How To Pay Off SBA COVID-19 EIDL Loan Early: A Walkthrough

Back in March, Congress created two loan programs to help small businesses and the self-employed mitigate the economic impact of the COVID-19 pandemic: the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP). Because we were not sure whether we were able to get either loan, we applied for both (see previous post COVID-19 Loans for Self-Employed: Where to Apply). We ended up getting both loans after a long application process — the EIDL loan directly through the SBA, and the PPP loan through a bank.

Our business stabilized somewhat in recent months. Revenue was down 65% in April compared to April of last year. It was down only 47% in June. It’s still bad but the trend is upward. So we decided to pay off the EIDL loan early.

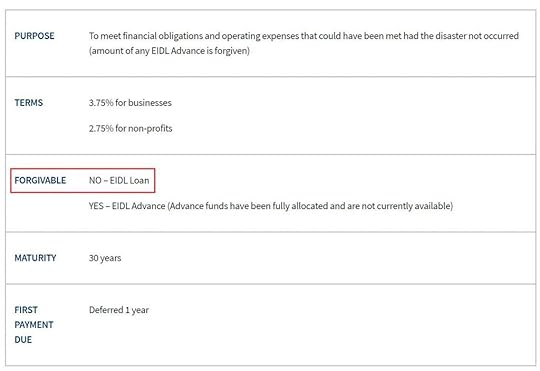

EIDL Loan Is Not Forgivable

The EIDL loan is a 30-year loan at a 3.75% interest rate. No payments are required during the first year but interest still accrues. Except for the EIDL grant ($1,000 per employee up to $10,000), the EIDL loan is not forgivable.

https://www.sba.gov/funding-programs/disaster-assistance/coronavirus-covid-19

https://www.sba.gov/funding-programs/disaster-assistance/coronavirus-covid-19Therefore if you no longer need the cash, it’s better to pay it back early to stop the interest. There’s no prepayment penalty. When no payments are due yet, the SBA isn’t sending any statement or payment stub. If you’d like to pay the loan off, it’s not obvious how much you need to pay or where to send the payment. I’m showing you what to do if you received the EIDL loan and you’d like to pay it off early or pay back a part of the loan to lower your interest charge.

SBA Loan Number

First, you need the SBA loan number for your EIDL loan. This 10-digit number is in the Loan Authorization and Agreement (LA&A) you electronically signed with the SBA. It’s at the beginning of page 2 and also on the upper left of all pages in that document.

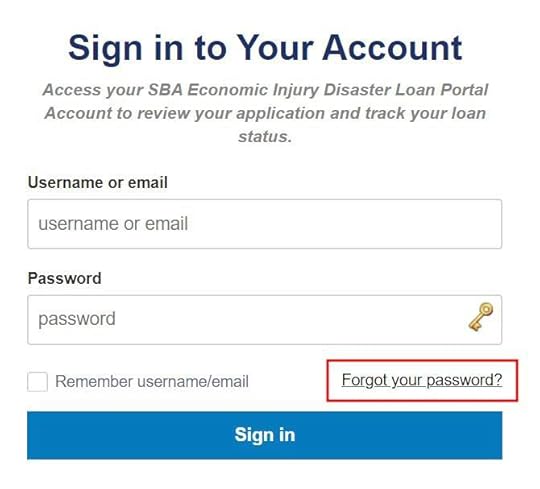

If you didn’t save the document you electronically signed with the SBA, you can go back to the EIDL loan portal at https://covid19relief1.sba.gov and sign in with the email and password you created. If you forgot the password, there’s a “forgot your password” link on the login page.

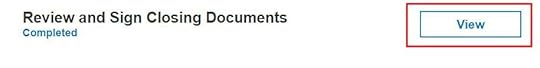

After you log in, you can re-download the signed loan document.

If you still can’t get into the loan portal, please call the SBA EIDL customer service center at 800-659-2955 or email disastercustomerservice@sba.gov.

SBA CAFS

Next, you need to register with the SBA’s Capital Access Financial System (CAFS). This is similar to the online banking site when you have a loan with a bank. If you have problems registering for online access, please scroll down for how to contact SBA’s Disaster Loan Servicing Center by phone.

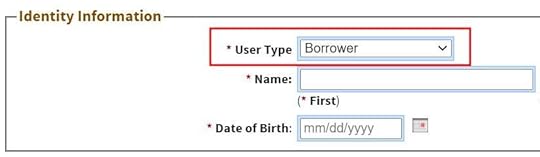

Click on the “Not Enrolled?” link above the login fields.

Choose “Borrower” under User Type.

After entering your zip code, click on the Lookup Zip button.

Enter your SBA loan number in the “Financial Commitment ID” field.

Payoff Amount

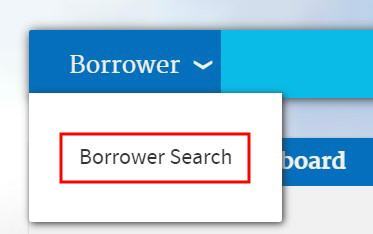

After you successfully register for access, you log in to CAFS with the user ID and password you created. The system will send a one-time PIN to your email address or mobile phone for two-factor authentication. After you get in, at the light blue bar at the top, click on Borrower, and then Borrower Search.

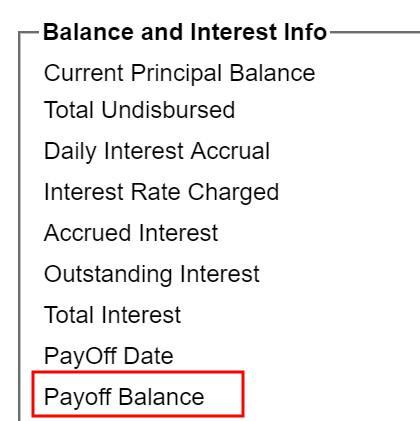

You will see a list of your loans. If you received both the EIDL loan and the PPP loan, you can identify your EIDL loan by the loan number, the loan amount, or the loan type (“DCI”). Click on the EIDL loan. You will see your loan details. If you are trying to pay the loan off, read the Payoff Balance during working hours Monday through Thursday.

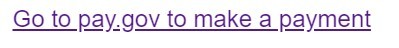

Further down the page, you will see a link that says “Go to pay.gov to make a payment.” So you go there next.

Pay.gov

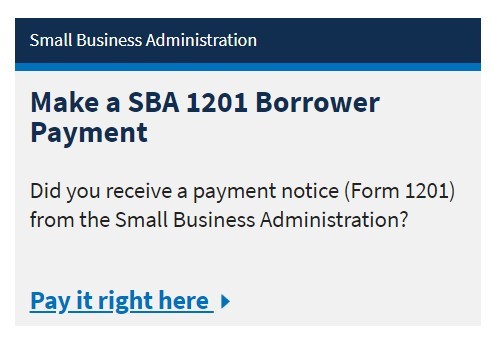

The link just sends you to the home page of pay.gov. This is a multi-purpose website for making many different kinds of payments to the U.S. government. You will see this in the middle of the home page:

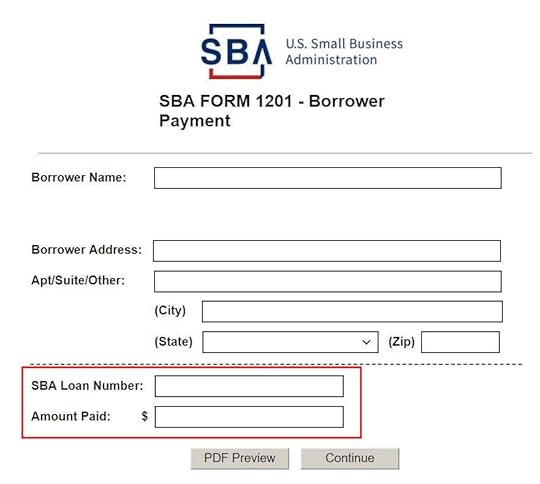

You follow that link even though you don’t really have a payment notice (Form 1201) from the SBA. When you follow along, the crucial information you need are your SBA loan number and the payment amount.

If you are trying to pay the loan off, enter the payoff amount you got from SBA CAFS (you can also make a partial payment). The soonest payment date is the next business day. That’s why if you are trying to pay it off, you need the latest payoff amount during the working hours Monday through Thursday. If you get the payoff amount in the evening or on a Friday, by the time the payment arrives, additional interest may have accrued and your payment will be short.

You will give the routing number and account number of a bank account for the payoff. Pay.gov will debit your account and send the payment to the SBA. You can go back to SBA CAFS after a few days to verify the payment and the loan status.

You are done when you see the loan status says “Paid in Full.”

SBA Disaster Loan Servicing Center

If you have problems enrolling in CAFS to view your payoff balance and loan status, you can also try calling SBA’s Disaster Loan Servicing Center. I haven’t called them myself because I was able to get into CAFS. I only found the information on SBA’s website.

SBA has two Disaster Loan Servicing Centers, one in Birmingham, AL, the other in El Paso, TX. Your loan may be assigned to one of the two centers. Or maybe either center will be able to tell you the payoff balance and verify that your loan is paid in full. The Loan Servicing Center also takes payments by phone.

Birmingham Loan Servicing Center

Phone: 800-736-6048

Hours of Operation: Monday – Friday 8:00 a.m. to 4:30 p.m. (CST)

Email: birminghamdlsc at sba dot gov

El Paso Loan Servicing Center

Phone: 800-487-6019

Hours of Operation: Monday – Friday 8:00 a.m. to 4:30 p.m. (MST)

Email: elpasodlsc at sba dot gov

The post How To Pay Off SBA COVID-19 EIDL Loan Early: A Walkthrough appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower