One year of tracking later, my net worth is up $60K – November 2020 Freedom update

About a year ago, I started seriously tracking my net worth. And every month, I’ve posted what I call Freedom updates. Obviously, 2020 has been a wild ride and a lot has happened. I’ve had months where I’ve been way up and way down. Sometimes by tens of thousands from month to month.

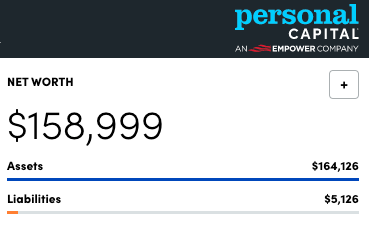

After bouts of whiplash, I want to look back at where I started – before I sold my condo in Dallas and Covid-19 hit – and compare where I am now. As of today, my net worth in Personal Capital is $158,999 (darn that extra dollar lol). I’m up over $60,000 from the end of last year. And currently at 31.8% of my goal of a $500,000 net worth.

“They” say investing your first $100K is the hardest. And now my investments are sitting at $127,353. I’m contributing 30% of my paychecks to my 401k. And come January 2021, I’ll dip into my savings account to max out the $6,000 Roth IRA contribution early in the year.

This sure ain’t where I began. Ain’t where I end, either!

But before I get into all that, I just want to celebrate my overall progress. Despite everything, I averaged $5,000 per month in net worth gains over the last year. And now that I have momentum built, I’m hoping it’s just a short jump to the next $100K. Onward!

November 2020 Freedom update

Last year, my goals for the following five years were to:

Buy as many investment properties as I can (probably two) – $TBD

Max out my 401k every year – $95,000 ($19K x 5)

Max out my Roth IRA every year – $30,000 ($6K x 5)

Save $20,000 in a savings account

Pay aggressively toward my mortgage and build more equity – $50,000

Pay off my car loan – $10,000 (my car is holding its value really well)

Hope for continued appreciation on my condo and returns on my investments – $???

Save and/or invest my bonuses, any blog income, and tax refunds – $???

Wow, a lot has already changed (but we knew that the entire time, eh?). I no longer have any interest in buying property, I’ve hit my first savings goal, and sold my condo (and therefore have no more equity). I’ve also paid my car loan down to ~$3,400.

This image is here to give your eyes a small break

I’ve tried to catalogue the evolution, but for 2021, my goals are to:

Max out my 401k – $19,500

Max out my Roth IRA – $6,000

Save $30,000 in a savings account (I want to be cash heavy and currently have $20,000, so $10,000 more)

Finish paying off my car loan – $3,400

Put any extra income into a taxable brokerage account – $???

I find it fascinating how goals evolve. I’m also proud of myself for letting my goals evolve and not being so rigid as to prevent that from happening. The calibrations are clearly working, and compound interest is starting to double down and work in my favor.

As good as reaching ~32% of my goal feels, I can already imagine how good reaching 50% of it will feel. And it’s so within reach!

Where I’m at

Last month, I declared I was at my best-ever net worth.

Boom shaka laka

This month, it’s true again. As long as I can maintain, I’ll expect each month to be better than the previous one, so I’ll retire that “best-ever” phrase and just keep rolling. If 2020 was any indication, that won’t always be true. But at least I can be less surprised and butt-hurt about it.

Up and up, out and out

Of my overall net worth, over $127,000 of that is tied up in index funds. This is where the compound interest gets to work its magic, and where I’ll be focusing most of my efforts in the upcoming year.

Yassss, it’s shrinking so fast

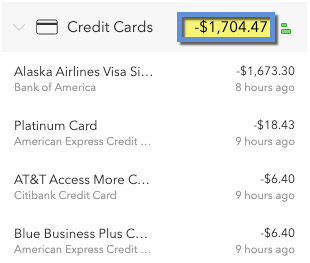

This time last year, I had $20,000 in credit card debt. But I bucked up and paid so much of it down. Now I’m so close to being done with it. I can’t tell you how relieved I am about this.

Even though I’m interest-free until September 2021, the psychological benefit is worth it to see this number at $0. Finally. One less liability causing friction to my momentum.

What. A Year.

Finally, wow – what a ride 2020 was. The big dip in March, all the smaller dips, then increases felt like a rollercoaster. If you can imagine riding up and down all those bumps and peaks and dips. As mentioned, most of my cash is invested in index funds and I try, god do I try, to keep my eyes off my portfolio. But where I was a year ago and where I am now – that difference – I mean…

I’m glad I stayed the course and forded the rivers or whatever. It wasn’t easy. I’m still learning to keep my emotions out of my investments. It’s a lesson well worth learning, and a slow one. Maybe the biggest one I learned from such a volatile year.