Inventory: The 23 credit cards I currently have – and why

Dang, the last time I did a full credit card inventory was three years ago. Can you believe?

Back then, I had 29 cards. These days I have 23, and currently have my eye on three more (ironically, all cards I’ve had before: Chase Sapphire Preferred, Citi Premier, and US Bank Altitude Reserve).

Of the 29 I had, some I closed, some were discontinued, and others were canceled for me. And I still have a lot of them today. Let’s hop to it!

Recent mainstays

I set up each section with:

Name of card – annual fee amount – # of years I’ve had it – keep or cancel

Amex

I used to be jamming with several Amex cards. But these daze, I’m down to just three. I just can’t with the airline and other goofy credits they used as justification to jack up their annual fees.

I am semi-interested in the Amex Gold card because of its strong category bonuses, but with that $250 annual fee? No thanks.

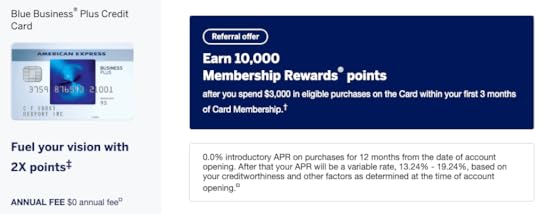

1. Blue Business Plus – $0 – 4 years – Keep

Link: Amex Blue Business Plus 10,000 point offer

No annual fee, 2X Amex Membership Rewards points on up to $50,000 in purchases per calendar year, AND the ability to transfer points to travel partners? Whaaat? This card is an absolute forever keeper.

Plus, thanks to Amex Offers, I actually make money from keeping this card.

What you waiting for?

There’s no official welcome offer, but you can use my referral link to earn 10,000 Amex Membership Rewards points after spending $3,000 on purchases within your first three months. This card doesn’t show up on your personal credit report because it’s a small business card. If you’ve never had it, I highly recommend it.

2. Hilton Aspire – $450 – 4 years – Keep

Link: Hilton Aspire

Amex has kept this card stacked with benefits and has never raised the $450 annual fee since it came out, including:

14X Hilton points on purchases at Hilton

7X Hilton points on flights booked directly with airlines on on Amex Travel

7X Hilton points at US restaurants

3X Hilton points for all other purchases

Up to $250 in Hilton resort credits per year

A free weekend reward night upon renewal each year

Up to $250 in annual airline fee credits

Diamond elite status , which gets you upgrades, free breakfast, bonus points at Hilton, and access to club lounges on every stay

Priority Pass Select membership

Terms Apply

If you like Hilton hotels, this card is an absolute keeper. The annual fee easily pays for itself.

Outside the Hilton Austin a year ago

I prefer Hilton hotels, and will keep this card for as long as the benefits remain this generous.

3. Hilton no annual fee – $0 – 5 years – Keep

Link: Amex Hilton card

I downgraded an old Hilton Surpass to this no annual fee card. It’s basic, but there’s no annual fee so I’ll keep it.

Barclays

4. AAdvantage Aviator no annual fee – $0 – 3 years – Keep

I downgraded my AAdvantage Aviator Red card (which has a $95 annual fee) to this one because there’s no annual fee. Barclays like to keep relationships with customers, so it’s helpful if I ever want another of their cards in the future.

Chase

I currently have eight Chase cards – the most of any bank!

5. Ink Business Preferred – $95 – 2 years – Cancel

I mostly got this card for the stellar welcome offer, but find myself not using it much. Can go in the bin next time the fee is due.

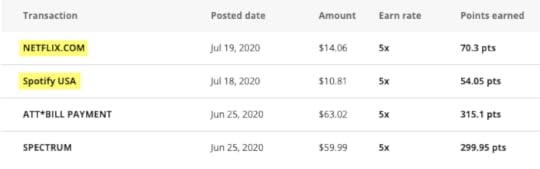

6. Ink Plus – $95 – 6 years – Keep

This card is no longer available to new applicants and offers 5X Chase Ultimate Rewards points on office supply purchases, cable, internet, phone bills, and oddly enough – streaming services.

