2022 2023 Tax Brackets, Standard Deduction, Capital Gains, etc.

My other post listed 2022 2023 401k and IRA contribution and income limits. I also calculated the inflation-adjusted tax brackets and some of the most commonly used numbers in tax planning for 2023 using the published inflation numbers and the same formula prescribed in the tax law. The official numbers announced by the IRS confirmed my calculations.

Table of Contents2022 2023 Standard Deduction2022 2023 Tax Brackets2022 2023 Capital Gains Tax2022 2023 Estate and Trust Tax Brackets2022 2023 Gift Tax Exclusion2022 2023 Savings Bonds Tax-Free Redemption for College Expenses2022 2023 Standard DeductionYou don’t pay federal income tax on every dollar of your income. You deduct an amount from your income before you calculate taxes. About 90% of all taxpayers take the standard deduction. The other ~10% itemize deductions when their total deductions exceed the standard deduction. In other words, you’re deducting a larger amount than your allowed deductions when you take the standard deduction. Don’t feel bad about taking the standard deduction!

The basic standard deduction in 2022 and 2023 are:

20222023Single or Married Filing Separately$12,950$13,850Head of Household$19,400$20,800Married Filing Jointly$25,900$27,700Basic Standard DeductionSource: IRS Rev. Proc. 2021-45, Rev. Proc. 2022-38.

People who are age 65 and over have a higher standard deduction than the basic standard deduction.

20222023Single, age 65 and over$14,700$15,700Head of Household, age 65 and over$21,150$22,650Married Filing Jointly, one person age 65 and over$27,300$29,200Married Filing Jointly, both age 65 and over$28,700$30,700Standard Deduction for age 65 and overSource: IRS Rev. Proc. 2021-45, Rev. Proc. 2022-38.

People who are blind have an additional standard deduction.

20222023Single or Head of Household, blind+$1,750+$1,850Married Filing Jointly, one person is blind+$1,400+$1,500Married Filing Jointly, both are blind+$2,800+$3,000Additional Standard Deduction for BlindnessSource: IRS Rev. Proc. 2021-45, Rev. Proc. 2022-38.

2022 2023 Tax BracketsThe tax brackets are based on taxable income, which is AGI minus various deductions. The tax brackets in 2022 are:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $10,275$0 – $14,650$0 – $20,55012%$10,275- $41,775$14,650 – $55,900$20,550 – $83,55022%$41,775 – $89,075$55,900 – $89,050$83,550 – $178,15024%$89,075 – $170,050$89,050 – $170,050$178,150 – $340,10032%$170,050 – $215,950$170,050 – $215,950$340,100 – $431,90035%$215,950 – $539,900$215,950 – $539,900$431,900 – $647,85037%Over $539,900Over $539,900Over $647,8502022 Tax BracketsSource: IRS Rev. Proc. 2021-45.

The 2023 tax brackets are:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $11,000$0 – $15,700$0 – $22,00012%$11,000 – $44,725$15,700 – $59,850$22,000 – $89,45022%$44,725 – $95,375$59,850 – $95,350$89,450 – $190,75024%$95,375 – $182,100$95,350 – $182,100$190,750 – $364,20032%$182,100 – $231,250$182,100 – $231,250$364,200 – $462,50035%$231,250 – $578,125$231,250 – $578,100$462,500 – $693,75037%Over $578,125Over $578,100Over $693,7502023 Tax BracketsSource: IRS Rev. Proc. 2022-38.

A common misconception is that when you get into a higher tax bracket, all your income is taxed at the higher rate, and you’re better off not having the extra income. That’s not true. Tax brackets work incrementally. If you’re $1,000 into the next tax bracket, only $1,000 is taxed at the higher rate. It doesn’t affect the income in the previous brackets.

For example, someone single with a $60,000 AGI in 2022 will pay:

First 12,950 (the standard deduction)0%Next $10,27510%Next $31,500 ($41,775 – $10,275)12%Final $5,27522%Progressive Tax RatesThis person is in the 22% tax bracket but only less than 10% of the $60,000 AGI is really taxed at 22%. The bulk of the income is taxed at 0%, 10%, and 12%. The blended tax rate is only 9.9%. If this person doesn’t earn the final $5,275, he or she is in the 12% bracket instead of the 22% bracket, but the blended tax rate only goes down slightly from 9.9% to 8.8%. Making the extra income doesn’t cost this person more in taxes than the extra income.

Don’t be afraid of going into the next tax bracket.

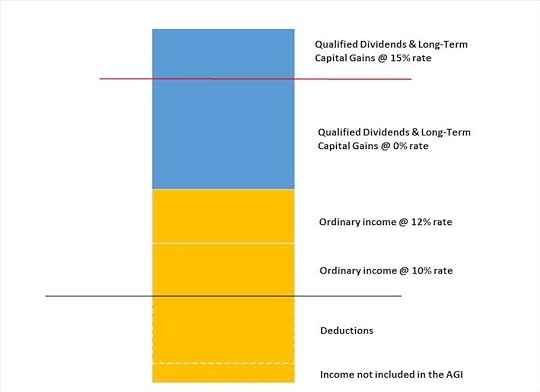

2022 2023 Capital Gains TaxWhen your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are below a cutoff, you will pay 0% federal income tax on your qualified dividends and long-term capital gains under this cutoff.

This is illustrated by the chart below. Taxable income is the part above the black line, after subtracting deductions. A portion of the qualified dividends and long-term capital gains is taxed at 0% when the other taxable income plus these qualified dividends and long-term capital gains are under the red line.

The red line is close to the top of the 12% tax bracket but they don’t line up exactly.

20222023Single or Married Filing Separately$41,675$44,625Head of Household$55,800$59,750Married Filing Jointly$83,350$89,250Maximum Zero Rate Amount for Qualified Dividends and Long-term Capital GainsSource: IRS Rev. Proc. 2021-45, Rev. Proc. 2022-38.

For example, suppose a married couple filing jointly has $70,000 in other taxable income (after deductions) and $20,000 in qualified dividends and long-term capital gains in 2022. The maximum zero rate amount cutoff is $83,350. $13,350 of the qualified dividends and long-term capital gains ($83,350 – $70,000) is taxed at 0%. The remaining $20,000 – $13,350 = $6,650 is taxed at 15%.

A similar threshold exists on the upper end for qualified dividends and long-term capital gains. When your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are above a cutoff, you will pay 20% federal income tax instead of 15% on your qualified dividends and long-term capital gains above this cutoff.

20222023Single$459,750$492,300Head of Household$488,500$523,050Married Filing Jointly$517,200$553,850Married Filing Separately$258,600$276,900Maximum 15% Rate Amount for Qualified Dividends and Long-term Capital GainsSource: IRS Rev. Proc. 2021-45, Rev. Proc. 2022-38.

2022 2023 Estate and Trust Tax BracketsEstates and trusts have different tax brackets than individuals. These apply to non-grantor trusts and estates that retain income as opposed to distributing the income to beneficiaries. Grantor trusts (including the most common revocable living trusts) don’t pay taxes separately. The income of a grantor trust is taxed to the grantor at the grantor’s tax brackets.

Here are the tax brackets for estates and trusts in 2022 and 2023:

2022202310%$0 – $2,750$0 – $2,90024%$2,750 – $9,850$2,900 – $10,55035%$9,850 – $13,450$10,550 – $14,45037%over $13,450over $14,450Estate and Trust Tax BracketsSource: IRS Rev. Proc. 2021-45, Rev. Proc. 2022-38.

2022 2023 Gift Tax ExclusionEach person can give another person up to a set amount in a calendar year without having to file a gift tax form. Not that filing a gift tax form is onerous, but many people avoid it if they can. In 2023, this gift tax exclusion amount will likely increase from $16,000 to $17,000.

20222023Gift Tax Exclusion$16,000$17,000Gift Tax ExclusionSource: IRS Rev. Proc. 2021-45, Rev. Proc. 2022-38.

The gift tax exclusion is counted by each giver to each recipient. As a giver, you can give up to $16,000 each in 2022 to an unlimited number of people without having to file a gift tax form. If you give $16,000 to each of your 10 grandkids in 2022 for a total of $160,000, you still won’t be required to file a gift tax form. Any recipient can also receive a gift from an unlimited number of people. If a grandchild receives $16,000 from each of his or her four grandparents in 2022, no taxes or tax forms will be required.

2022 2023 Savings Bonds Tax-Free Redemption for College ExpensesIf you cash out U.S. Savings Bonds (Series I or Series EE) for college expenses or transfer to a 529 plan, your modified adjusted gross income must be under certain limits to get a tax exemption on the interest. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan. Here are the income limits in 2022 and 2023:

20222023Single, Head of Household$85,800 – $100,800$91,850 – $106,850Married Filing Jointly$128,650 – $158,650$137,800 – $167,800Income Limit for Tax-Free Savings Bond Redemption for Higher EducationSource: IRS Rev. Proc. 2021-45, Rev. Proc. 2022-38.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 2023 Tax Brackets, Standard Deduction, Capital Gains, etc. appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower