How Does Robinhood Make Money? – Updated 2022

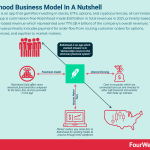

Robinhood is an app that gamifies investing in stocks, ETFs, options, and cryptocurrencies, all commission-free. While the app is commission-free Robinhood made $1.81 billion in total revenues in 2021, primarily based on transaction-based revenue which represented over 77% ($1.4 billion) of the company’s overall revenues. Transaction-based revenues primarily includes payment for order flow from routing customer orders for options, cryptocurrencies, and equities to market makers.

Revenues breakdown2021Transaction-based revenues$1.4 BillionNet interest revenues$257 MillionsOther revenues$155.9 MillionsTotal Revenues$1.81 BillionNet Losses$-3.68 BillionsTransaction-based revenues breakdown2021%Options$688.8 Millions49%Cryptocurrencies$419.38 Millions30%Equities$287.73 Millions21%Other$6.33 Millions0.5%Total$1.4 Billion Robinhood Key Financial Stats201920202021Net Cumulative Funded Accounts5.1 Millions12.5 Millions22.7 MillionsMonthly Active Users (MAU)4.3 Millions11.7 Millions17.3 MillionsAssets Under Custody (AUC)$14.13 Billion$62.97 Billion$98 BillionAverage Revenues Per User (ARPU)$65$108$103Key Facts FoundersVladimir Tenev & Baiju BhattYear FoundedApril 18, 2013Year of IPO7/28/2021IPO Price$38.00Total Revenues at IPO$958 MillionsTotal Revenues in 2021$1.4 BillionEmployees3,800 full-time employees as of December 2021Revenues per Employee$369,039.47Robinhood business model short breakdownWe describe the Robinhood business model via the VTDF framework developed by FourWeekMBA.

Robinhood Business ModelDescriptionValue Model: Democratize Investing.Robinhood’s mission is to “democratize access to the American financial system.” They do that via a gamified investment platform which is easy to set up and use with no commissions (customers are routed to market makers who earn Robinhood payment for order flow commissions).Technological Model: Asymmetric Platform, Two-Sided Network Effects.Robinhood leverages two-sided network effects, where the more free users join the platform, the more it becomes attractive to market makers, thus prompting the platform to add a growing number of assets quickly. While Robinhood is primarily free for users, it generates revenues by routing customers to market makers and getting commissions for that. That is the mechanism of the so-called “payment for order flow.” That means that market makers are the primary customers for Robinhood.Distribution Model: Branding/Product Development/Growth Hacking, Deal Making, Lobbying.For Robinhood to keep growing, the company needs to invest massive resources back into its platform to enable a larger and larger number of users to invest on top of it. The company also invests substantial resources in branding campaigns, securing distribution deals on various platforms, and keeping its app’s rankings high across the Apple and Android stores. In addition, since Robinhood operates in a highly regulated sector, it needs to be able to keep close ties with regulators in the financial sectors (this is why Robinhood has internalized various lobbyists profiles in the last 2-3 years).Financial Model: Payment for Order Flow.While Robinhood is free for users, users transacting on Robinhood are routed to market makers, thus earning the company commissions for this trading activity, facilitating liquidity through various markets. In 2021, for instance, Robinhood made most of its money from the payment for order flow related to options and cryptocurrencies (and within cryptocurrencies primarily with Doge).Robinhood business model todayWhile Robinhood’s app is free, and it makes it easy for users to invest, it does make money in an asymmetric way. In fact, the company makes money on the transactions placed by its users, not by charging a commission, but instead by the so-called payment for order flow (“PFOF”).

Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.

Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.Indeed, transaction-based revenues (which represented over 77% of the company’s revenues in 2021) consist of amounts earned from routing customer orders for options, cryptocurrencies, and equities to market makers.

As the company highlights, when customers place orders for options, cryptocurrencies, or equities on Robinhood, the platform routes these orders to market makers, receiving a commissions from them for creating market liquidity.

When it comes to equities and options trading, these fees are known as payment for order flow (“PFOF”).

When it comes to cryptocurrency trading, those are called “Transaction Rebates.”

When it comes to equities, the fees are based on the publicly quoted bid-ask spread for the security being traded.

For options, the fee is on a per contract basis based on the underlying security.

In the case of cryptocurrencies, Robinhood’s rebates are a fixed percentage of the notional order value.

Robinhood’s revenues, in 2021, were primarily driven by options and cryptocurrency trading.

While Robinhood supports various cryptocurrencies for trading, during the second quarter of 2021 and for the first, second, and third quarters of 2021, transaction-based revenue attributable to transactions in a single cryptocurrency (Dogecoin) generated approximately 7%, 32%, and 8% of our total net revenues, for each quarter!

Quick intro to RobinhoodAs pointed out on the Robinhood website you can “Invest in stocks, ETFs, options, and cryptocurrencies, all commission-free, right from your phone or desktop.“Robinhood earns money by offering:Robinhood Gold, a margin trading service, which starts at $6 a monthEarn interests from customer cash and stocks, just like a bank collects interest on cash depositsAnd from rebates from market makers and trading venuesRobinhood’s claimed mission is to “democratize access to the American financial system.”

Indeed, Robinhood’s primary value proposition is fueled by an investing platform that lets you buy and sell stocks, exchange-traded funds, options, and cryptocurrencies, all commission-free. As its mission is to democratize the financial system, this goes through three main elements of the platform:

User-friendlyMade for all investors–newcomersAnd convenient also to experts (even though that is not the primary target)As Vlad Tenev, co-founder of Robinhood told Business Insider “there were a lot of people who didn’t believe in it, and we had to bang down a ton of doors. We were really relentless.”

After seventy-five pitches they finally got a round of investing that allowed them to launch the platform.

As explained on the Robinhood website, the realization of a market potential from the app came from the two founders’ experience in selling software to Wall Street’s hedge funds.

They figured those funds paid nothing for those transactions, while the average American would be charged for fees that would be up to $10 for every trade. From that, they realized they could democratize the whole process.

That is why in December 2013 they launched the service on Hacker News even before it was available:

If we look at the Robinhood business model more in detail, we find out it makes money with three primary ways:

Interest earning accountsA freemium model relying on more “advanced” featuresMonetizing via market making feesInterests earning accountsWhen the cash on Robinhood accounts are uninvested cash, those can be lent out and invested in other safe financial instruments that make Robinhood earn a small return on each dollar invested.The freemium modelFreemium is an effective model that can help companies leverage the free offering to create a sales funnel that generates a continuous stream of leads and paying customers.

Indeed, Robinhood offers basic services for free, and it offers more advanced functionalities (like buying on margins, or after-hours trading) part of a paid package called Robinhood Gold.

Read: Successful Types Of Business Models

Market making feesAnother more controversial way for Robinhood to make money is through market makers, which pay small fees to Robinhood for sending trades to process through their platforms.

When a company becomes a synonym of buying stocksDuring the pandemic Robinhood became even more popular, as more people looked into investing:

Stories of Robinhood amateurs, retail investors, performing better than Wall Street firms, became a mantra that helped the company further spread and grow.

However, Robinhood also became an app used by teenagers. In June 2020, a 20-year old started to trade options at the margin, and he had accumulated a paper loss of over $700K which led him to suicide.

This opened up the worry of predatory issues from the Robinhood part and the risk of running an app that makes it easy for everyone to trade. How Robinhood will address these issues will also affect how the platform will evolve and how regulation will react to that.

Handling hypergrowthAs we saw at the beginning of this story, Robinhood’s preferred mode of expansion has always been through a waitlist that the company opened to quickly gain traction.

Robinhood started to roll out its waitlist in 2019, for the UK. This was an important move, as it would have enabled an expansion outside the US.

As the company announced back in 2019:

In 2013, Robinhood set out on a mission to democratize the financial system. We pioneered commission-free investing in the US to enable everyone to participate in the markets. Since then, over six million Americans have discovered Robinhood.

And it continued:

Today, we’re excited to continue our journey and introduce the Robinhood investing platform to the UK. With Robinhood, you can invest in thousands of US and global stocks, commission-free. There are no foreign exchange fees and no account minimums. Sign up today to get early access when we launch in early 2020.

Yet, as the pandemic hit and growth picked up even further, also troubles came with it. Indeed, one thing is growth, another is hypergrowth.

When companies scale too quickly, especially in a sector, like Robinhood’s growth within the financial industry, things can get messy.

In an industry highly regulated, and with the potential to negatively influence the lives of many young people approaching trading for the first time, Robinhood had to pause its international growth plan and focus on the US market.

In a statement released to TechCrunch the company announced:

A lot has changed in the world over the past few months, and we’ve made the difficult decision to postpone our UK launch indefinitely.

And it stressed out how it needed to focus back on its core, the US, before being able to grow internationally, and not for lack of resources.

The company, back in May 2020, closed a round of $280 million, led by Sequoia, which valued the company at $8.3 billion.

Therefore, the focus back to the US, more than a problem of lack of allocated resources for growth, is a problem of handling scalability in an industry that has high regulatory boundaries.

Robinhood and the meme economy Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.

Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.As I explained in the piece about meme investing:

Platforms like Robinhood make money on fees from large Wall Street institutions through a mechanism known as “payment for order flow.” In short, this is controversial not only from the fact it kind of goes against Robinhood’s mission to democratize investing but also in terms of potential conflict of interests between the platform and its retail investors.

In fact payments for order flow or “PFOF” work apps like Robinhood, or other stock brokerage firms make money by selling trades of their customers.

For helping the market to be liquid Robinhood gets a fee on each trade, which is taken from the spread (the difference) between the bid and ask price. The more liquid the market the tighter the bid and ask price, and vice-versa. And this, of course, might be a very lucrative side of the business for Robinhood.

But it poses the question of how consistent it is with its mission.

Indeed, during the take over of meme stocks in 2021, as explained in meme investing, Robinhood stopped the trades of some of these stocks (like GameStop) claiming a liquidity/risk insurance policy. Yet some doubted that this was also due to the fact that retail traders were squeezing out of the market a few hedge funds with short positions, also owned by some institutions Robinhood was doing business with (for more details look the whole meme investing piece).

As an answer to these concerns Robinhood’s CEO highlighted the possibility to give away, or reduce this revenue stream, in a piece entitled “The Sub-Penny Opportunity,” Vlad Tenev explained:

The Sub-Penny Rule (SEC Rule 612) prevents exchanges from quoting in increments less than a penny. This limitation can result in an artificially wide NBBO, which is the pricing benchmark used by off-exchange market-makers.

And he further explained:

Robinhood’s IPO

In a nutshell, exchanges cannot fairly compete with off-exchange market makers in executing our customers’ orders. As a first step toward better enabling our exchanges to compete fairly, we propose amending Rule 612 to allow exchanges to quote prices up to four decimal places for all stocks.

Back in 2005, when Rule 612 was adopted, the consensus was that price increments of $0.0001 were economically insignificant. Supporters of the rule argued that sophisticated investors may use these smaller increments to step ahead of retail investors by trivial amounts. Some also argued that technology hadn’t advanced enough to properly handle an enormous increase in on-exchange quoting.

However, since that time, technology has advanced by leaps and bounds, and commission-free trading has become the industry norm. It’s now clear that customers value sub-penny price improvements and no longer consider them economically insignificant, especially in low-priced, high-volume stocks that may only trade with a penny spread.

Finally, the Robinhood prospectus is out we can finally look under the hood of the company to understand how its revenues are broken up.

As highlighted in Robinhood’s financial prospectus most of its revenues in 2021 were transaction-based. As we’ll see this means that Robinhood is making most of its revenues from payment per order flow.

As highlighted in Robinhood’s financial prospectus most of its revenues in 2021 were transaction-based. As we’ll see this means that Robinhood is making most of its revenues from payment per order flow.  During the pandemic, Robinhood managed to increase all its KPIs, primarily thanks to meme stocks, and crypto investing, which draw to the platform millions of new users.

During the pandemic, Robinhood managed to increase all its KPIs, primarily thanks to meme stocks, and crypto investing, which draw to the platform millions of new users.  Among the assets that recorded an exponential growth for Robinhood, equities, and options – driven by meme stocks like GameStop and AMC, cryptocurrency investing – primarily driven by Dogecoin; made up the incredible growth in assets traded on the platform and therefore the fees taken by Robinhood.

Among the assets that recorded an exponential growth for Robinhood, equities, and options – driven by meme stocks like GameStop and AMC, cryptocurrency investing – primarily driven by Dogecoin; made up the incredible growth in assets traded on the platform and therefore the fees taken by Robinhood.  Within the transaction-based revenues, most of them came from market makers. And among those Citadel Security represented 34% of the total market maker revenues for Robinhood. This is relevant because Citadel Securities LLC is the largest market maker in the US, which during the short squeeze from Redditors bailed out hedge fund Melvin Capital. Wall Street As Main Customer

Within the transaction-based revenues, most of them came from market makers. And among those Citadel Security represented 34% of the total market maker revenues for Robinhood. This is relevant because Citadel Securities LLC is the largest market maker in the US, which during the short squeeze from Redditors bailed out hedge fund Melvin Capital. Wall Street As Main CustomerAs the company highlighted in its financial prospectus:

We primarily earn transaction-based revenues from routing user orders for options, equities and cryptocurrencies to market makers when the performance obligation is satisfied, which is at the point in time when a routed order is executed by the market maker. The transaction price for options is on a per contract basis, while for equities it is primarily based on the bid-ask spread of the underlying trading activity. For cryptocurrencies, the transaction price is a fixed percentage of the notional order value. For each trade type, all market makers pay the same transaction price. Payments are collected monthly in arrears from each market maker.

And it continued:

Because a majority of our revenue is transaction-based (including payment for order flow, or “PFOF”), reduced spreads in securities pricing, reduced levels of trading activity generally, changes in our business relationships with market makers and any new regulation of, or any bans on, PFOF and similar practices may result in reduced profitability, increased compliance costs and expanded potential for negative publicity.

How do these transactions are computed?

Robinhood explains:

Doge Represented Most Of Robinhood Growth For Crypto AssetsA majority of our revenue is transaction-based, in that we receive consideration in exchange for routing our users’ equity, option and cryptocurrency trade orders to market makers for execution. With respect to equities and options trading, such fees are known as PFOF. With respect to cryptocurrency trading, we receive “Transaction Rebates.” In the case of equities, the fees we receive are typically based on the size of the publicly quoted bid-ask spread for the security being traded; that is, we receive a fixed percentage of the difference between the publicly quoted bid and ask at the time the trade is executed. For options, our fee is on a per contract basis based on the underlying security. In the case of cryptocurrencies, our rebate is a fixed percentage of the notional order value. Within each asset class, whether equities, options or cryptocurrencies, the transaction-based revenue we earn is calculated in an identical manner among all participating market makers. We route equity and option orders in priority to participating market makers that we believe are most likely to give our customers the best execution, based on historical performance, and we do not consider transaction fees when routing orders. For cryptocurrency orders, we route to various market makers that we believe offer competitive pricing, and we do not consider Transaction Rebates when routing cryptocurrency orders.

As highlighted in its financial prospects:

A substantial portion of the recent growth in our net revenues earned from cryptocurrency transactions is attributable to transactions in Dogecoin. If demand for transactions in Dogecoin declines and is not replaced by new demand for other cryptocurrencies available for trading on our platform, our business, financial condition and results of operations could be adversely affected.

Dogecoin was so important in terms of revenue streams related to crypto investing, that in Robinhood prospectus it was highlighted how the company would be negatively affected “if the markets for Dogecoin deteriorate or if the price of Dogecoin declines, including as a result of factors such as negative perceptions of Dogecoin or the increased availability of Dogecoin on other cryptocurrency trading platforms.”

Who Are Robinhood Customers?As highlighted in the financial prospects “from January 1, 2015, to March 31, 2021, over half of the customers funding accounts on our platform told us that Robinhood was their first brokerage account.”

And it continued “as of March 31, 2021, approximately 70% of our AUC came from customers on our platform aged 18 to 40, and the median age of customers on our platform was 31.”

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkOther case studies:

The Power of Google Business Model in a NutshellHow Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Amazon Makes Money: Amazon Business Model in a NutshellHow Does Netflix Make Money? Netflix Business Model ExplainedHow Does Spotify Make Money? Spotify Business Model In A NutshellDuckDuckGo: The [Former] Solopreneur That Is BeatingGoogle at Its GameHow Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

The post How Does Robinhood Make Money? – Updated 2022 appeared first on FourWeekMBA.