Oregon Department Of Revenue Collections Phone Number

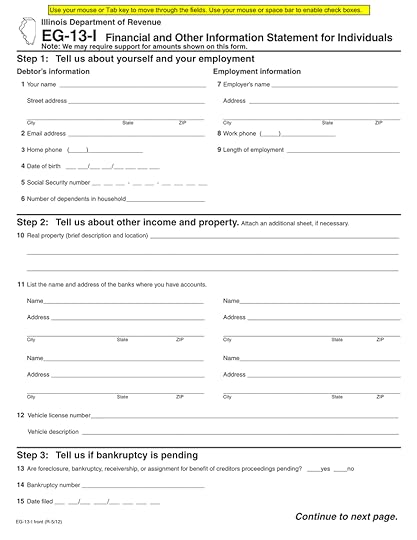

Oregon Department Of Revenue Collections Phone Number. After you request a waiver, begin sending your payments by check immediately. If you have a bill that is being handled by the division of collections and you would like to pay in full or set up a payment agreement, please click here.

Sc Department Of Revenue Form Wh 1612 brinkodesigns from brinkodesigns.blogspot.com

Sc Department Of Revenue Form Wh 1612 brinkodesigns from brinkodesigns.blogspot.comAfter you request a waiver, begin sending your payments by check immediately. We accept all relay calls. Use this address list to ensure your form or letter gets to the right place.

Source: www.formsbank.com

Source: www.formsbank.comI would like to submit a compliment or complaint. Contact and follow us phone:

Source: www.formsbank.com

Source: www.formsbank.comBy checking the yes box and providing your cell phone number on the payment plan application. Pay with a bank draft or credit card.

Source: www.pdffiller.com

Source: www.pdffiller.comHowever, if you contact the department of revenue, they may work with you to get the garnishment reduced. A debt collector is someone who attempts to collect a debt you owe.

Source: brinkodesigns.blogspot.com

Source: brinkodesigns.blogspot.comRather than trying to call oregon department of revenue first, consider describing your. The montana department of revenue is unable to assist in securing your stimulus payment.

Source:

Source: The minnesota department of revenue asks you to supply this information on the contact form to verify your identity. By providing your ssn and year of birth, it ensures your arts tax filing and payment are properly applied to your account.

Source: mborydesign.blogspot.com

Source: mborydesign.blogspot.comCookies are required to use this site. If the letters or numbers are still not visible, press the tab key.

Source: designbyraquel.blogspot.com

Source: designbyraquel.blogspot.comYour browser appears to have cookies disabled. Cookies are required to use this site.

Source: www.formsbank.com

Source: www.formsbank.comCall 211 from anywhere in the state to locate a vita site near you during income tax season How do i contact oregon department of revenue?

Source: sonicwavedesign.blogspot.com

Source: sonicwavedesign.blogspot.comThe only thing the state of oregon is good at is getting the. You must process the department's wage attachment even if your employee is subject to another garnishment.

Source: www.formsbank.com

Source: www.formsbank.comYou may send us tax law questions using one of the emails below. By checking the yes box and providing your cell phone number on the payment plan application.

Source: studylib.net

Source: studylib.netYou may send us tax law questions using one of the emails below. How do i contact oregon department of revenue?

Source: studylib.net

Source: studylib.netBy checking the yes box and providing your cell phone number on the payment plan application. In oregon, debt collectors must register with the oregon department of consumer and business services and comply with state and federal fair debt collection laws.

Source: studylib.net

Source: studylib.netThese buildings may not allow cell phones with cameras. Map of salem oregon irs office in salem, oregon.

Source: revneus.blogspot.com

Source: revneus.blogspot.comUse this address list to ensure your form or letter gets to the right place. I would like to submit a compliment or complaint.

Source: www.formsbank.com

Source: www.formsbank.comAddress and phone number for salem oregon irs office, an irs office, at oak street southeast, salem or. We are not available on weekends or state holidays.

Source: www.formsbank.com

Source: www.formsbank.comBy checking the yes box and providing your cell phone number on the payment plan application. If you owe me money, you'll send it back sans interest whenever you feel like getting around to it.

Source: www.formsbank.com

Source: www.formsbank.comOregon department of revenue industries: These steps can range from an initial balance due notice to more serious collections enforcement actions such as liens, administrative judgments, garnishments, asset seizures and referrals to collection agencies or prosecuting attorneys.

[image error]Source: oregon-form-40.pdffiller.com15 reviews of oregon department of revenue so, let me get this straight: This is the oregon department of revenue.

Source: www.formsbank.com

Source: www.formsbank.comBy checking the yes box and providing your cell phone number on the payment plan application. By providing your ssn and year of birth, it ensures your arts tax filing and payment are properly applied to your account.

Source: www.formsbank.com

Source: www.formsbank.comRather than trying to call oregon department of revenue first, consider describing your. Your browser appears to have cookies disabled.

We Accept All Relay Calls.Oregon department of revenue contact phone number is : I've said it before and i'll say it again: You must process the department's wage attachment even if your employee is subject to another garnishment.

We Also Need The Year Of Birth To Ensure We Do Not Assess The Tax On Someone Under 18 Years Old.Oh, i see how that works. By checking the yes box and providing your cell phone number on the payment plan application. Contact and follow us phone:

Filing A Tax Lien Against Your Property In The County Lien Record.If it is the collections agency then please include the name. Much like the irs and oregon department of revenue (dor), the city requires a full social security number (ssn) and complete date of birth to correctly identify individuals. The department of revenue is responsible for taking steps to ensure individuals and businesses pay their tax liability.

Your Browser Appears To Have Cookies Disabled.How do i contact oregon department of revenue? I would like to submit a compliment or complaint. The only thing the state of oregon is good at is getting the.

If You Owe Me Money, You'll Send It Back Sans Interest Whenever You Feel Like Getting Around To It.After you request a waiver, begin sending your payments by check immediately. Oregon department of revenue industries: By providing your ssn and year of birth, it ensures your arts tax filing and payment are properly applied to your account.