How Does Facebook [Meta] Make Money? Facebook Business Model – Updated 2022

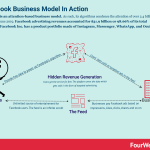

Facebook, the main product of Meta is an attention merchant. As such, its algorithms condense the attention of over 2.91 billion monthly active users as of June 2021. Meta generated $117.9 billion in revenues, in 2021, of which $114.9 billion from advertising (97.4% of the total revenues) and over $2.2 billion from Reality Labs (the augmented and virtual reality products arm).

Facebook, metaverse and rebranding as MetaAt the end of October 2021, Mark Zuckerberg announced the Facebook Inc. rebrand as Meta. A company focused and dedicated to building the Metaverse. Beyond buzzwords and corporate communication. What does that imply?

With the announcement, Facebook, changed its name to Meta. It wasn’t just a name change (although it was perceived by many as such) but it also worked as an organization restructuring.

Indeed, with this move Facebook, now Meta, wanted to show its bold move into VR/AR, which are seen by Zuckerberg as the next mass consumers’ platform after the smartphone.

In short, with this new organization, they are trying to go after, what today we call the Metaverse, which is something still hard to make sense of, since its definition is getting shaped now.

Thus, Facebook, now Meta, is trying to become a leading player in this new market. But to really understand that we need to look at the overall Facebook business model.

Snapshot of Facebook key stats and factsAs reported officially by Facebook, the company’s main headquarter is situated on 1 Hacker Way, Menlo Park, California 94025.As we highlighted the “Hacker Way” is Mark Zuckerbergs’ key driving business strategy mindset.Facebook, now Meta had f 71,970 employees as of December 31, 2021.The company also reported 2.91 billion monthly active users (remember that Facebook Inc, also comprises other products like Instagram, while they affect the Facebook bottom line, Facebook doesn’t report how much of it is coming from each product and doesn’t tell us the users count of those platforms). In 2021 Facebook, now Meta, generated $117.9 billion in revenues, compared to the $85.9 billion in 2020. In 2021 Meta generated $39.3 billion in net income, compared to $29.1 billion in 2020. In 2021 Meta business model was driven by advertising revenues, which represented 97.4% of the total revenues, compared to the 98.6% of 2020. As of 2021, Facebook spent over 20%($24.6 billion) of its revenues in R&D. While it spent about 12% of its revenues in Sales and Marketing activities ($14 billion).

Facebook key community metrics, as of 2021 (Source: Facebook Financials).

Facebook key community metrics, as of 2021 (Source: Facebook Financials).

A FourWeekMBA Analysis shows that in 2021, the growth of Facebook’s revenues were driven by the US & Canada users’ monetization, due to a 24% price per ad increase in 2021. This means that Facebook is squeezing its users’ attention, to give a boost at its advertising revenues.

A FourWeekMBA Analysis shows that in 2021, the growth of Facebook’s revenues were driven by the US & Canada users’ monetization, due to a 24% price per ad increase in 2021. This means that Facebook is squeezing its users’ attention, to give a boost at its advertising revenues. As we saw, Facebook, now Meta makes money with an advertising business model. Almost all the revenue comes from targeted advertising.

Facebook revenue breakdown in 2021 was:

Advertising (over 97% of revenues): the company generated over $114.9 billion in advertising primarily consisting of displaying ad products on Facebook, Instagram, Messenger, and third-party. As Facebook highlighted, in 2021, the number of ads delivered increased by 10%, as compared with approximately 34% in 2020. And the price per ad increased of 24% in 2021, compared to a 5% decrease in 2020. This means that Facebook is squeezing users’ attention to drive up revenues (not a good sign).Payments and other fees (less than 1% of total revenues): $721 million in revenues primarily consisted of the net fee received from developers using Payments infrastructure or revenue from the delivery of virtual reality platform devices and most importantly revenue from the delivery of consumer hardware devices.Reality Labs generated about $2.27 billion in revenues (almost 2% of the total revenues) from the delivery of consumer hardware products, such as Meta Quest (former Oculus), Facebook Portal, and wearables, and related software and content. In 2021, Facebook started to report this segment separately, comparade to the advertising segment, as in theory, this should become the main business unit for the company in the coming decade (this is a matter of survival for Facebook). Facebook’s same mission statement, changed vision (hint: it’s all about the metaverse)The company’s mission was to “to give people the power to build community and bring the world closer together.”

As Facebook, became Meta, its mission statement staid the same, however its vision changed.

In fact, while Meta’s mission is still to give people the power to build community and bring the world closer together.

The vision is that “of helping to bring the metaverse to life.”

As the company highlighted in its 2021 financials:

The pillars of Meta’s business modelWe build technology that helps people connect, find communities, and grow businesses. Our useful and engaging products enable people to connect andshare with friends and family through mobile devices, personal computers, virtual reality (VR) headsets, wearables, and in-home devices. We also help peoplediscover and learn about what is going on in the world around them, enable people to share their opinions, ideas, photos and videos, and other activities withaudiences ranging from their closest family members and friends to the public at large, and stay connected everywhere by accessing our products. Meta is movingbeyond 2D screens toward immersive experiences like augmented and virtual reality to help build the metaverse, which we believe is the next evolution in socialtechnology

Family of Apps • Facebook. Facebook helps give people the power to build community and bring the world closer together. It’s a place for people to share life’smoments and discuss what’s happening, nurture and build relationships, discover and connect to interests, and create economic opportunity. They cando this through News Feed, Stories, Groups, Watch, Marketplace, Reels, Dating, and more. • Instagram. Instagram brings people closer to the people and things they love. Instagram Feed, Stories, Reels, Video, Live, Shops, and messaging areplaces where people and creators can express themselves and push culture forward through photos, video, and private messaging, and connect withand shop from their favorite businesses. • Messenger. Messenger is a simple yet powerful messaging application for people to connect with friends, family, groups, and businesses acrossplatforms and devices through chat, audio and video calls, and Rooms. • WhatsApp. WhatsApp is a simple, reliable, and secure messaging application that is used by people and businesses around the world to communicateand transact in a private way. Reality Labs • Reality Labs. Reality Labs’ augmented and virtual reality products help people feel connected, anytime, anywhere. Meta Quest lets people defydistance with cutting-edge VR hardware, software,

Facebook’s products lineFacebook [Meta] producs line comprises:

FacebookThe main product, which enables people to connect, share, discover, and communicate with each other on mobile devices and personal computers. Some of the Facebook’s key features comprise: Facebook News Feed, Stories, Groups, Shops, Marketplace, News, and Watch.

Instagram Instagram makes money via visual advertising. As part of Facebook products, the company generates revenues for Facebook Inc. overall business model. Acquired by Facebook for a billion dollar in 2012, today Instagram is integrated into the overall Facebook business strategy. In 2018, Instagram founders, Kevin Systrom and Mike Krieger, left the company, as Facebook pushed toward tighter integration of the two platforms.

Instagram makes money via visual advertising. As part of Facebook products, the company generates revenues for Facebook Inc. overall business model. Acquired by Facebook for a billion dollar in 2012, today Instagram is integrated into the overall Facebook business strategy. In 2018, Instagram founders, Kevin Systrom and Mike Krieger, left the company, as Facebook pushed toward tighter integration of the two platforms.The fastest growing, mobile-based social media. Which Facebook acquired in 2012, for $1 billion and which today is worth many times over that. Instagram is primarily a mobile native app, to share photos, videos, and private messaging, and connect with and shop from their favorite businesses and creators. Some key features of Instagram comprise: the Instagram Feed, Stories (become a standard in social media, this format was copied from Snapchat), Reels (a feature that is becoming a standard format in social media, primarily copied from TikTok), IGTV, Live, Shops, and messaging.

MessengerThe messaging application for people to connect with friends, family, groups, and businesses across platforms and devices through chat, video, and Rooms.

WhatsAppWhatsApp, the messaging application, which was acquired by Facebook for $19 billion back in 2014. Which Facebook integrated within its family of apps. While WhatsApp doesn’t monetize with ads directly, it is integrated in the other products.

Founded in 2009 by Brian Acton, Jan Koum WhatsApp is a messaging app acquired by Facebook in 2014 for $19B. In 2018 WhatsApp rolled out customers’ interaction services. WhatsApp might be transitioning toward a set of features from video chats to social commerce that might transform WhatsApp into a Super App.Facebook Reality Labs

Founded in 2009 by Brian Acton, Jan Koum WhatsApp is a messaging app acquired by Facebook in 2014 for $19B. In 2018 WhatsApp rolled out customers’ interaction services. WhatsApp might be transitioning toward a set of features from video chats to social commerce that might transform WhatsApp into a Super App.Facebook Reality LabsFacebook Reality Labs is the augmented and virtual reality laboratory wchich produces hardware and consumer devices. This is comprised of Oculus, a leader in VR headset, which Facebook acquired in 2014 for $2.3 billion. Oculus Quest, the main product line of what has been rebranded as Facebook Reality Labs is the VR device, which will also play a key role in the development of the Metaverse.

We’ll see why the Metaverse plays such a key role for Facebook’s future. And it’s all about distribution.

It’s all about ARPU: How much are you worth to Facebook?

ARPU stands for average revenue per user. In short, how much money a company can get on average from each user. In the Facebook case, we can take into account the monthly active users.

For a company like Facebook, for which over 98% of its revenues come from advertising the amount of time people spend on the so-called news feed is crucial to increase the profitability metrics of the company.

That isn’t only because Facebook is an advertising company, but also the way its business model was built. If you think about Google, what makes the company able to monetize its users is not necessarily how much time they spend on the search results pages. Instead, that is based on how fast users can find what they need. Once they click through that is how Google makes money.

Of course, things are changing fast both on Google and on Facebook. Yet as of now the more time you spend on Facebook and the more you’re active on it, the more you allow it to make money. What else? Not all users are born equal. In fact, according to the geography and the ad market of each country, the monetization strategy changes.

For instance, that is how much each user based on geography was worth to Facebook in the third quarter of 2018:

US and Canada: $27.61Europe: $8.82Worldwide: $6.09Therefore, a user from the US or Canada as of 2018 is worth more than a user from Europe or the Asia-Pacific region. The long-term objective for Facebook is to keep increasing its monetization for each user, especially in the developing parts of the world where there is still space to grow the user base, which instead has stalled in the US and Canada:

The Facebook business model is quite simple: advertising. Even though there are two sources of income, most of the revenue comes from ads.

I wouldn’t be surprised to see the other sources of income, other than advertising, grow in the next years. That is good to diversify the revenue stream.

However, as of now, the company growth is tied to its ability to engage its daily active users.

Some users (for instance, North America and Europe) are worth more on Facebook because those areas are monetized differently. Also, there is one key metric that tells us if the value of Facebook will keep growing in the long-run: ARPU.

Facebook, together with Google, is the most profitable attention merchant. The company has emulated successfully the Google advertising machine.

With a couple of slight differences.

First, Facebook’s ads are pushed to the users via targeting, where in Google’s case these ads are pushed based on contextual search. Second, where Google’s distribution passes through ownership of hardware (Google manufactures the Pixel), browser (Google owns Chrome), mobile operating system (Google runs Android), and search. Thus, Google (Alphabet) is way more vertically integrated:

Facebook’s distribution is primarily based on strong brand names. With the acquisitions of Instagram, WhatsApp and Oculus, Facebook has kept a strong distribution, yet primarily based on the strenght of these brands.

Thus, from here we can really really explain the swift move that Facebook made into the Metaverse.

We can argue that Mark Zuckerberg’s Meta is in a Blitzscaling mode. Where it’s both trying to defend its business model, and attack the market, by creating a whole new industry, potentially bigger than mobile.

To understand this, we need to look at the Apple’s privacy update on mobile devices.

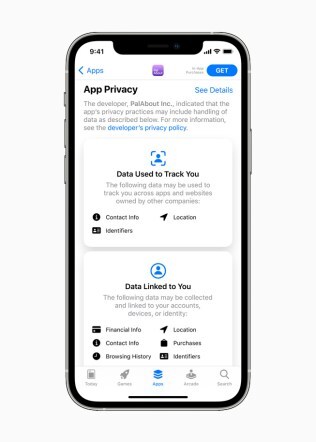

The Apple’s privacy changeThe triggering move to Facebook’s rebrand has been the survival threat posed by Apple to the entire Facebook business model. On January 2021, Apple announed the “Data Privacy Day” where it explained:

“A Day in the Life of Your Data” helps users better understand how third-party companies track their information across apps and websites, while describing the tools Apple provides to make tracking more transparent and give users more control. The explainer sheds light on how widespread some of these practices have become. On average, apps include six “trackers” from other companies, which have the sole purpose of collecting and tracking people and their personal information.Data collected by these trackers is pieced together, shared, aggregated, and monetized, fueling an industry valued at $227 billion per year.

App privacy nutrition lab, by Apple (Source: Apple). This was just another of the steps Apple had taken to completely rehaul the digital advertising industry. In fact, Apple started to roll out a new default mode for privacy on its mobile devices. Where it showed users a clear statement where it said “Facebook would like permission to track you across apps and websites owned by other companies.” This led and it’s leading many users to opt-out from mobile tracking and therefore advertising. Potentially creting a negative impact to the whole Facebook ecosystem. The Metaverse Supply Chain

App privacy nutrition lab, by Apple (Source: Apple). This was just another of the steps Apple had taken to completely rehaul the digital advertising industry. In fact, Apple started to roll out a new default mode for privacy on its mobile devices. Where it showed users a clear statement where it said “Facebook would like permission to track you across apps and websites owned by other companies.” This led and it’s leading many users to opt-out from mobile tracking and therefore advertising. Potentially creting a negative impact to the whole Facebook ecosystem. The Metaverse Supply Chain In the 2021, Founder’s letter Mark Zuckeberg highlighted:

We are at the beginning of the next chapter for the internet, and it’s the next chapter for our company too.

In recent decades, technology has given people the power to connect and express ourselves more naturally. When I started Facebook, we mostly typed text on websites. When we got phones with cameras, the internet became more visual and mobile. As connections got faster, video became a richer way to share experiences. We’ve gone from desktop to web to mobile; from text to photos to video. But this isn’t the end of the line.

The next platform will be even more immersive — an embodied internet where you’re in the experience, not just looking at it. We call this the metaverse, and it will touch every product we build.

And he continued:

In the metaverse, you’ll be able to do almost anything you can imagine — get together with friends and family, work, learn, play, shop, create — as well as completely new experiences that don’t really fit how we think about computers or phones today. We made afilm that explores how you might use the metaverse one day.

Facebook, now Meta emphasized its role in this development as:

Our role in this journey is to accelerate the development of the fundamental technologies, social platforms and creative tools to bring the metaverse to life, and to weave these technologies through our social media apps. We believe the metaverse can enable better social experiences than anything that exists today, and we will dedicate our energy to helping achieve its potential.

These statements which sound inspirational are actually explaining the long-term survival threat posed to Facebook, the rebrand as Meta, and its long-term success, achievable if Facebook managed to build the Metaverse!

What can you do in the Metaverse?While Facebook’s vision for the Metaverse is limited for now, this might comprise various business worlds, domains and ecosystems. In fact, Metaverse is a term that comprises VR/AR, crypto and more.

Yet, In Facebook’s Meta vision, the Metaverse will have a few key killer features like gaming, fitness and more:

Horizon HomeMessengers calls in VRWork and ProductivitySummary Facebook was founded in 2004 by Mark Zuckerberg in his dorm room at Harvard. Since then the company has never stopped growing. If it were a country, Facebook would probably be the most crowded on earth. However, the ability of the company to increase its value over time is based on how much money on average can make for each user.Over 97% of Facebook’s revenues come from advertising. Therefore, unless things will change; the news feed is still the primary driver for monetizing Facebook’s content. A simple change in its algorithm can influence the mood of billions of people. Also, it can affect the value of the company for billions of dollars.Facebook swiftly moved into the Metaverse, as Apple’s privacy changes also threatened the company’s long-term survival. That is why Facebook, now Meta is committed in building the so-called Metaverse. Key conclusions Though Meta claims to move toward the Metaverse, advertising through Facebook/Instagram is still the primary driver. While Facebook has kept growing in areas of the world like Asia and the rest of the world, its monetization and ARPU are still primarily tied to US & Canada, which, in 2021 represented over 43% of the total revenues. In 2021, ARPU was $11.57 worldwide. While in US & Canada it was $60.57, in Europe it was $19.68, in Asia $4.89 and in the rest of the world it was $3.43. This shows the great discrepancy in ability to monetize traffic un North America and Europe vs. other areas of the world. Most advertising revenues still come from mobile and from a main product: Instagram. Meta managed to increase susbtantially its revenues in 2021, primarily thanks to the number of ads delivered, which increased by 10% (compared to approximately 34% in 2020). The primary ad revenue driver was the price per ad increase of 24% in 2021 ( compared to a 5% decrease in 2020). This metric is extremely important as it shows that Facebook is squeezing users’ attention to drive up revenues.Reality Labs sales were primarily driven by Meta Quest (former Oculus), which turned out to be a great VR gaming console. Will it be able to make the jump and become the primary device for content creation, and consumption in the virtual reality? That’s an open question. While other tech giants like Google and Apple are vertically integrated, and control the whole supply chain of data. In fact, Apple runs iOS operating system on the iPhone and the Apple Store. While Google runs Android operating system on Android Devices, and the Google Play marketplace on top of these devices. These are the mobile distribution pipelines that enable apps, like Facebook & Instangram to be experienced by billions of users. While the Facebook’s family of apps still enjoy strong brands, thus, making it hard for companies like Apple and Google (which control the mobile distribution pipelines) to block users’ growth for the company. These companies can still affect negatively the Meta advertising machine, as they can change the rules of how users need to approve personalized advertising – unilaterally. While there is not clear sign of slowed revenues for Meta, in 2021. It’s worth emphasizing how the company kept growing its revenues by increasing the cost of advertising substantially (not a viable strategy in the long-term). In addition, the company expects a substantial slow-down in 2022, as effect of the Apple’s privacy policy change (users have to opt-int explicitly to targeted ads). In fact, Meta’s CFO has already announced a substantial – expected – decrease of profitability for the company in 2022. This means, that the move to the metaverse, for Facebook (now Meta) isn’t just a strategic move. That is a survival move! Where Facebook hasn’t integrated its supply chain over the years, primarily relying on third-party marketplaces (Apple Store and Google Play), to make its business model survive in the long-term, the company will need to build the hardware, operating system, software and marketplace that might power up the next generation of mass consumer devices!Related Case Studies Instagram makes money via visual advertising. As part of Facebook products, the company generates revenues for Facebook Inc. overall business model. Acquired by Facebook for a billion dollar in 2012, today Instagram is integrated into the overall Facebook business strategy. In 2018, Instagram founders, Kevin Systrom and Mike Krieger, left the company, as Facebook pushed toward tighter integration of the two platforms.

Instagram makes money via visual advertising. As part of Facebook products, the company generates revenues for Facebook Inc. overall business model. Acquired by Facebook for a billion dollar in 2012, today Instagram is integrated into the overall Facebook business strategy. In 2018, Instagram founders, Kevin Systrom and Mike Krieger, left the company, as Facebook pushed toward tighter integration of the two platforms.

Discord makes money in several ways. From its Discord Store, where users can buy premium games, to the seller shops, that primarily works with a 90/10 revenue share for developers and game sellers. And the ability for sellers to get more visibility on the platform by adding features to the game visibility.

Discord makes money in several ways. From its Discord Store, where users can buy premium games, to the seller shops, that primarily works with a 90/10 revenue share for developers and game sellers. And the ability for sellers to get more visibility on the platform by adding features to the game visibility.

Founded in 2009 by Brian Acton, Jan Koum WhatsApp is a messaging app acquired by Facebook in 2014 for $19B. In 2018 WhatsApp rolled out customers’ interaction services, starting to make money on slow responses from companies. And Facebook also announced conversations on WhatsApp prompted by Facebook Ads.

Founded in 2009 by Brian Acton, Jan Koum WhatsApp is a messaging app acquired by Facebook in 2014 for $19B. In 2018 WhatsApp rolled out customers’ interaction services, starting to make money on slow responses from companies. And Facebook also announced conversations on WhatsApp prompted by Facebook Ads.

Pinterest makes money by selling advertising for marketers and companies that can gain visibility for their brands and more sales for their shops. In 2018, Pinterest made over $755 million in advertising revenue and it had 250 million monthly active users.

Pinterest makes money by selling advertising for marketers and companies that can gain visibility for their brands and more sales for their shops. In 2018, Pinterest made over $755 million in advertising revenue and it had 250 million monthly active users.

Twitter is a platform business model, monetizing the attention of its users in two ways: advertising and data licensing. In 2018, advertising represented 86% of its revenue at over $2.6 billion. And data licensing represented over $424 million primarily related to enterprise clients using data for their analyses.

Twitter is a platform business model, monetizing the attention of its users in two ways: advertising and data licensing. In 2018, advertising represented 86% of its revenue at over $2.6 billion. And data licensing represented over $424 million primarily related to enterprise clients using data for their analyses.

Telegram is a messaging app emphasizing privacy and encryption, launched in 2013. It doesn’t make money yet, while it raised over $1.7 billion in Initial Coin Offerings throughout 2018, halted by the SEC in 2019. Telegram wants to keep the app 100% free while trying to sustain its growth.

Reddit is a social news and discussion website that also rates web content. The platform was created in 2005 after founders Alexis Ohanian and Steve Huffman met venture capitalist Paul Graham and pitched the company as the “front page of the internet.” Reddit makes money primarily via advertising. It also offers premium membership plans.

Reddit is a social news and discussion website that also rates web content. The platform was created in 2005 after founders Alexis Ohanian and Steve Huffman met venture capitalist Paul Graham and pitched the company as the “front page of the internet.” Reddit makes money primarily via advertising. It also offers premium membership plans.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Facebook [Meta] Make Money? Facebook Business Model – Updated 2022 appeared first on FourWeekMBA.