The #1 Most Important Marketing Strategy for Financial Advisors

Some things never change. In marketing, we hear a lot about social media, YouTube, Instagram, and Facebook ads. Marketing companies may try to sell you on fancy marketing funnels or new secrets. But really, how do we know what’s the most important marketing strategy for financial advisors?

The reality is that marketing hasn’t changed much in the last few decades.

The #1 most important marketing strategy for financial advisors is staying in front of your network with content marketing sent by email.

It’s that combination that outperforms other strategies every single time.

What I mean by that is regularly communicating to:

Remind people what you do

Explain who you serve and the problems you solve

Stay top-of-mind so people turn to you with their questions

Share valuable, relevant information with your target market

Be the “go-to” expert in the area you serve

You can accomplish this in a variety of ways, but the most common platform is a blog post that is shared by email and social media—just like this blog post that you’re reading, which was likely sent to you via email or found on social media.

If you’re not regularly staying in front of your clients, network, and referral partners with your own content, I can guarantee you’re missing out on referrals.

It is an old-school marketing technique. But even with the rise of social media and other digital marketing tools, content marketing still reigns supreme. The proof is in the statistics.

Here are 9 reasons why every digital marketing expert (including myself) swears by content and email marketing as the most important marketing strategy.

1. Email Outperforms Social Media Every Time

Engagement rates for social media are shockingly low compared to email. Facebook, Instagram, and Twitter have an overall engagement rate of 0.58%, while emails have a 22.86% open rate and a 3.71% click-through rate. (1)

These statistics show us that someone is 6x more likely to click a link in an email than they are in a social media post. Why? