What Are An LLC And An LLP? LLC Vs LLP In A Nutshell

A limited liability company (LLC) is a separate business entity with one or multiple owners that are otherwise known as members. Various legal filings and fees are required to create an LLC. A limited liability partnership (LLP), on the other hand, is a general partnership between two or more people that does not require legal filings.

Understanding LLCsLimited liability companies (LLCs) are business entities that exist in the United States. The entity itself is separate from its owners from a legal standpoint. This means the owners can access company funds without being personally liable for its debts.

It can be helpful to consider an LLC as the combination of a partnership and a corporation. The owners of the LLC can receive the same legal protections as a corporation with much less paperwork and at a reduced cost. The owners of an LLC are called members and there may be a single individual or multiple members.

Understanding LLPsLimited liability partnerships (LLPs) describe formal structures between two or more partners that offer some degree of protection from the liabilities of the partnership.

LLPs are favored by licensed professionals such as architects, lawyers, and accountants since they are prohibited from forming LLCs in some U.S. states. This arrangement allows the professional to avoid unlimited liability for the business’s obligations and any potential partner negligence.

LLPs require at least two founding partners, with the specifics of the partnership stipulated in a partnership agreement.

Core differences between an LLC and LLPMost of the core differences between an LLC and LLP arise from the fact that LLC owners are called members while LLP owners are called partners. With that in mind, let’s now take a look at some of the differences between the two entity types:

Limited liability protectionThe members of an LLC are only liable for debts equivalent to the amount they have personally invested in the business. They are not liable for the misconduct of another member but, having said that, are liable for their own misconduct.

In general, LLP partners are liable for the misconduct of other partners. However, in some states, there exists limited liability where partners are not liable for partner misconduct but remain liable for business obligations.

TaxesFor taxation purposes, an LLC can be taxed as a partnership, C corporation, S corporation, or sole proprietorship.

The tax structure of an LLP is limited to partnerships only. What’s more, the Internal Revenue Service (IRS) considers the company’s profit or loss to be reflected in the personal income tax returns of the partner(s). In other words, the entity itself does not pay tax.

Management and decision makingAs we noted earlier, the owners of an LLC are known as members while the owners of an LLP are considered partners.

LLCs have more flexibility in terms of internal management structure and decision-making responsibility, with these details set out in an operating agreement.

LLPs, on the other hand, make similar assertions in a partnership agreement where there are also details relating to profit-sharing and operating structure.

Key takeaways:A limited liability company (LLC) is a separate business entity with one or multiple owners known as members. A limited liability partnership (LLP) is a general partnership between at least two people known as partners.Licensed professionals such as architects, lawyers, and accountants use LLPs since they are prohibited from forming LLCs in some U.S. states. LLCs can be complex, but it is helpful to think of them as a mixture of corporation and partnership.LLCs differ from LLPs when one considers the extent of liability protection, management and decision making, and taxation structure.Main Free Guides:

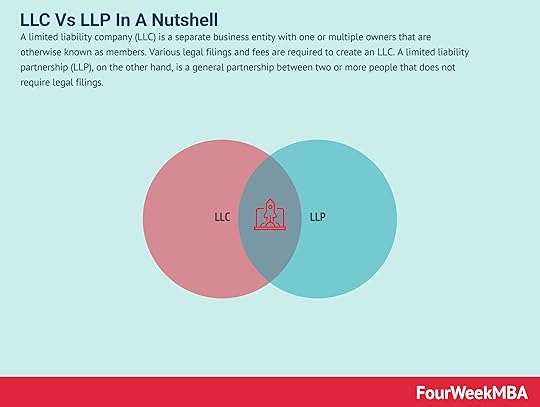

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Concepts Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes.

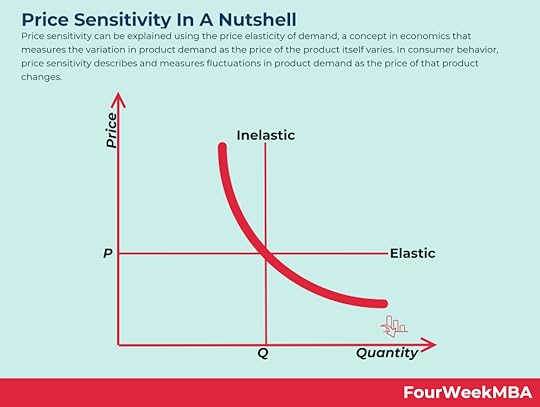

Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes. A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.

A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.  Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services.

Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services. In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.

A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. Negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. Negative network effects (congestion or pollution) reduce the value of the platform for the next user joining. The post What Are An LLC And An LLP? LLC Vs LLP In A Nutshell appeared first on FourWeekMBA.