Condo sold, net worth return to form, & up $35K – July 2020 Freedom Update

Big news first: I closed on my condo on June 29! It hit the market April 22, and I got the offer on May 30. As y’all know, I’ve been on veritable pins and needles waiting for this. Now that it’s over, I’m almost embarrassed at the sheer amount of mental and psychic energy I put into it.

It drained me and consumed my thoughts. For the first time since I was little, I got down on my knees at night and prayed (for a smooth, quick sale).

This whole thing started in January when I got a small ceiling leak and morphed into this whole debilitating thing. But it’s done. And I finally feel like I’M BACK.

Now I live in an apartment in Dallas with the goodest boy

I’m always amazed (in a bad way) at how consumed I get with situations to the point where it zaps me so fully. That said, the last couple of weeks before closing were absolutely freaking crazy. In no way would I describe myself as being “calm.”

I didn’t post a June 2020 Freedom update because I knew the sale was pending and that it would shake up my financial situation. It did. And now I’m heading into the best financial shape of my life.

July 2020 Freedom Update

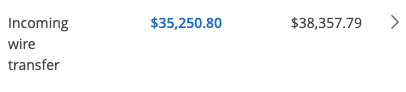

On June 29, I got up early and went to the title office. Within an hour, it was done. Later that day, I got the money from the sale.

Wowza

All told, I walked away with $35,250.80. Not as much as I wanted or could’ve gotten, but plenty considering I was ready to get rid of the condo for pennies if necessary.

Manna

In the interim, I sat and had a long margarita. Selling that condo was such a relief. Such a weight off. I let the liquor take off even more. It was my first drink in several weeks.

Then I went home and set about distributing the money. I’d thought about it for a while – exactly what I wanted to do with it. After I canceled my homeowner’s insurance and turned off the electricity, I split the proceeds into little pieces – and met a slew of my 2020 financial goals in the process.

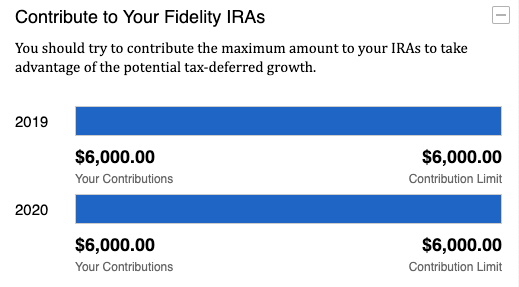

Maxed out my 2020 Roth IRA

First things first, I sent $6,000 to my Roth IRA and maxed it out for 2020 in one fell swoop. When the cash cleared, I bought $6,000 worth of VTI and called it a day. Boring, simple, easy index funds: exactly what I want in my retirement accounts.

VTI is my newest flavor of vanilla. Here’s what’s in my Roth IRA

I have a few different index funds in my Roth IRA. The stocks are total market, with near-equal portions of FSKAX, FZROX, and VTI. I went back and forth about FSKAX vs VTI, but wanted to see how an ETF stacked up to a mutual fund over time. I’m also keeping an eye on FZROX (Fidelity’s completely free to own fund) and will change that up in January 2021 if needed.

This felt so dang good

But they’re all index funds and all roughly the same. I guess I like comparing similar flavors.