How to Let Your Spouse Access Your Fidelity or Vanguard Accounts

When you have a joint account, either person on the account can transact in the account. As part of our estate planning package, my wife and I created a trust with both of us as co-trustees (see Will and Trust Through Employer Legal Plan). We stated in the trust that each trustee can act alone. Our trust account is set up as such, similar to a joint account.

Table of ContentsNo Joint IRA or Joint HSAPower of Attorney May Not Be RecognizedNot Limited to SpouseVanguardFidelityBidirectional PermissionsNotarized SignaturesNew AccountsRevoke AccessNo Sharing Login and PasswordTrusted ContactsNo Joint IRA or Joint HSAHowever, our IRAs and HSAs can only be in our individual names. It’s not possible to have a joint IRA or a joint HSA.

We have named beneficiaries, but the beneficiaries only become relevant after the owner dies. When you are living, a spouse doesn’t have any authority over your IRA or your HSA unless you specifically grant the permissions.

Power of Attorney May Not Be RecognizedWe also executed a Durable Power of Attorney (DPOA) in our estate planning package. We granted the authority to act on behalf of each other in case we aren’t capable to act ourselves, but we also learned that financial institutions often don’t recognize these broad Powers of Attorney. They want their own language.

It’ll be a bummer if you’re only told they don’t accept your Durable Power of Attorney when you really need to use it. Most financial institutions have a process to give someone access to your accounts. It’s better to be prepared and go through the process before you need someone to act on your behalf.

Not Limited to SpouseAlthough it’s most common to give access to your spouse, the authorization process doesn’t limit it to a spouse. You can grant authorization to a sibling, an adult child, or even a non-family member.

VanguardWe have IRAs at Vanguard. Vanguard has a process to authorize another person to act on your behalf over your accounts. They call it agent authorization or account permissions.

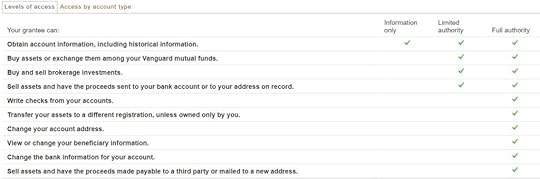

Vanguard allows three levels of access.

“Information Only” can monitor the account but can’t do anything. “Limited Authority” can transact within the account or send money out to an already linked bank account or the address on file. “Full Authority” can do a number of other things.You can grant the Information Only or Limited Authority permission online. It’s not clear how you can grant Full Authority. It looks like there used to be a form but all the links to the form are dead on Vanguard’s website. Please contact Vanguard customer service if you’d like to grant Full Authority.

After you log in to your Vanguard account, click on “Profile & account settings” at the top.

Click on the Security tab and then “Account permissions.”

The grantee must also have a Vanguard account. You need one of their Vanguard account numbers. Vanguard will send an email to the grantee to confirm that they will accept the authorization. The permissions are effective only after the grantee accepts. The grantee will see additional accounts listed when they log in.

FidelityWe also have IRAs and HSAs at Fidelity. Fidelity has a similar process to grant permissions. They have a clear explanation and a video about their four levels of access:

Follow the link to start the process to authorize access to your accounts.

Similar to Vanguard, Fidelity will send an email to the person receiving the access authorizations. The authorizations are effective only after the grantee accepts.

The grantee will see additional accounts listed when they log into their Fidelity account. The additional accounts will be under a separate account group. They can customize the display name of each account to something that makes more sense to them.

Bidirectional PermissionsIf a married couple would like to give access to each other, they need to go through the process separately from each direction.

Notarized SignaturesGranting the highest level of access — Full Authority in Vanguard and Power of Attorney in Fidelity — requires notarized signatures. If you’d like to grant access at the highest level, you can grant at the second-highest level online first while you work on the paperwork for the highest level.

New AccountsThe access permissions you grant are for specific accounts. Remember to go through the authorization process again when you open new accounts.

Revoke AccessThe person who granted access can revoke the permission at any time. Follow the same process of granting access to revoke access to your accounts.

No Sharing Login and PasswordGoing through the official process of authorizing access is the right way to do it. Sharing your login and password with another person can weaken your protection from the financial institution. It can also put the other person in a position where they can be accused of identity theft or hacking.

After you authorize access, each person should log in with their own username and password.

Trusted ContactsIn light of elder financial abuse and scams, new regulations require financial institutions to offer the ability to designate trusted contacts. When they suspect a customer is being scammed or the customer has displayed diminished mental capacity, the financial institution will contact the trusted contact(s) to make sure the transactions are legit or alert the trusted contacts of potential issues.

Adding a trusted contact by itself does not give the trusted contact any permission to access the accounts but it can be used in conjunction with account access permissions. For instance, if an elderly parent adds an adult child as the trusted contact in addition to giving the adult child permission to view the accounts, the adult child can monitor the parent’s accounts and receive alerts from the financial institution for suspicious activities.

To add trusted contacts:

Fidelity: How to add a trusted contactVanguard: Profile & account settings -> Trusted ContactLearn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Let Your Spouse Access Your Fidelity or Vanguard Accounts appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower