How Does Klarna Make Money? Klarna Business Model In A Nutshell

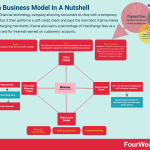

Klarna is a financial technology company allowing consumers to shop with a temporary Visa card. Thus it then performs a soft credit check and pays the merchant. Klarna makes money by charging merchants. Klarna also earns a percentage of interchange fees as a commission and for interests earned on customers’ accounts.

Origin storyKlarna is a financial technology company founded in Stockholm in 2005.

The company is perhaps best known for its buy now, pay later (BNPL) service. This enables consumers to purchase a product with no upfront cost. Instead, the product is paid off over four interest-free installments over a predetermined period. For larger purchases, Klarna users can finance their purchases over 3 years.

To onboard customers, Klarna allows consumers to shop with a temporary Visa card number known as a “ghost card”. That is, the customer does not need to provide payment details to the merchant when making a purchase. Klarna then performs a soft credit check on the card number ID and pays the merchant. Lastly, the consumer receives the product and an invoice from Klarna with payment instructions.

Klarna mission and visionKlarna’s mission is to “make paying as simple, safe and smooth as possible.“

While Klarna’s vision is to “transfer the power from the large corporations to the consumer and empower consumers to make fast and informed decisions.”

Klarna revenue generationTo drive revenue, Klarna very much relies on charging the merchant as opposed to the consumer.

Let’s take a look at some of the primary revenue drivers of Klarna.

Payment feesThe majority of Klarna’s revenue is derived from a merchant transaction and variable percentage fee. These fees fluctuate according to the payment method and country of origin of the customer. In the United States, for example, merchants must pay Klarna a 30 cent transaction fee on top of a variable fee between 3.29-5.99%.

Payment fees are also generated when customers:

Want to check out with a few clicks. Known as the Instant Shopping feature, Klarna charges merchants a $30 monthly product fee with a fixed $0.30 transaction fee. Merchants are also hit with a 3.29% fee for onsite transactions and a 3.79% fee for offsite transactions.Want to pay in four installments. In this case, Klarna charges the same $0.30 transaction fee combined with variable fees as high as 5.99%.Want to pay monthly. Here, Klarna takes a $0.30 fixed transaction fee and 3.29% in variable fees. Customers will also be charged interest throughout the loan, with annual percentage rates as high as 29.99%.Fail to pay by the specified date. Late fees are charged monthly and can top $35.Interchange feesKlarna recently launched a bank account facility with the issuance of a free debit card to users in collaboration with Visa.

When a consumer makes an eligible purchase, an interchange fee (typically around 1%) is paid by the merchant to the card issuer. Klarna then takes a portion of the interchange fee in exchange for promoting Visa as a service to its customer base.

Cash interestWith the aforementioned bank account facility, Klarna earns money on the cash in those accounts by lending it out to other institutions.

Klarna vs Affirm vs AfterpayKlarna, Affirm, and Afterpay are all buy-now-pay-later (BNPL) providers that allow consumers to purchase goods and services and then pay them off with micro-installments over a set period.

While a new market entrant in this industry feels like a daily occurrence, Klarna, Affirm, and Afterpay represent some of the largest and most popular BNPL providers in 2022. In this article, we’ll compare and contrast aspects of their respective businesses to enable consumers and merchants to choose the one that best suits their needs.

Credit approvalLittle separates the three companies in terms of credit approvals, which many critics argue is a serious deficiency of the BNPL concept in any case.

Each app combines typical “soft” information such as salary and credit history with insights gleaned from machine learning and a user’s social media activity. For consumers, this means there is little appreciable difference between providers in terms of whether their application is accepted or rejected.

Interest and late feesWhere there are differences, however, is in the way payments and fees are charged.

For customers of Klarna and Afterpay, the “loan” that allows them to purchase products without having the funds to do so comes with no interest fees. Affirm will collect interest fees if the consumer chooses the monthly installment option instead of the typical fortnightly plan.

In terms of late fees, Affirm does not charge them while the fee is $7 for Klarna and $8 for Afterpay. Instead of a monetary penalty, Affirm will block its customers from being able to make additional purchases. Note that these are fees for North American customers and will vary by country.

Payment schedulingAfterpay users must pay 25% of the total purchase price upfront and split the remaining 75% with payments over the next three fortnights (six weeks).

Affirm is a more lenient, allowing customers to spread their payments out over up to three years. This makes it better suited to high-ticket items or for those who simply want a simple, long-term payment solution not unlike a traditional loan.

Klarna, on the other hand, offers terms similar to those of Afterpay when it was first launched. That is, four payments split over two months or eight weeks.

Merchant fees and featuresMerchants that want to include Afterpay as a payment option pay a commission rate of 4-6% of the transaction plus 30 cents. The exact fee is based on a negotiated amount between the merchant and Afterpay. Note also that merchants are not paid until the customer has received their items in the mail.

Affirm merchants are paid within 1-3 business days of the purchase and the company provides more flexibility with respect to the payment terms that are offered to consumers. Affirm also charges a commission and while the exact rate is undisclosed, most estimates suggest it is around 3%.

Klarna’s merchant fee structure is comparable to those offered by Afterpay. There is a 30-cent transaction fee plus a variable fee of between 3.29% to 5.99%. Unlike Afterpay, however, Klarna pays the merchant upfront and assumes the customer’s credit risk. It also offers merchants a diverse range of payment options, including direct checkout and even loan financing.

Summarizing the key differences between Klarna, Affirm and AfterpayKlarna, Affirm, and Afterpay represent some of the largest and most popular BNPL providers in 2022, but there are subtle differences in their business models.Klarna and Afterpay charge no interest fees provided the customer makes their payments on time, while Affirm will collect interest fees if a buyer chooses the monthly payment plan. Late fees are also charged by Klarna and Afterpay for missed payments. Affirm, on the other hand, simply chooses to ban customers from making additional purchases.In terms of payment scheduling, Afterpay asks for 25% of the total purchase price upfront with the remainder to be paid across three fortnights. Klarna has a similar schedule with payments spread out after eight weeks instead of six. Affirm allows consumers to spread their payments out over as many as three years. As a result, it tends to be more suitable for more significant purchases.Key takeaways:Klarna is a Swedish financial technology company founded in 2005. The company is known for its innovative payment services, including BNPL functionality and other flexible arrangements.Klarna makes its money by charging the merchant and not the consumer. The company only makes money from the customer when they elect to spread out the cost of a purchase over multiple months.In addition to typical payment and transaction fees, Klarna also earns a percentage of interchange fees as a commission. They also derive income from the cash sitting in the accounts of their customers.Connected Business ModelsAfterpay Business Model Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Quadpay Business Model

Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Quadpay Business Model Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.SoFi Business Model

Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.SoFi Business Model SoFi is an online lending platform that provides affordable education loans to students, and it expanded into financial services, including loans, credit cards, investment services, and insurance. It makes money primarily via payment processing fees and loan securitization.Chime Business Model

SoFi is an online lending platform that provides affordable education loans to students, and it expanded into financial services, including loans, credit cards, investment services, and insurance. It makes money primarily via payment processing fees and loan securitization.Chime Business Model Chime is an American neobank (internet-only bank) company, providing fee-free financial services through its mobile banking app, thus providing personal finance services free of charge while making the majority of its money via interchange fees (paid by merchants when consumers use their debit cards) and ATM fees.How Does Venmo Make Money

Chime is an American neobank (internet-only bank) company, providing fee-free financial services through its mobile banking app, thus providing personal finance services free of charge while making the majority of its money via interchange fees (paid by merchants when consumers use their debit cards) and ATM fees.How Does Venmo Make Money Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo also launched a debit card in partnership with Mastercard. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.FinTech Business Models

Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo also launched a debit card in partnership with Mastercard. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.FinTech Business Models Fintech business models leverage tech and digital to enhance the financial service industry. Fintech business models, therefore, apply tech to various financial service use cases. Fintech business model examples comprise Affirm, Chime, Coinbase, Klarna, Paypal, Stripe, Robinhood, and many others whose mission is to digitize the financial services industry.

Fintech business models leverage tech and digital to enhance the financial service industry. Fintech business models, therefore, apply tech to various financial service use cases. Fintech business model examples comprise Affirm, Chime, Coinbase, Klarna, Paypal, Stripe, Robinhood, and many others whose mission is to digitize the financial services industry.Read Next:

How Does Robinhood Make MoneyHow Does Venmo Make MoneyHow Does Honey Make MoneyHow Does YouTube Make MoneyHow Does Telegram Make MoneyHow Does Discord Make MoneyMain Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelsThe post How Does Klarna Make Money? Klarna Business Model In A Nutshell appeared first on FourWeekMBA.