Make Backdoor Roth Easy On Your Tax Return

It’s tax filing time. I’ve been fielding a lot of questions on my articles about the backdoor Roth (if you are not familiar with it please read these first):

Backdoor Roth: A Complete How-ToHow To Report Backdoor Roth In TurboTaxHow To Report Backdoor Roth In H&R Block SoftwareHow to Report Backdoor Roth In FreeTaxUSAOne theme quickly emerged. All those who are confused were contributing to the traditional IRA for the previous year and then converting it to Roth. They made it too hard for themselves.

For example, they contributed to the traditional IRA for the previous year between January 1 and April 15 and then converted it to Roth. They are planning to contribute for the current year, again in the following year before April 15, before converting it to Roth. Although it’s OK to do so, it just gets very confusing at tax time when they do it this way.

The tax law requires that you report your traditional IRA contribution *for* that year and your converting to Roth *during* that year.

In the example above, the contribution made *for* year X in year X+1 goes on the tax return for year X. It has to carry over the tax basis to the return for year X+1. The conversion to Roth *during* year X+1 goes on the tax return for year X+1. The contribution *for* X+1 to be made in X+2 again goes on the tax return for year X+1 but the conversion *during* year X+2 must wait for the tax return for year X+2.

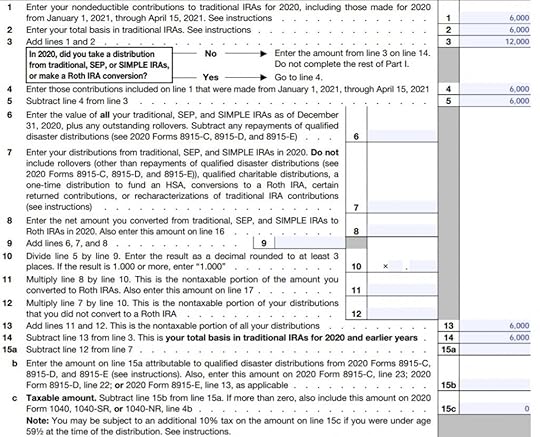

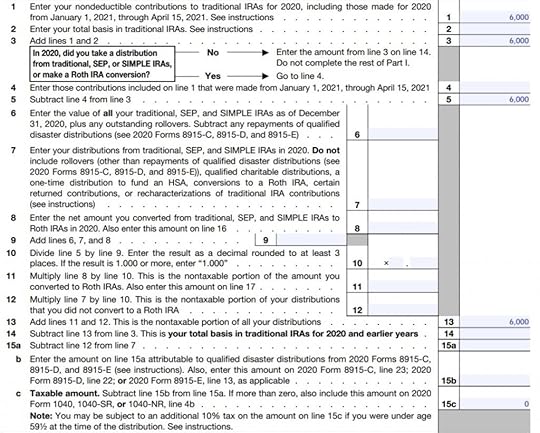

The tax return for the current year ends up having a basis carried over from the previous year, a conversion, a contribution (made in the next year), and a basis carried forward to the next year. The Form 8606 ends up looking like this:

This is very confusing.

The easy way to do it is to contribute for the current year rather than waiting until the following year. Contribute for year X in year X and convert in year X. Contribute for year X+1 in year X+1 and convert in year X+1. This way will be clean and neat. Both the contribution and the conversion go on the same tax return. You don’t carry over anything from one year to the next or wait until the following year to finish it off.

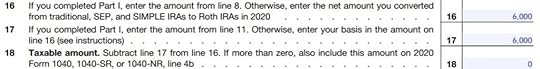

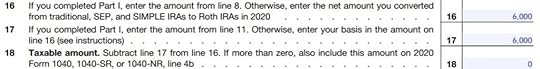

The Form 8606 when you are doing it the easy way looks like this:

That’s very clean.

If you are doing backdoor Roth, please do yourself a big favor and do it the easy way. Contribute for the current year and convert it in the same year. Contribute for year X in year X and convert during year X. Don’t wait until the following year. Otherwise you just confuse yourself at tax time.

If you must get caught up for one year, that’s fine. Contribute for the previous year before April 15, but also contribute for the current year in the current year, and convert both during the current year. You can convert more than once in any year, and there is no limit on the amount you convert. This way you will have a clean slate come next year, which lets you do it the easy way going forward.

Comments are closed because questions are becoming repetitive. Be sure to read existing comments for answers to questions similar to yours.

The post Make Backdoor Roth Easy On Your Tax Return appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower