA at least five years ago. All your withdrawals from the Roth IRA are tax-free, end of story. You get a big relief when you’re 59-1/2. You don’t have to provide any other data or records. So don’t think you must meticulously keep everything. Just save one statement from a Roth IRA to show that you had it open at least five years ago.

Not Yet 59-1/2?It’s a whole different story if you’re planning to withdraw from your Roth IRA before age 59-1/2. You do need detailed records to answer those questions from TurboTax. You can use something like the spreadsheet I included in Maintain a Roth IRA Contributions and Withdrawals Spreadsheet.

To be honest, I gave up on keeping track of Roth IRA contributions, recharacterizations, conversions, rollovers, and distributions. I’ll take the easy path and wait until the year I’m 59-1/2.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Roth IRA Withdrawal After 59-1/2 in TurboTax and H&R Block appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower