Website Flipping Starter Guide

This is a crash course introduction to website flipping.

I’ve been making money flipping websites for 12+ years. I’ve bought, grown, and sold multiple sites as a side-business, with many 6-figure exits.

You’re about to learn:

The ins and outs of website flippingHow to get startedHow profitable website flipping can beAnswers to commonly asked questionsLet’s get to it!

Jump to…What is website flipping?How much money do I need?Where to buy and sell websites?Red flags to look out forQuick wins to increase site valueWhat skills do I need?Common MythsSuccess StoriesIs it profitable?Pros and ConsLearn moreWhat is website flipping?

Jump to…What is website flipping?How much money do I need?Where to buy and sell websites?Red flags to look out forQuick wins to increase site valueWhat skills do I need?Common MythsSuccess StoriesIs it profitable?Pros and ConsLearn moreWhat is website flipping?The idea of website flipping, similar to real estate flipping, is to purchase an income-producing website, make some improvements, and then sell (i.e., flip) to another buyer.

At a high-level, a content website is built on a content management system (CMS) such as WordPress which houses content written by the owner themselves, or hired writers.

In general, most of these websites drive human visitors (i.e., website traffic) by implementing SEO techniques to rank content within search engines, and/or from social platforms, such as Pinterest, Facebook, Instagram, etc.

This traffic is then converted into revenue by using display ads, affiliate marketing, digital products, or other means.

A website asset can be flipped at a standard multiple of 2.5 to 3 times its annual profits, as of this writing. In other words 30 – 36 times monthly profits.

For example:

Those are just some typical examples, but your experience may vary.

For those who understand how to find undervalued websites, flipping can be a great way to make money online. However, it is an active job where the “flipper” has to work to increase the website’s sale valuation.

Editor’s note: website flipping can be considered a Resale business, which we classify as a Level 3 online business. See this framework for more info.

How much money do I need to start website flipping?For those interested in doing website flips, I first highly recommend building and growing a website from scratch.

Only then will you understand the ins and outs of what goes into a website, how it’s built, and what levers you can pull to increase income.

However, if you want to purchase a revenue-generating site earning $100/mo, it will cost you $3,000 to $3,500 at fair market valuations.

I recommend buying a site earning at least $100/mo because that gives you enough cash flow (and motivation) to continue growing.

Where to buy and sell websites?There are two major ways to buy websites:

Directly from private website ownersThrough website brokeragesThe latter will be the most common way to find websites for sale and is the one that most flippers utilize.

Out of all the website brokers, I highly recommend the following three:

Flippa: Public Auction MarketplaceTypical asset prices: No minimum requirementListing type: Auction, Classified listings

Flippa: Public Auction MarketplaceTypical asset prices: No minimum requirementListing type: Auction, Classified listingsFlippa is the eBay of digital assets. They have the largest amount of active websites, SaaS, e-commerce, mobile apps, etc. for sale.

Most of their listings are auctions with a fixed end time, but they do allow for classified listings that are ongoing with a minimum price, and an option to place a “Buy It Now” price.

Flippa is great to find deal flow, but you have to know how to weed out the bad deals from the good ones. That requires a proper due diligence methodology. If you can hone such skills, then you can truly find the “needle in the haystack” type of deals.

Visit Flippa Empire Flippers: Private Brokerage Typical asset prices: $100,000 or moreListing type: Fixed pricing based on their valuations

Empire Flippers: Private Brokerage Typical asset prices: $100,000 or moreListing type: Fixed pricing based on their valuationsEmpire Flippers are one of the largest private brokerages for content websites and e-commerce businesses (primarily Amazon FBA).

They vet each asset to ensure traffic, P&L, etc. all line-up. Empire Flippers does not broker smaller sites that would be friendly for a beginner budget. Most of their deal flow is valued at above $100,000.

Empire Flippers sends out a weekly email Monday morning USA time with sites for sale that week. Note that the good deals sell almost within 24 hours; there is a ton of demand for quality businesses.

Visit Empire Flippers Motion Invest: Private BrokerageTypical sale prices: $50,000 or lessListing type: Fixed pricing based on their valuations

Motion Invest: Private BrokerageTypical sale prices: $50,000 or lessListing type: Fixed pricing based on their valuationsA relatively new marketplace, Motion Invest solely focuses on content-based website businesses.

They vet each deal before it hits the marketplace. Their deals are more beginner-friendly; at times they have sites listed for less than $10,000.

They also have a dutch-auction marketplace where the price will continue dropping by a certain amount every 2 days until a buyer acquires the business. This is a unique structure in the broker marketplace.

If you are looking for smaller content sites, Motion Invest is a good choice.

Visit Motion InvestWhat should you look for? What are some red flags?Here are a few major red flags you should look out for when buying a website business…

Falsified Traffic Data

Falsified Traffic DataTraffic – in other words, visitors coming to the website – is the main pillar of a website. Without traffic, there is no revenue, nor any asset value. Traffic sources can be from organic search engines, social media, email marketing, among others.

When you are buying a website business, make sure to verify traffic numbers.

Ask the seller for Google Analytics guest access so that you can verify the following:

Traffic trend over time Number of page views Which pages are getting traffic on the siteThe geographic location of traffic Expert tip: You can verify the Google Analytics traffic trend against third-party tools such as Ahrefs and/or SEMRush.

Expert tip: You can verify the Google Analytics traffic trend against third-party tools such as Ahrefs and/or SEMRush.

Falsified P&L

Falsified P<his is a common issue in any business, brick & mortar or online. Verification of the P&L is key to buying an asset.

In digital businesses, ask the seller to provide the following:

Detailed screenshots from each revenue source for each month of operationsVideo recording of seller walking through each revenue source showing the earnings Expert tip: Cross-reference your traffic page views against the revenue per month. For example, calculate the revenue per visitor (i.e., revenue divided by visitors) and check this against industry averages for the niche.

Expert tip: Cross-reference your traffic page views against the revenue per month. For example, calculate the revenue per visitor (i.e., revenue divided by visitors) and check this against industry averages for the niche.

Low-quality SEO Backlinks

Low-quality SEO BacklinksIf the site is SEO-focused (i.e., receiving traffic from organic search engines like Google), make sure to double-check the quality of backlinks that have been built.

There are two main ways to check this:

Third-party tools such as Ahrefs, SEMRush, Moz, and/or Majestic SEOGoogle Search ConsoleA seasoned website investor has a subscription to third-party tools which makes due diligence much simpler. You should also ask for guest access to Google Search Console where you can pull a CSV report of the backlinks.

Expert tip: Keep an eye out for low-quality links from non-niche relevant articles. For example, if you are vetting a site in the kitchen niche, and you see many links that were built from news sites that seem out of the ordinary – this is a red flag that requires further investigation.

Expert tip: Keep an eye out for low-quality links from non-niche relevant articles. For example, if you are vetting a site in the kitchen niche, and you see many links that were built from news sites that seem out of the ordinary – this is a red flag that requires further investigation.

Every Friday we email 11,113 people like you with top tips, insights and opportunities to build your online business. No hype, no scams, no fake gurus. Sign up below to get the next one.

HP

We'll first send a confirmation email to make sure it’s you 🔒

Check out our privacy policy to see how we protect and manage your data.

What are some common “quick wins” to increase a website’s valuation?

Like with any asset, the goal is to increase its value with quick wins. A content website has many “levers” that you can manipulate to increase earnings.

Some quick wins to look for…

Add Display AdvertisementsMany affiliate-based content businesses, which monetize the site via commission-based products/services, usually do not deploy display ads via networks like Ezoic, Mediavine, AdThrive, or Google Adsense.

Display ads can add a new revenue stream to an existing site solely monetized with affiliate marketing. In general, display ads do not reduce affiliate commissions.

The benefit of display ads is that they do not require changes to the site structure or layout; The networks place advertisements automatically within the site’s elements thus it is one of the most passive ways to generate revenues.

Expert tip: Add display ads to your site for 30 – 90 days and monitor the affiliate commissions during this time.

Expert tip: Add display ads to your site for 30 – 90 days and monitor the affiliate commissions during this time.

Informational content (i.e., what, how, where) are perfect candidates to be monetized with display ads, but they also are great for adding affiliate links.

If you can write an article that answers a visitor’s question, and then point them to a product or service that offers a solution to their problem, some of them will click through and buy. If you are an affiliate for the product or service you recommend, you will earn a commission.

Expert tip: Add call-out boxes or comparison tables to the end of informative articles to increase conversions.

Expert tip: Add call-out boxes or comparison tables to the end of informative articles to increase conversions.

Comparison tables often have the highest clickthrough rates of any element on the page. A quick win is to place comparison tables right after the introduction section of the article.

A comparison table should have the following:

Name and pictureBullet point of high-level featuresCall-to-action buttonHere is an example of a comparison table that has high clickthrough rates:

Expert tip: Make sure to use a distinct color for the call-to-action buttons (e.g., yellow, red). This ensures users focus on the button as they scroll down the page.

Expert tip: Make sure to use a distinct color for the call-to-action buttons (e.g., yellow, red). This ensures users focus on the button as they scroll down the page.

Everything in the world of website investing can be learned. Having a technical background helps but is not necessary.

These are the major skills to develop…

Ability to learnHaving the ability to research and learn-as-you-go is critical.

All the information to grow your website business is readily available online via other blogs, YouTube videos, or online courses. The ability to apply the learnings to your site is crucial.

Team managementThe ability to build and manage a team gives you a big advantage. A website usually requires writers, editors, assistants (to format and publish articles), server experts, among other talents.

In the beginning, you will handle most of these tasks yourself. But as you scale, outsourcing will be key. As you hire, you will level-up from working IN the business to working ON the business.

DelegationHiring is not enough. The ability to “let go” and delegate the tasks to your team is key.

Some investors are not able to delegate, which results in them getting overwhelmed over time and/or the business is neglected.

Delegate early!

Basic data skillsYou should have the ability to view charts, understand P&Ls, and develop key performance indicators (KPIs).

This will help you spot the right website asset to buy, and also help you to grow the asset.

Don’t get attached to the businessAlways keep your business positioned for a sale. Always keep your P&L up to date. Do not get attached to the business. While this may not seem like a skill, it is.

Being prepared for a sale will help in case you do have to sell. Best case you never need to sell. But life can get in the way. So be ready.

Two Silly Myths About Website Flipping Website flipping is passive income

Website flipping is passive incomeThis is a misconception.

A website is a living breathing entity that needs to be taken care of. At times there will be less work, but there will always be work.

You can delegate most of it to experts, but managing the team will then become the work.

Website flipping can be learned quickly

Website flipping can be learned quicklyThe ability to buy, stabilize, grow, and sell takes practice, intuition, and grit.

While it’s easy to get started – since acquisitions can be done for less than $10,000 – repeating successful flips over and over again takes systematic procedures, and the ability to find quality deals.

👇 Subscribe to eBiz Weekly 👇Every Friday we email 11,113 people like you with top tips, insights and opportunities to build your online business. No hype, no scams, no fake gurus. Sign up below to get the next one.

HP

We'll first send a confirmation email to make sure it’s you 🔒

Check out our privacy policy to see how we protect and manage your data.

Website Flipping Success Stories

Lifestyle Niche Site Sold for $27,000 after 8 months

Lifestyle Niche Site Sold for $27,000 after 8 monthsWe acquired a niche site in the lifestyle/health niche for $5,500 in August 2020. The website was earning around $250 – $300/month when acquired.

We grew the site by performing conversion rate optimization (CRO) to increase earnings, and also generate more traffic with on-page search engine optimization (SEO) and more content.

The site grew in traffic and earnings to reach just shy of $1,000/month by November 2020. Check out the revenue charge below:

We sold the site for $27,000 in January 2021.

Here is the P&L breakdown:

Acquired for $5,500Revenues while holding: $3,673Content writer costs: $705Theme costs: $56Asset sale: $27,000Total profit: $24,412We increased our original investment of $5,500 within 6-months to $24,412 profit.

That is a 4.5X on our initial capital.

$2,700 to $24,000 In A Year

$2,700 to $24,000 In A YearOnfolio did a case study on how they took an acquisition for $2,700 to sell for $24,000 in one year.

This site was making around $200/mo and was acquired for $2,700. This puts the multiple at 13.5x monthly revenues or 1.12x annual revenues. This was a good acquisition by the Onfolio team since typical valuations are at the 30x monthly or 2.5 – 3x annual revenues.

However, proper due diligence was not done since both the traffic and revenues were decreasing. This caused a steep decrease of 30% thus impacting revenues.

Due diligence is the most important factor when evaluating any acquisition. However, the site was turned around by doing the following:

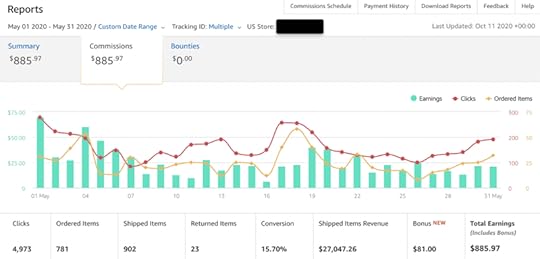

On-page changes to the content to target keywordsInternal linking between articlesBacklink building by reaching out to other blogs in the spaceAdding new revenue streamsThis allowed the site to increase revenues to $885/mo via Amazon Associates. Here is a screenshot of earnings:

The site was then sold to a private party for $24,000.

Is website flipping profitable?Yes, website flipping certainly can be profitable.

For someone getting started, their first niche site will consist mostly of sweat labor and investing in a few software, services, and training courses:

Training:Authority Hacker course or plenty of YouTube videosWebsite backend:

WordPress for freeWebsite theme:

GeneratePress, Thrive Themes, ElementorContent:

Free. First-timers should write content to save fundsSEO:

Free. Do it yourself and learnHosting:

Can range from $5 – $15/mo. I recommend Siteground or Bluehost for beginners.

That’s it to get started.

The main aspect then becomes how much content can you produce yourself. Of course, you can outsource parts of this.

Websites sell for a multiple of 30 – 35 times monthly average profits. Therefore, getting a site to earn $500/mo can net you $15,000 to $17,500.

Pros and cons of website flipping Pros

ProsEasy to bootstrap with a low budget. All information is readily available for free onlineEasy to outsource parts of the site maintenance once revenue is coming inPlenty of broker marketplaces that will handle your website sale processSale valuations are favorable to anyone entering (range from 3x – 3.5x annual profits)

Cons

ConsIf the primary driver of traffic is search engines, a Google algorithm update can reduce your site’s value almost overnightCommission payout changes can happen without warning (e.g., Amazon Associates cut commissions without warning in April 2020)Can be challenging to find good websites for sale; there are more bad deals than goodCan be difficult for newcomers to perform due diligence on a website they want to buyHiring talent online is different than hiring talent face-to-faceLearn more about website flipping

This was a detailed primer on website flipping. Websites are digital assets that provide cash flow. They can be acquired from various private and public marketplaces for favorable valuations.

If you are interested in acquiring a business, digital assets like websites would be a good first choice.

To learn more about website flipping for free, check out The Website Flip newsletter, where I share growth case studies, guides, and exclusive deal flow for sale.

Other ways to make money onlineThere are many other ways to make money online, to work from home or anywhere in the world.

Full list of ways to make money onlineMore profiles of online money makers👇 Subscribe to eBiz Weekly 👇Every Friday we email 11,113 people like you with top tips, insights and opportunities to build your online business. No hype, no scams, no fake gurus. Sign up below to get the next one.

HP

We'll first send a confirmation email to make sure it’s you 🔒

Check out our privacy policy to see how we protect and manage your data.