How to Add a Joint Owner or Change Beneficiary on I Bonds

When you have an account with a bank or a brokerage account, usually you can designate a beneficiary (or multiple beneficiaries with split percentages) for your account. The beneficiary gets everything in your account in case you die. It works differently when you have I Bonds in a personal account at TreasuryDirect, where your second owner and beneficiary are set separately for each holding, not for the whole account.

In This ArticleRegistration at Time of PurchaseReview Current RegistrationsCreate Your Desired RegistrationAssociate New Registration to Existing BondsGrant Transact or View RightsDeposited Paper Bonds with Joint OwnershipRegistration at Time of PurchaseWithin the same TreasuryDirect account, you can own some bonds by yourself without any second owner or beneficiary, some bonds with Person A as the second owner (“you WITH A”), some bonds with Person B as the second owner (“you WITH B”), some bonds with Person C as the beneficiary (“you POD C”), and some bonds with Person D as the beneficiary (“you POD D”). POD stands for Pay On Death. Most people probably don’t need this level of granularity but it’s an option. For more on the difference between a second owner and a beneficiary, please read I Bonds Beneficiary vs Second Owner in TreasuryDirect.

These options are only available in a personal account. An entity account for a trust or a business can’t have bonds with a second owner or a beneficiary. A trust or a business also can’t be designated as a second owner or a beneficiary. The second owner or beneficiary must be a person.

You designate the second owner or the beneficiary at the time of each purchase. The granularity compensates for the lack of designating multiple beneficiaries by percentages at the account level. While you can’t designate 50:50 between your two children as beneficiaries for the whole account, you can enter two orders every time you buy $10,000 worth of I Bonds: one order for $5,000 with Child A as the beneficiary and another order for $5,000 with Child B as the beneficiary.

Each ownership combination — you alone, you WITH person X as the second owner, or you POD person Y as the beneficiary — is called a registration. You can have as many registrations as you’d like and you can associate any one of your registrations to any bond in your account.

The registration for a bond you set at the time of purchase can be changed post-purchase. If you didn’t set a second owner or a beneficiary when you first bought the bonds or if you change your mind at a later time, you can add, remove, or change the second owner or the beneficiary at any time.

Review Current RegistrationsBefore you make any changes to the registration on any of your bonds in the account, you should review how they’re currently set and see which ones need to be changed. After you login to the account, click on “Current Holdings” at the top.

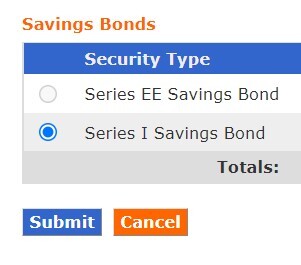

Then scroll down to the bottom and select Series I Saving Bond.

You will see a list of your bonds grouped by your existing registrations. Take notes for which bonds you’d like to make a change.

Create Your Desired RegistrationNow, you need to create a registration with the ownership combination you’d like to have. Say you originally bought the bond with your name alone and now you’d like to add a second owner, or you’d like to elevate your beneficiary to a second owner, you should create a registration for you with this person as the second owner (“you WITH X”). Or if you’d like to change your beneficiary to a different person, you should create a registration for you with this new person as the beneficiary (“you POD Y”).

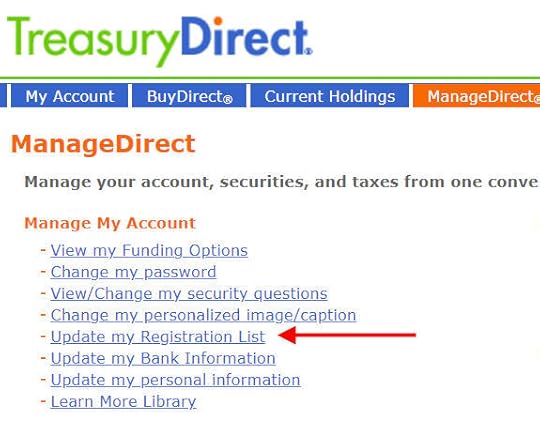

Click on “Update my Registration List” under ManageDirect.

You’ll see a list of existing registrations in your account. Click on “Add Registration” to create a new one.

