Austerity or trickle up - time to choose

Austerity or trickle up — time to choose

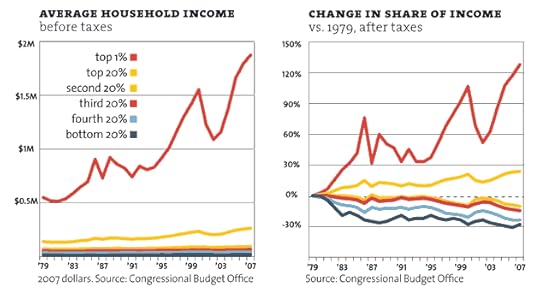

As the US and the UK debate massive spending plans, once again, the same top down approach that focuses on companies is being utilised (trickle down) as in 2008. That led to the past 12 years of austerity and the widening gap in financial inequality. This time, how about we focus on people for a change, not just businesses. Trickle up. Let’s see what trickle up could have accomplished if that had been the approach in 2008.

Austerity or Trickle-Up?

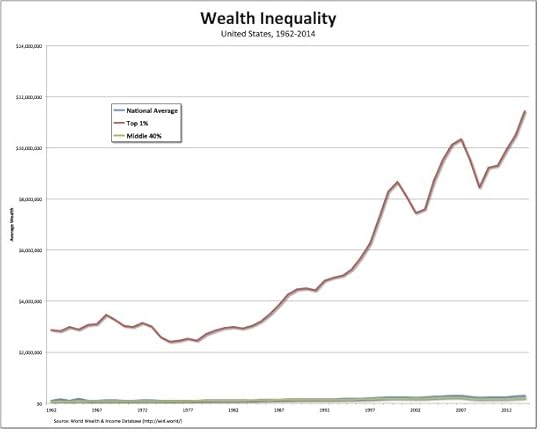

Since 2008, households have had to endure ‘austerity’ to pay for the government bailout of financial institutions and the financiers. Households have increased their debt to survive, social services have been cut and the gap between the super-rich and middle class grew like it was on steroids. Why? We might wonder. The answer is straight forward. It’s that trickle-down theory again.

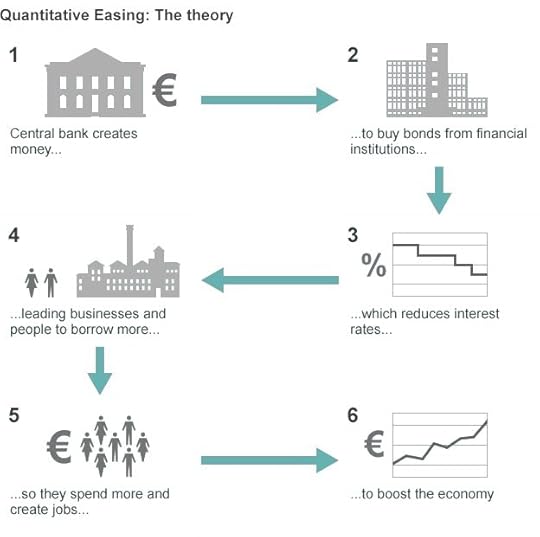

You see, the central banks decided that if they printed more money, $3.7 trillion in the US and £445 billion in the UK, and used that money to buy back bonds from the rich, then the rich would invest and spend this money and this would stimulate the economy and stop a crash like in the 1920’s. They called it ‘quantitative easing’ instead of trickle-down, but it’s essentially the same thing. And the results were the same. The rich got richer and bought more assets and the middle classes got poorer and had to borrow more money from the rich to simply stay afloat. Here’s a nice image courtesy of the BBC to illustrate the quantitative easing theory and it looks suspiciously like trickle-down economics. Thank you Gordon Brown, the Labour politician who made all this possible and ‘saved’ the world.

Courtesy BBC

This theory didn’t really pan out well. Austerity happened for most of the population and wealth inequality increased.

We know that 70% of the economy is being driven by consumer spending. If the goal was to boost the economy (picture #6), then surely stimulating consumer spending should have been the objective. Seems to me, the rational thing to have done, would have been to stimulate spending by consumers, trickle-up economics.

But, what would have happened had trickle-up been the route taken instead of trickle-down? People would have spent more money; government tax revenues would have been up; jobs would have been created; government services would not have been cut and austerity would have been avoided.

Let’s play with the exact same amount of money that the governments spent on quantitative easing so that we have a fair comparison and see what would have happened. Like-for-like spending. That’s £445 billion in the UK and $3.7 trillion in the US.

First, how could the government have motivated people to spend more? Here’s an idea. Total UK consumer debt today, including student loans, is £428 billion in the UK and $4 trillion in the US. The governments could have used that same quantitative easing money and paid off the ENTIRE country’s consumer debt, student loans, credit cards, auto loans and personal loans. Just imagine, no more debt. Without going back into debt, consumers would have had more money to spend, simply because they wouldn’t have been making loan repayments. I reckon that would have put a smile on many people’s faces and they would have been out there spending — boosting the economy. Wow. I can imagine that that would have kick-started some serious consumer spending. The opposite of austerity would have happened.

And where would that quantitative easing money have gone? To the retail banks, the ones that lend money to real people and real businesses. The retail banks would have had money in the till. They could then have started lending money to businesses that would then have had money to expand and invest in the future.

Using the images in the trickle-down theory, let’s look at it in reverse.

Start at step 1, we need the money after all, but then let’s go to step 6 and work backwards to step 3. We’ll skip step 2, as I’ll explain.

6) Consumer spending would have boosted the economy

5) This would have created more jobs and enticed businesses to expand and invest more

4) Lending to businesses would have increased

3) Interest rates could have gone down, if they even needed to, as banks would have been flush

The only thing missing is step 2, ‘buy bonds from financial institutions’, i.e. buying bonds from investment banks — in other words, buying bonds from the financiers who created the crisis in the first place.

What would not buying the bonds have meant? Some investment banks would have gone tits up and the financiers wouldn’t have had the taxpayers picking up their gambling tab. And, of course, they wouldn’t have been able to keep on gambling so easily. As well as this, the widening gap between the super-rich and the middle-classes would have slowed down. Result. I doubt many of us would have been shedding a tear for the financiers.

Hmm, trickle-up economics sounds pretty good. Wish we’d done that, so we didn’t end up with this.

Trickle-down economics simply does not work. You can only have so many Ferraris, masseuses, personal trainers, houses, gardeners and yachts. After that, the extra money is used to buy the world’s assets. It does NOT trickle-down. It gushes up into a few people’s pockets.

Trickle-down does the opposite of what it says on the tin. It reduces investment and consumer spending — it actually hurts the economy. As Billionaire investor, Nick Hanauer pointed out in his controversial TED talk, ‘Businesses and the rich do not create jobs. Jobs are created by a feedback loop between customers and businesses that is set in motion by consumers increasing their demand.’[i]

You have to wonder how people come up with such obviously lame ideas like trickle-down. Perhaps they know it is a bad idea, but they just need a justification for taking more. Just a thought.

You know what the financiers would have been saying to an idea like this? It would be, ‘this is socialist and we’d be rewarding people for getting into debt’.

What the financiers are really trying to say is that taxpayers paying off the financiers’ gambling debts, the debts that got them their toys and almost brought down the financial system, is fine. It’s capitalism. Yet, taxpayers paying off all of a country’s loans in one go — student loans, credit cards and payday loans, but not yacht loans, I might add — so they can boost the economy, is presented as socialist. That’s nuts. Millions of people would have disposable income and breathe a sigh of relief.

The financier gamblers were the ones who were rewarded for bad behaviour. Perhaps we should have let them fail and lose their beach houses.

Austerity is the result of trickle-down economics and financiers. We must sort this out, as financial inequality is a threat to democracy and capitalism.

Page 100 Read more

[i] https://en.wikipedia.org/wiki/Nick_Hanauer

The post Austerity or trickle up - time to choose appeared first on come the evolution.