2021 Portfolio Strategy

With the end of 2020 thankfully coming into view, I thought it would be good to review different asset classes, their relative recent performance and evaluate portfolio strategy heading into 2021. One theme that is consistent is that asset prices have seen tremendous inflation recently, and no asset class has been spared. There have been many drivers to this, including expansive monetary and fiscal policy in response to the COVID-19 pandemic and a nascent economic recovery. Finding value has become increasingly difficult, which is why in the stock market for example, many analysts are saying it's a "stock picker's" market. Bitcoin, gold/silver and bonds have also enjoyed a good run this year and with low interest rates, residential real estate is starting to see some strong price appreciation (about 7% year to date nationally, which is quite a bit higher than the 10 year average of about 5%).

With the end of 2020 thankfully coming into view, I thought it would be good to review different asset classes, their relative recent performance and evaluate portfolio strategy heading into 2021. One theme that is consistent is that asset prices have seen tremendous inflation recently, and no asset class has been spared. There have been many drivers to this, including expansive monetary and fiscal policy in response to the COVID-19 pandemic and a nascent economic recovery. Finding value has become increasingly difficult, which is why in the stock market for example, many analysts are saying it's a "stock picker's" market. Bitcoin, gold/silver and bonds have also enjoyed a good run this year and with low interest rates, residential real estate is starting to see some strong price appreciation (about 7% year to date nationally, which is quite a bit higher than the 10 year average of about 5%). The stock market continues to reach new highs on a daily basis as shown in the charts below for the S&P 500, Dow Jones Industrial Average and NASDAQ:

S&P 500

S&P 500

Dow Jones Industrial Average

Dow Jones Industrial Average NASDAQ

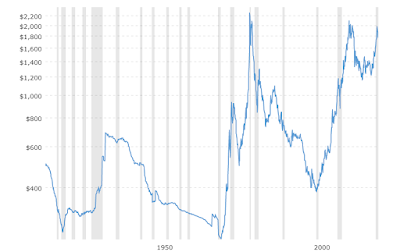

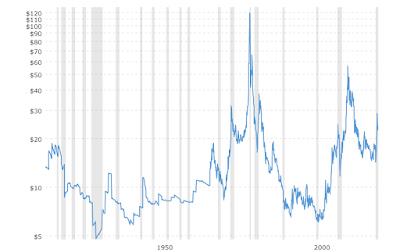

NASDAQGold and silver have also done quite well recently, with gold again approaching all time highs, while silver still looks like it has more potential upside, at least relative to all time highs:

Gold

Gold Silver

Silver30 Year Treasury Bonds have also rallied tremendously as interest rates have steadily declined, leaving little to no upside to owning Treasuries with rates so low, and only downside if rates begin to rise:

30 Year Treasury Yield

30 Year Treasury YieldBitcoin has also had a great run this year, nearing an all time high:

Bitcoin

BitcoinWith all major asset classes moving upward, almost in unison, except for some isolated opportunities (i.e., picking overlooked or unfairly beaten-down stocks poised to increase in value or maybe investing in silver), its a very difficult environment for investors to navigate. Cash (in excess of any emergency fund requirements) is not a great place to be, since interest rates currently being paid barely keep up with inflation. It would certainly not be wise to attempt to short any of these markets given the considerable upward momentum, which many analysts expect will continue into the new year. Also, the underlying drivers of low interest rates, strong fiscal and monetary stimulus and an economic recovery seem likely to stick around for a while, which will only drive asset values higher, at least in the medium term.

This is why now more than ever it's important to maintain a broadly diversified investment portfolio, like I have outlined in the Financial Fortress concept. For small, individual investors like me it's the only way to "win" in the long run, since we just can't time the market or move as quickly as the institutional money.

Here's my current portfolio allocation:

Stocks - 33% (34% I actively manage myself, the rest is indexed)Cash and equivalents - 21%Real Estate - 20%Bonds - 19%Alternatives - 7%Lately, private equity (angel investing) has started to look attractive for a small allocation. There are many crowdfunding sites, but I have used Seed Invest in the past and recently started monitoring their deals again. They have made it a lot easier to invest over the years and many of their deals only require a $1,000 minimum and you don't even need to be an accredited investor in all cases. While there is a high probability of loss in this type of investing, there is equally a great chance for reward however angel investing does require a great deal of patience. Spreading out an investment of $1,000 each, over multiple startups and just patiently waiting seems like a great approach to add a little upside to your portfolio while keeping the overall risk low through asset allocation (maybe no more than 2-5% of your total investable assets). An interesting theme right now is the commercial application of big data, Artificial Intelligence (AI) and robotics in all industries. I believe this is the next major technology revolution, which the COVID-19 pandemic has greatly accelerated as companies look to become more efficient and competitive. Last week, I wrote about three upcoming IPO's and one of them, C3.ai is in this type of business. Like the other IPO's last week, this one blew up on opening day, but if it drops below $100, it may be worth picking up some shares.Other alternative investments such as music royalties have not panned out as well as I would have liked as I have written about previously, even though I continue to monitor new offering activity. The payments I received this year were less than half of what I received last year. I think the pandemic hit these investments really hard with the cancellation of live events and new movie/show production, leaving only streaming, radio play and legacy movie/show productions that incorporate the music as viable income streams for audio rights holders. So much for "non-correlated."

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.

Published on December 13, 2020 21:04

No comments have been added yet.