What is the critical element in a business pitch for investment?

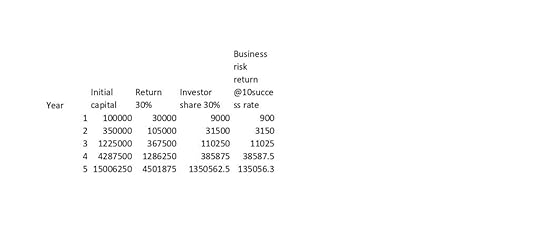

An investor is looking at businesses at projects that will yield sustained returns. As I repeatedly keep saying, the investor is in the business of making money. Most investors secure funds from high-network individuals and institutions, promising them a high return on the capital deployed. The majority of the investors that you see in the market are mere intermediaries of employees of fund houses. Their mandate is to secure projects that pose a minimum risk and yield high returns.

A pitch should, therefore, contain concrete evidence that the project idea has been tested and has the potential to yield great returns. The project need not be immediately in the black. What is important is the evidence of the promise of returns. I do not subscribe to the camp that you can attract investor interest by dressing up the balance sheet. Even if an investor may fall for it, most investors hire an analyst to undertake due diligence on the asset. It will not be long before the real numbers emerge. The deal will not go through, and funding will not be done.

Competition analysis, industry mapping, and customer profiling are tools for discovering the innate strengths of a venture. At the heart of this exercise is demonstrating that the business will yield consistent returns on investment.

Professional certification:

Marketing strategy Similar Posts:

What are the key features of a business plan for popcorn production venture? Why is scalability and organic growth in a startup critical to an investor?What is the best way to pitch your small business?

Why is scalability and organic growth in a startup critical to an investor?What is the best way to pitch your small business?The post What is the critical element in a business pitch for investment? appeared first on Sudhirahluwalia, Inc.