Regulate This! Yeah? How?

As day follows night, the vaporization of FTX has spurred calls for regulation of crypto markets. Well, what kind of regulation, exactly? It matters.

It appears highly likely that SBF and his Merry Gang (of pervy druggies?) broke oodles of laws, in multiple jurisdictions. Class action lawsuits are definitely incoming, and the DOJ’s SDNY attorneys’ office is commencing a criminal investigation. No doubt criminal investigations will follow in other locations. So what would more laws accomplish, and what kind of laws and regulations would help?

It is interesting to note that SBF was going around DC and the media talking up regulating the industry, and winning effusive plaudits (but not from CZ!) for doing so, but his proposals didn’t come within a million miles of his alleged wrongdoing. I’m sure you’re shocked.

On CNBC, Bankman-Fried endorsed three regulatory endeavors: stablecoin auditing, “markets regulation” of spot trading, and token registration (at about the 4:30 mark):

None of which touches on the fundamental issue in the FTX fiasco, and in crypto market structure generally: the role of “exchanges” in supplying broker dealer and banking services, including liquidity, maturity, and credit transformations.

No doubt SBF was adding to his savior glow by pushing regulation that he knew was utterly irrelevant to the core of his business (and the business of all other crypto “exchanges”). And look at how many suckers fell for it.

So what would help? As I noted at the outset, FTX, Bankman-Fried, et al likely violated numerous laws. So what additional laws would reduce the likelihood and severity of such actions?

In thinking about this, remembering the distinction between ex ante and ex post regulation is important. Ex post regulation involves the imposition of sanctions on malfeasors after they have been found to have committed offense: the idea is to deter bad conduct through punishment after the fact. In contrast, ex ante regulation attempts to prevent bad acts by imposing various constraints on potential wrongdoers.

The choice between ex ante and ex post depends on a variety of factors. Two of the most important (and related) are whether the bad actor is judgment proof (i.e., will have the resources to recompense those he has harmed) and the probability of detection. (These are related because a low probability of detection requires a higher penalty to achieve deterrence, but a higher penalty increases the chances that the wrongdoer is judgment proof).

In the case of things like what has apparently happened here, the probability of detection is high (1.00 actually), but the magnitude of the harm is so great and the (negative) correlation between the harm and the wrongdoer’s ability to pay is so high (essentially -1.00) that ex post deterrence is problematic.

(Judgment proof-ness is actually a justification for criminal law and the use of incarceration as punishment. Deterrence through fines doesn’t work with broke bad guys, so non-monetary punishment is necessary–but often not sufficient!)

So there is a case for ex ante regulation here, just as there is a case for ex ante regulation of banks and intermediaries like broker dealers and FCMs. Banking examiners, regulatory audits, customer seg rules, and the like.

But these are obviously not panaceas. Bank fraud still occurs with depressing regularity, and the things that facilitate it, like valuation challenges, accounting shenanigans, and so on, occur in spades in crypto. And, even in highly regulated US markets, violation of seg rules and misuse of customer assets occurs: yeah, I’m looking at you John Corzine/MF Global.

The big problems in crypto markets are essentially agency problems, especially since the crucial agents–crypto “exchanges”–are so concentrated and so vertically integrated into both execution and various forms of financial transformations.

Ex ante regulation focused on such issues could be a boon, and could help stabilize crypto markets generally. The spillovers we are seeing from FTX’s vaporization are essentially a reputational contagion: the mini (so far) runs on other “exchanges” reflect FUD about their probity and solvency. (NB: Binance, as the biggest “exchange,” and as opaque as FTX, is a serious run risk. BlockFi and AAX may already be in the crosshairs here: glitch in the systems upgrade. Riiiiigggghhhht.)

The challenge is that the demise of financial intermediaries is well-described by a famous Hemingway quote:

“How did you go bankrupt?” Bill asked. “Two ways,” Mike said. “Gradually, then suddenly.”

An intermediary can go along swimmingly, meeting all seg requirements and the like, and a big market move or bad bet or an operational SNAFU can put it on the brink very suddenly–and encourage gambling for resurrection by using customer funds to extend and pretend. So don’t expect such regulation to be a panacea, and prevent the recurrence of FTXs. Regulation or no, this happens with intermediaries that engage in liquidity, maturity, and credit transformations that are inherently fragile. (And may be fragile by design, as Doug Diamond has pointed out.)

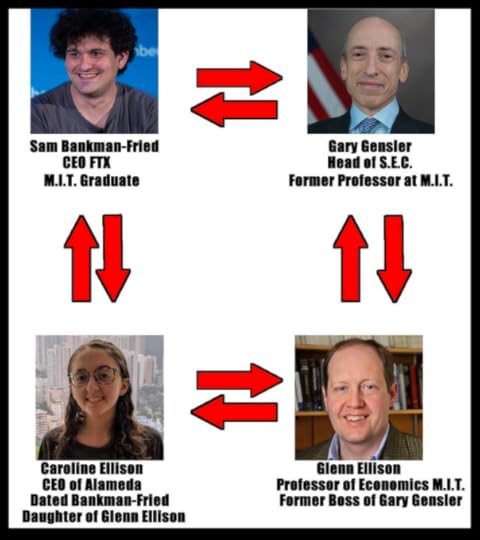

On the regulation issue, one fascinating sidebar is my old bête noire, Gary Gensler. You don’t need to play 6 Degrees From SBF to ensnare most of the Democratic establishment: one or two degrees will do, and Gensler definitely qualifies.

In addition to the MIT connection, Gensler apparently had other interactions with Bankman-Fried. And of course Gensler is a player in the Democratic Party (he was Hillary’s campaign’s finance chair, after all), and Bankman-Fried was a major Dem donor (second largest after Soros in the most recent cycle, and he had talked about spending up to a billion in the 2024 campaign).

When initially questioned about FTX, Gensler was very defensive: “Building the evidence, building the facts often takes time.”

I am reserving judgment, but I hope someone takes the time to examine the links and interactions between SBF/FTX and Gensler (and other DC creatures)–and build the evidence and facts, if it comes to that.

My guess is that Gensler will try to pull a judo move and use this fiasco as a justification for expanding the power of the SEC. Indeed, I expect him to be in high dudgeon precisely to deflect attention from his (and his party’s) links to SBF. Don’t let him get away with it.

And don’t think that these links can be exposed through a FOIA. Gensler has long been known for using his private email to conduct official business. (Which is precisely why I didn’t bother FOAI-ing him years ago regarding my suspicions of his interactions with David Kocieniewski.) So deeper digging is required, and it should commence, post haste.

Craig Pirrong's Blog

- Craig Pirrong's profile

- 2 followers