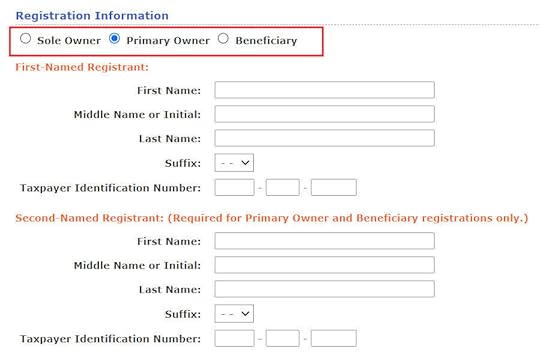

The radio buttons at the top shows the registration types. Sole Owner means you alone, without a second owner or a beneficiary. Primary Owner means you with a second owner. Beneficiary means you with a beneficiary. If you chooses Primary Owner or Beneficiary, enter yourself as the First-Named Registrant and the second owner or the beneficiary as the Second-Named Registrant.

The new combination will be added to your list of registrations. It’s not associated with any bonds yet. If you’d like to use this new registration for all new bonds you buy in the future, select it in the list and click on the “Preferred Registration” button.

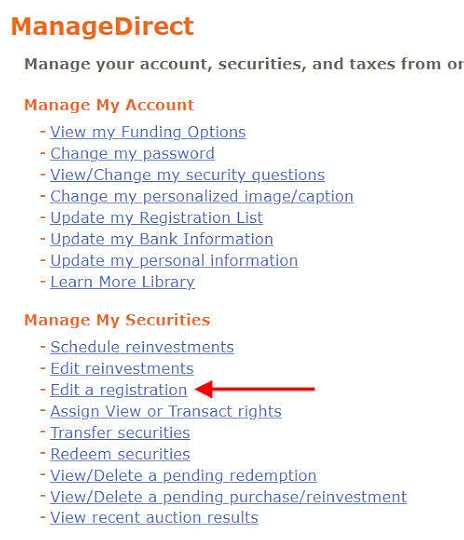

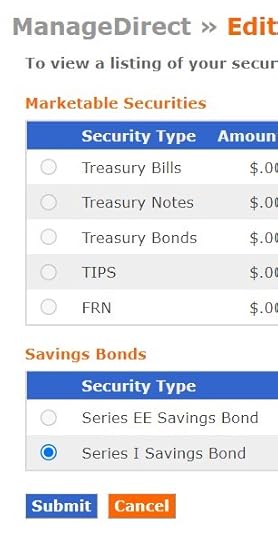

Associate New Registration to Existing BondsMaking a new registration your preferred registration only affects the default for new bonds you buy in the future. To change the registration on your existing bonds, click on “Edit a registration” under ManageDirect.

Scroll down to the bottom and select Series I Savings Bond.

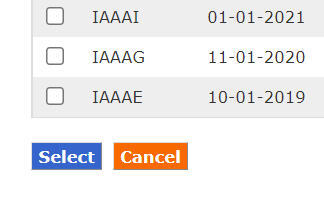

You will see a list of your I Bonds. Check the box for the ones you’d like to change. Or check all of them if you’d like to change the registration for all existing bonds.

Choose your desired registration in the dropdown. The bonds you selected will change to this new registration after you click on Submit. As long as you’re still the primary owner, changing the registration doesn’t trigger taxes.

Grant Transact or View Rights

Grant Transact or View RightsIf you granted Transact or View rights to the previous second owner or beneficiary, those rights will be automatically canceled after you change the Registration. You’ll need to grant Transact or View rights to your new second owner or beneficiary if you’d like. For more on why you may want to grant Transact or View rights and a walkthrough of how to do it, please read How To Grant Transact or View Right on Your I Bonds.

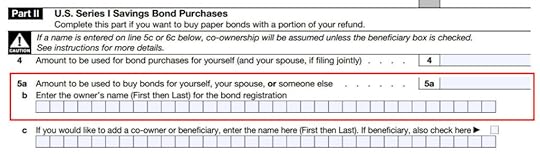

Deposited Paper Bonds with Joint OwnershipIf you have bonds in your account that originated from paper bonds you bought with your tax refund (see Overpay Your Taxes to Buy I Bonds and How To Deposit Paper I Bonds to TreasuryDirect Online Account), those bonds may have been issued to you and your spouse jointly (“you OR spouse”) when you filed a joint tax return.

This “OR” type of ownership is different than the “you WITH X” type of ownership in that the two owners are equal. There’s no primary owner or second owner in the “OR” type of ownership. One owner can’t kick out the other owner without the other owner’s consent. The “OR” ownership is preserved when paper bonds are deposited into the TreasuryDirect account. These bonds become “restricted securities” and you can’t change the registration on them.

If you don’t like this restriction, don’t use Box 4 on IRS Form 8888 when you buy I Bonds with your joint tax return. Use Line 5a and enter only one name. Alternate the owner between you and spouse in different years.

You can change the registration and grant rights after you deposit the paper bonds with only one name. This way you can have the same registration for all the bonds in your account.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Add a Joint Owner or Change Beneficiary on I Bonds appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower