What is conflict theory?

Conflict theory argues that due to competition for limited resources, society is in a perpetual state of conflict.

Understanding conflict theoryConflict theory was developed by German philosopher Karl Marx who studied the causes of conflict between the bourgeois (middle to upper-middle class) and proletariat (the working class and poor) in Europe.

Marx was particularly interested in the political, social, and economic ramifications of increasing capitalism in Europe in the mid-1800s. Since capitalism was premised on the existence of a powerful minority class of wealthy individuals and a relatively oppressed majority class, Marx believed the opportunities for conflict were rife.

Conflict theory is based on the idea that both classes are locked in a perpetual battle over resources that are not distributed evenly across society. Wealthier individuals tend to hoard the resources they possess, while poorer individuals do whatever they can to obtain them. These incompatible interests are the drivers of conflict.

Note that Max believed conflict itself was neither good nor bad and instead, should be considered a natural human tendency that most default to. As a consequence, the theory could be used to explain any social phenomenon such as revolution, war, violence, discrimination, and most other forms of injustice.

Conflict theory in economicsIn an economic context, Marx focused on two factors:

The mode of production – in other words, an industrial factory, andRelations of production – a term describing the unequal balance of power between factory workers and factory owners.Since the bourgeoisie owns (and controls) the mode of production, they tend to exploit the proletariat as a way to increase profits. The proletariat has much less power, with only their labor to sell and no access or control over capital.

This causes the common predicament where the proletariat works as little as possible to be paid as much as possible. The bourgeois factory owners, on the other hand, want the proletariat to work as hard as possible for the least amount of pay.

Conflict theory in financeGovernments attempt to manage conflict over financial resources via the reallocation of funds between the rich and the poor. Some common initiatives include a mandated minimum wage, special incentives, favorable tax structures, and social assistance.

The underlying belief behind these measures is that a wealth gap that becomes too wide will cause social unrest to ensue. This may range from a peaceful protest on one end of the spectrum to outright civil war. Advocates of conflict theory believe the government bailouts and Occupy Wall Street movement that occurred during the 2008 GFC is one prime example.

Indeed, competition for limited resources ultimately reached a point where the government needed to intervene to redistribute resources more effectively. Since that time, the divide between the rich and poor has grown once more and there may be similar conflicts in the near future.

Key takeaways:Conflict theory argues that due to competition for limited resources, society is in a perpetual state of conflict. It was developed by German philosopher Karl Marx who studied the class conflict between the wealthy and not-so-wealthy.In an economic context, conflict theory deals with the interaction between the mode of production and relations of production. Workers attempt to work as little as possible for the maximum amount of pay, while factory owners strive to pay the lowest possible wage while extracting maximum worker productivity.Governments attempt to manage conflict over financial resources via the reallocation of funds between the rich and the poor. This can be achieved via numerous initiatives or as a response to financial events such as the GFC.Main Free Guides:

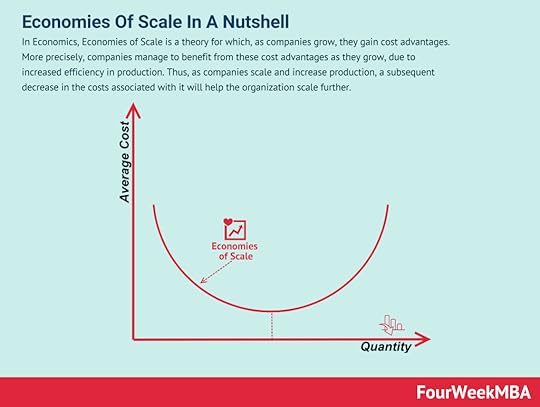

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsConnected Business Concepts In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

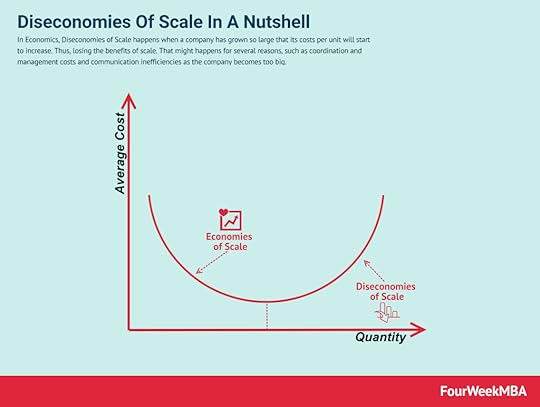

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.

The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.The post What is conflict theory? appeared first on FourWeekMBA.