It’s a bit niche, but 5X for my streaming stuff is nice

I keep it for the bonus categories and also to preserver the ability to transfer my Chase Ultimate Rewards points to travel partners – mostly Hyatt. The airline partners are all a bit crappy tbh.

7. British Airways no annual fee – $0 – 3 years – Likely cancel

Yes, there’s a no fee version of the British Airways card. I was surprised too. When a representative offered it to me, I said sure.

What will mostly likely end up happening is I’ll offer to close this card when I get ready to open a new Chase Sapphire Preferred card, as I don’t think Chase would let me have nine cards. So I’ll keep this one as leverage for that time.

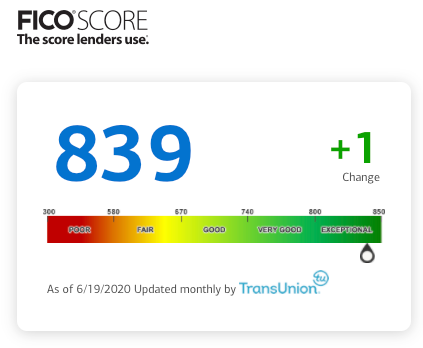

8. Freedom – $0 – 18 years – Keep

My oldest card. I got it when I was 18. And I’ll be 36 next month. Crazy!

This card keeps my accounts aged nicely and my credit score high.

My Chase Freedom helps my AAoA pretty high

Plus, I use the card often thanks to rotating quarterly bonus categories. Which reminds me, I need to activate the bonus for this quarter.

9. Freedom Unlimited – $0 – 8 years – Keep

This was my old Sapphire Preferred, but I downgraded it to this. I use it at Costco and that’s about it – and only because Costco only accepts Visa. It doesn’t get much love otherwise. :/

10. Hyatt (old version) – $75 – 7 years – Keep

I’ve always found a creative use for the Hyatt free night, except for maybe this year. Even if I can’t redeem it because of coronavirus, I’ll hang onto it because:

Coronavirus won’t last forever (right?!)

It’s a slightly older card, so it helps boost my overall credit

I do love Hyatt though, and hope to be back in their hotels soon.

11. IHG Select (old version) – $49 – 5 years – Keep

Same deal at the Hyatt card above. I like the annual free night, but don’t encounter many IHG hotels otherwise.

My IHG stay earlier this month was my first and likely last for a while

12. United Explorer – $95 – 4 years – Keep

I was keeping this card to:

Get more United award space

Use the two lounge passes per year

Keep my United miles alive

Now that I’m not traveling and United miles no longer expire, keeping this card is a bit… dubious.

But like the hotel cards, I’m mostly keeping it out of hope at this point. It would be second on the chopping block after the British Airways card if I do end up canceling. I just paid the annual fee right when coronavirus started bearing down, so I’ll give it until next year to see what happens.

Citi

Now Citi… we love. I use their cards more than any others and have six in total. Their bonus categories, earning structures, and the way the card benefits stack across cards works great for my spending patterns.

Plus, there’s a huge overlap in airline transfer partners with both Chase and Amex. I love my ThankYou points!

13. CitiBusiness AAdvantage Platinum Select – $95 – 3 years? – Cancel

I was keeping this card for the American Airlines benefits. Living in Dallas and having no desire to earn any type of airline elite status, I found myself on American Airlines more often than not.

The enhanced boarding and free checked bag was worthwhile, but I’ll likely cancel when the fee comes due and just get another one later because they’re easy enough to get. Probably from Barclays so I can keep my Citi slots open.

14. AAdvantage MileUp – $0 – 8 years – Keep

Free to have, downgraded from an old AA card. Never use it though. Maybe I should after my recent incident.