What Is Micro-Investing? Micro-Investing In A Nutshell

Micro-investing is the process of investing small amounts of money regularly. The process of micro-investing involves small and sometimes irregular investments where the individual can set up recurring payments or invest a lump sum as cash becomes available.

Understanding micro-investingBefore there was such a thing as a digital transaction, consumers looking to save their spare change may have used a piggy bank. As cash becomes obsolete, however, many consider micro-investing to be a viable modern-day alternative.

Micro-investing is a passive solution designed to make investing simple and accessible for beginners. Most can get started with as little as $5 invested into a diversified portfolio.

The process of micro-investing involves small and sometimes irregular investments. The individual can set up recurring payments or invest a lump sum as cash becomes available. Some micro-investing platforms will also allow the user to round up a transaction to the nearest dollar and invest the difference. For instance, the purchase of a coffee for $3.75 would be rounded up to $4 with the remaining 25 cents invested.

With interest rates at historic lows, micro-investing can generate a better return than if the funds were to sit idle in a standard savings account.

The main micro-investing platformsThere are many micro-investing platforms on the market today, with most removing or at least reducing the barriers to traditional investing such as brokerage fees, management fees, and minimum investment amounts.

Some of the most popular micro-investing platforms include:

Acorns Acorns is a fintech platform providing services related to Robo-investing and micro-investing. The company makes money primarily through three subscription tiers: Lite – ($1/month), which gives users access to Acorns Invest, Personal ($3/month) that includes Invest plus the Later (retirement) and Spend (personal checking account) suite of products, Family ($5/month) with features from both the Lite and Personal plans with the addition of Early.

Acorns is a fintech platform providing services related to Robo-investing and micro-investing. The company makes money primarily through three subscription tiers: Lite – ($1/month), which gives users access to Acorns Invest, Personal ($3/month) that includes Invest plus the Later (retirement) and Spend (personal checking account) suite of products, Family ($5/month) with features from both the Lite and Personal plans with the addition of Early. A mobile app that rounds up the spare change from daily purchases and invests the remainder into a diversified portfolio of exchange-traded funds (ETFs), bonds, indexes, and even Bitcoin. Users can choose a portfolio based on their risk appetite and there is no fee for depositing or withdrawing funds from the platform.

Public.comA commission-free micro-investing platform for Millennial and Generation Z consumers that incorporates aspects of social media. Public.com users can own fractional shares in stocks and ETFs, follow popular creators, and discuss strategies with a community of like-minded others.

M1 Finance M1 Finance is a North American online trading platform for common and preferred stocks and exchange-traded funds (ETFs). The company also offers margin lending, cash management, and a checking or debit account service. M1 Finance has a standard assortment of revenue streams for an investment platform. As a market maker earns money on the bid-ask spread, M1 Finance also offers a single premium subscription dubbed M1 Plus, and through interest and interchange fees.

M1 Finance is a North American online trading platform for common and preferred stocks and exchange-traded funds (ETFs). The company also offers margin lending, cash management, and a checking or debit account service. M1 Finance has a standard assortment of revenue streams for an investment platform. As a market maker earns money on the bid-ask spread, M1 Finance also offers a single premium subscription dubbed M1 Plus, and through interest and interchange fees. A micro-investing platform that also serves as a robo-advisor. M1 Finance is an automated solution that invests on a user’s behalf and will also rebalance a portfolio based on preconfigured asset allocation targets.

Spaceship VoyagerAnother robo-advisor platform that lets the user transfer small amounts into three portfolio options comprised of some of the world’s most innovative and socially responsible companies. Spaceship Voyager charges a flat monthly fee with no additional charge for a customer holding multiple portfolios.

Robinhood Robinhood is an app that helps to invest in stocks, ETFs, options, and cryptocurrencies, all commission-free. Robinhood earns money by offering: Robinhood Gold, a margin trading service, which starts at $6 a month, earn interests from customer cash and stocks, and rebates from market makers and trading venues.

Robinhood is an app that helps to invest in stocks, ETFs, options, and cryptocurrencies, all commission-free. Robinhood earns money by offering: Robinhood Gold, a margin trading service, which starts at $6 a month, earn interests from customer cash and stocks, and rebates from market makers and trading venues.One of the first micro-investing platforms launched in 2013. The app was designed to be as intuitive as possible with no bells and whistles or confusing terminology. For the more hands-on micro- investor, Robinhood provides real-time market data and also allows Bitcoin trading.

Key takeaways:Micro-investing is the process of investing small amounts of money regularly.Micro-investing can occur via a recurring or lump sum payment. Many platforms also allow customers to round up day-to-day transactions to the nearest dollar and invest the difference automatically.Micro-investing platforms include Acorns, Public.com, M1 Finance, Spaceship Voyager, and Robinhood. Most were designed to remove the barriers associated with traditional investing, such as brokerage fees, fund management fees, and minimum investment amounts.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Concepts To Micro-InvestingBusiness Incubator A business incubator is an organization that helps start-up companies or entrepreneurs develop their businesses. Assistance usually takes the form of dedicated office space, management training, and venture capital funding. According to the National Business Incubation Association, there are more than 1,400 incubators in the United States.Angel Investing

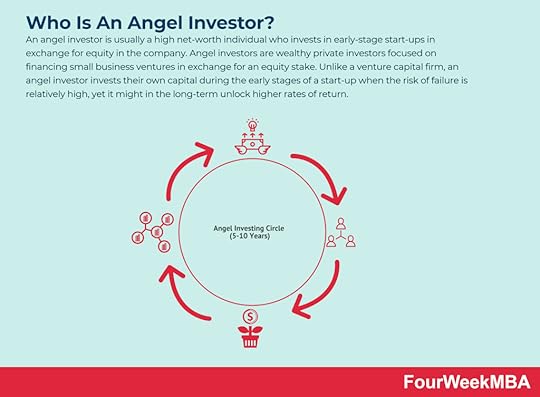

A business incubator is an organization that helps start-up companies or entrepreneurs develop their businesses. Assistance usually takes the form of dedicated office space, management training, and venture capital funding. According to the National Business Incubation Association, there are more than 1,400 incubators in the United States.Angel Investing An angel investor is usually a high net-worth individual who invests in early-stage start-ups in exchange for equity in the company. Angel investors are wealthy private investors focused on financing small business ventures in exchange for an equity stake. Unlike a venture capital firm, an angel investor invests their own capital during the early stages of a start-up when the risk of failure is relatively high, yet it might in the long-term unlock higher rates of return. Venture Capital

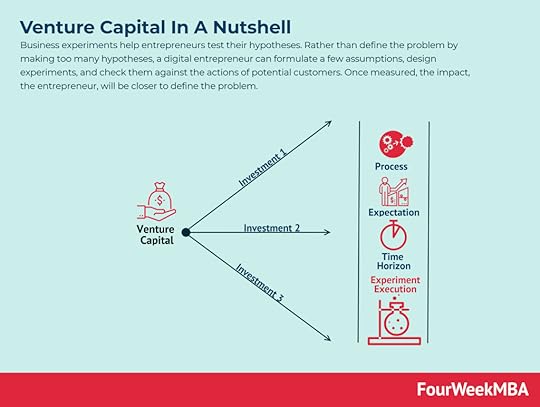

An angel investor is usually a high net-worth individual who invests in early-stage start-ups in exchange for equity in the company. Angel investors are wealthy private investors focused on financing small business ventures in exchange for an equity stake. Unlike a venture capital firm, an angel investor invests their own capital during the early stages of a start-up when the risk of failure is relatively high, yet it might in the long-term unlock higher rates of return. Venture Capital A venture capitalist generally invests in companies and startups which are still in a stage where their business model needs to be proved viable, or they need resources to scale up. Thus, those companies present high risks, but the potential for exponential growth. Therefore, venture capitalists look for startups that can bring a high ROI and high valuation multiples.Economic Moat

A venture capitalist generally invests in companies and startups which are still in a stage where their business model needs to be proved viable, or they need resources to scale up. Thus, those companies present high risks, but the potential for exponential growth. Therefore, venture capitalists look for startups that can bring a high ROI and high valuation multiples.Economic Moat Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have.Meme Investing

Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have.Meme Investing Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.Payment for Order Flow

Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.Payment for Order Flow Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.What is a SPAC

Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.What is a SPAC A special purpose acquisition company (SPAC) is a company with no commercial operations that are created to raise capital through an IPO to acquire another company. The SPAC is also called for that reason a “blank check company” as it will use the money provided by investors to enable private companies to go public via the SPAC.

A special purpose acquisition company (SPAC) is a company with no commercial operations that are created to raise capital through an IPO to acquire another company. The SPAC is also called for that reason a “blank check company” as it will use the money provided by investors to enable private companies to go public via the SPAC.The post What Is Micro-Investing? Micro-Investing In A Nutshell appeared first on FourWeekMBA.