How to Report Backdoor Roth In FreeTaxUSA: A Walkthrough

TaxAct used to be a low-cost alternative to the big two tax prep software TurboTax and H&R Block. However, its pricing strategy changed in recent years. Now TaxAct is just as expensive or sometimes even more expensive than TurboTax and H&R Block. The good news is another low-cost alternative emerged. It’s called FreeTaxUSA.

FreeTaxUSA is purely online; there is no download option. It uses the freemium pricing model. Federal tax filing is free, regardless of the complexity of the return. After you are done with federal, if you need to file a state return, it costs $12.95. They also offer a deluxe upgrade for $6.99, which includes audit assist, priority support, and amended returns. All told, the total cost is under $20 and it includes e-filing for both federal and state.

Low cost is good and all, but how good is the software? I decided to test-drive it with a slightly complicated subject: reporting the Backdoor Roth. Over the years I created guides for how to report Backdoor Roth in TurboTax and how to report Backdoor Roth in H&R Block. A reader asked me to also create a guide for doing the same in FreeTaxUSA.

Just as a refresher, a Backdoor Roth involves making a non-deductible contribution to a Traditional IRA followed by converting from the Traditional IRA to a Roth IRA. Both the contribution and the conversion need to be reported in the tax software. For more information on Backdoor Roth, see Backdoor Roth: A Complete How-To.

What To ReportYou report on the tax return your contribution to a Traditional IRA *for* that year and your converting to Roth *during* that year.

For example, when you are doing your tax return for year X, you report the contribution you made *for* year X, whether you actually did it during year X or between January 1 and April 15 of the following year. You also report your converting to Roth *during* year X, whether the contribution was made for year X, the year before, or any previous years. Therefore a contribution made during the following year for year X goes on the tax return for year X. A conversion done during year Y after you made a contribution for year X goes on the tax return for year Y.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finish your conversion in the same year. I called this a “planned” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for year X in year X and convert it during year X. Contribute for year Y in year Y and convert it during year Y. This way everything is clean and neat. If you are already off by one year, catch up. Contribute for both the previous year and the current year, then convert the sum during the same year. See Make Backdoor Roth Easy On Your Tax Return.

FreeTaxUSAHere’s the scenario we’ll use as an example:

You contributed $6,000 to a traditional IRA in 2020 for 2020. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2020, the value grew to $6,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments from the screens shown here.

Before we start, suppose this is what FreeTaxUSA shows:

We’ll compare the results after we enter the Backdoor Roth.

Convert From Traditional IRA to RothThe tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

When you convert from Traditional IRA to Roth, you will receive a 1099-R. Complete this section only if you converted *during* the year for which you are doing the tax return. If you only converted during the following year and you don’t have a 1099-R yet, skip to the next section “Traditional IRA Contribution.” You’ll complete this section next year.

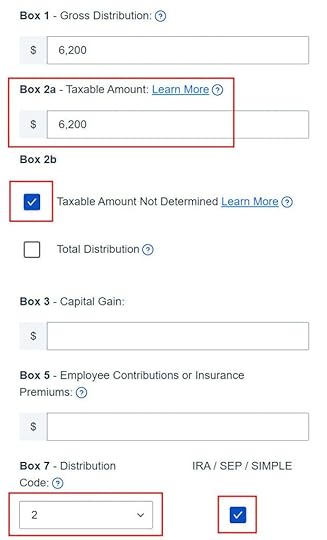

In our example, by the time you converted, the money in the Traditional IRA had grown from $6,000 to $6,200.

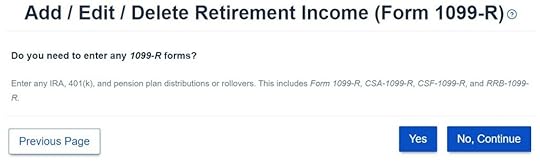

Click on Yes when it asks you about the 1099-R.

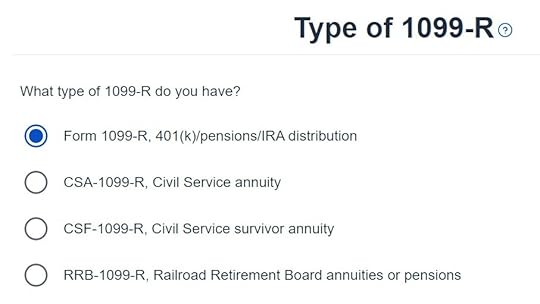

It’s just a regular 1099-R.

Enter the 1099-R exactly as you have it. Pay attention to the code in Box 7 and the checkboxes. It’s normal to have the same amount as the taxable amount in Box 2a, when Box 2b is checked saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. My 1099-R has code 2, and the IRA/SEP/SIMPLE box is also checked.

Right after you enter the 1099-R, you will see the refund number drop. Here we went from a $1,540 refund to $264. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

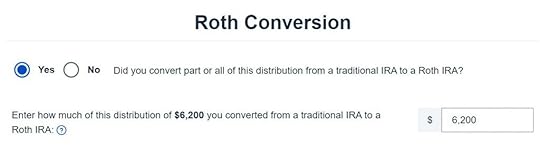

It asks you about Roth conversion. Answer Yes to conversion and enter the converted amount. This whole 1099-R is the result of a Roth conversion.

You are done with this 1099-R. Repeat if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse.

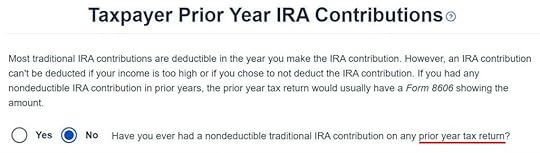

It asks you about basis carried over from previous years. If you did a clean “planned” backdoor Roth every year, although technically the answer is Yes, you have nothing to carry over from year to year. In our simple example we don’t have any. If you do, get the number from line 14 of Form 8606 from your previous year’s tax return.

Not impacted by a disaster.

Now continue with all other income items until you are done with income. Your refund meter is still lower than it should be, but it will change soon.

Traditional IRA Contribution

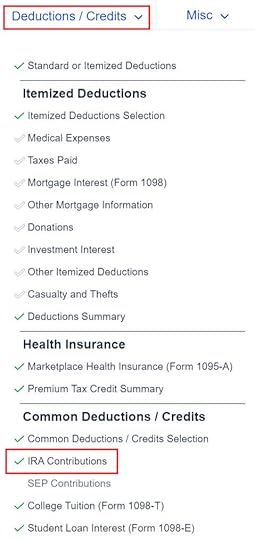

Find the IRA Contributions section under the “Deductions / Credits” menu.

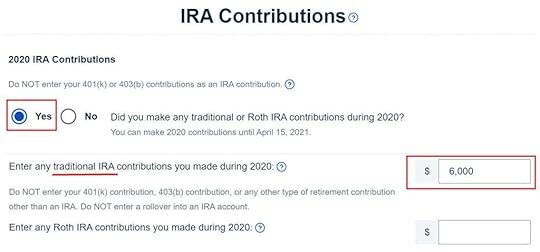

Choose Yes and enter your contribution. In our example you contributed $6,000 directly to a Traditional IRA. If you originally contributed to a Roth IRA and then you recharacterized the contribution as traditional contributions, enter the amount in the Roth IRA box and choose Yes below when it asks you whether you recharacterized.

Your refund number goes up again! It was a refund of $1,540 before we started. It went down a lot and now it’s back to $1,496. The $44 difference is due to paying tax on the $200 earnings before we converted to Roth.

We don’t have a SEP or SIMPLE account.

Withdrawal means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer ‘No’ here.

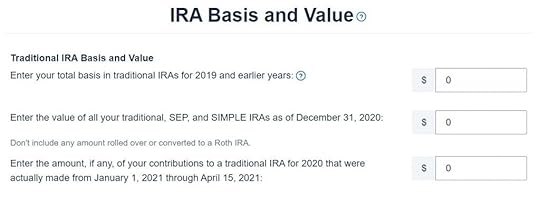

In our example, we don’t have any basis carried over from the previous years. We don’t have any money in traditional, SEP, or SIMPLE IRAs as of the end of the year (we already converted to Roth by then). Our contribution was made during the year in question, not in the following year.

It tells us we don’t get a deduction. We know. It’s because our income was too high. That’s why we did the Backdoor Roth to begin with.

If you only contributed *for* last year but you didn’t convert until the following year, remember to come back next year to finish the conversion part.

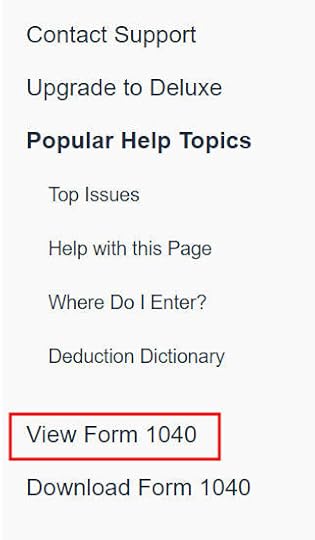

Taxable Income from Backdoor RothAfter going through all these, let’s confirm how you’re taxed on the backdoor Roth. Click on “View 1040” on the right-hand side.

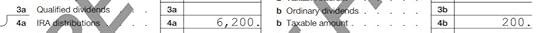

Look for Line 4 in Form 1040.

It shows $6,200 in IRA distributions and only $200 is taxable. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You will pay tax on a small amount in earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

The post How to Report Backdoor Roth In FreeTaxUSA: A Walkthrough appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower