Up $8K, starting a new 401k, and possibly switching brokerages? – January 2021 Freedom update

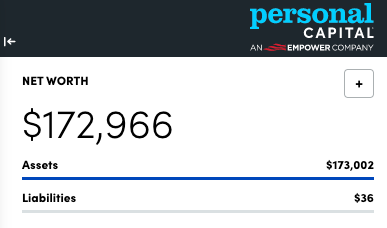

Since last month, I went from 33% of the way toward my $500,000 net worth goal to 35% of the way there. Once I reach $200,000, I’ll be 40% of the way. I find that breaking it up into little steps is a lot more manageable than thinking about the entire goal all at once.

This month finds me sitting at ~$173K, so I’m focused on ways to reach that next milestone. The stock market has been kind, and I’m back to rebuilding my savings after paying off all my credit cards and car note last month. All told, I’m up ~$8,000 this month. And in a few days, I should be getting the first deposit into my new 401k from the job I started a few weeks ago.

Cute dog alert! He was napping right before I took this pic of us

Now that I have no liabilities and only assets to think about, my finances have gotten a bit… routine? So of course I have to rock the boat.

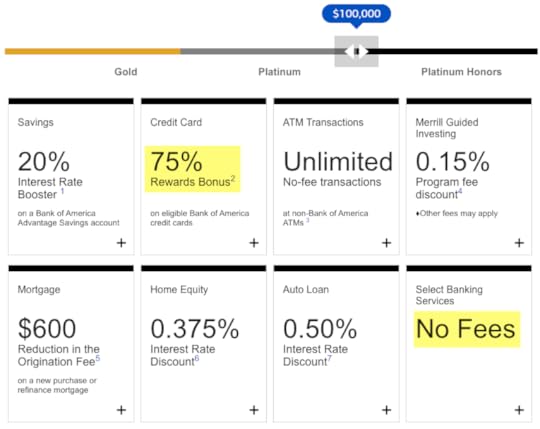

I’m seriously thinking of moving some assets to Bank of America – enough to qualify for the Platinum Honors tier in the Preferred Rewards program – and opening a couple of new cards and a checking account with them. But the thought of switching from Fidelity to Bank of America and from earning points to cashback is giving me heartburn.

Thus are the thoughts that find me on this cool, rainy evening in north Texas.

January 2021 Freedom updateSo I think I set up my new 401k correctly and hoping the first contribution hits next week. I have roughly $1,700 going in every month to hit the $19,500 maximum this year. My new company doesn’t offer a 401k match, so it’s all me. I’ve already maxed out my Roth IRA for 2021, so this is purely for the tax and investment benefits – and to get closer to my Freedom goal.

Last year, there were ups and down, but I was up $60,000 once the dust settled. If that holds true again this year, I will be nearly 50% of the way toward my goal when 2022 rolls around. Now that the first $100K is behind me, I’m hoping things will speed up thanks to compound interest and time in the market.

I’m trying not to read too much about the stock market, but there’s talk of another bubble. Staying the course has gotten me this far, so I’m gonna stick to the plan and roll with it.

Rebuilding savingsI’d like to get $30,000 in a savings account as an emergency fund and to be in a cash-heavy position. So for the next few months, I’ll be putting any extra funds into savings. Then I’ll think about investing the rest in a brokerage account – or maybe continue to save in case a good deal comes up on a house.

Although I don’t know where I’d live yet. I recently submitted applications to two Studio Art programs to get my MFA in Painting. So I’ll see what happens and let that direct my course. I’m hoping to be out of Dallas in the next few months.

Another thing is the computer I’m typing this on is from 2013. It’s still going strong, but has moments where it’s slow or glitches out. I’ve been thinking about getting a new one. But this time, I want all the software and upgrades and extra memory and accessories and all the rest. I’d earmark $3,000 for a new device. If I have it for seven years like I’ve had this one, it’ll be worth it. I was a poor college kid when I got my current basic model computer. It’s been great, but I want to really treat myself next time.

I mention this because it would affect how quickly I’m able to meet this savings goal.

Should I leave Fidelity for Bank of America?Everybody knows I love Fidelity and have been fidelitous to them since forever. But ever since I rolled over my old 401k into my traditional IRA, I find myself with a ~$100,000 account.

Should I?

Through April 15, 2021, there’s a bonus offer for opening a new Merrill Edge account. I could roll over that IRA and get a $375 bonus while also qualifying for the Platinum Honors tier in the Preferred Rewards program.

The highest level in one shot

That would get me a free checking account and a 75% bonus on the rewards from Bank of America credit cards. Which would also mean I could earn a couple more credit card bonuses in the process and add new cards to my rotation.

It would be easy enough to move some funds to Merrill Edge and earn a few bonuses. So I’m considering making a jump for it. I’m just not sure if it’s worth it.

I definitely prefer to earn points as opposed to cashback. But it couldn’t hurt to mix things up a little – could it?

If you have Platinum Honors status with Bank of America, is it worth it? I have until April to think it over. But if a checking account bonus pops up before then, I might not be able to resist.

Marking this as “Highly Interesting.” Because I can’t leave well enough alone.

So I’m 35% of the way toward my goal. That’s pretty rad.

CurrentLast MonthChange2021 Goal ASSETS 401k xxxxxx$19,500 Overall investments$143,742$137,248+$6,494As much as possible Savings$19,916$16,775+$3,141$30,000 Net worth in Personal Capital $172,966$165,033+$7,933$500,000 Track your net worth with Personal Capital

I don’t get out much these days

All told, my investments are sitting around $144K.

On the way to $200K invested

And like last month, this month presents another highest-ever net worth.

The trend continues

Everything I get – side income, another stimulus check, extra money after monthly expenses – I plan to aggressively save. If I can get to $200,000 net worth in a few months, that would be so encouraging. Gonna keep plugging away at it. Every day.

January 2021 Freedom update bottom lineLink: Track your net worth with Personal Capital and get a $20 Amazon gift cardAnd if I could reach 50% of my overall goal by the end of 2021, my momentum would be unstoppable. Now that I’m getting closer, I’m all the more encouraged to save and invest. It’s almost a game now – a really fun one. Especially now that I have no liabilities acting as inertia.

But because I’m me, I’m considering switching to Bank of America to see what their cards and accounts are about. I’ve been with Fidelity forever but if there’s more to gain, I’m all for trying – especially if I can pick up a few bonuses along the way. If you have any experiences, recommendations, or inside scoop please let me know in the comments!

And thank you for reading and following. Starting now, it’s on to the next $100K milestone! Hope to have more to report for the next update. Things are surely on the go. Stay safe out there!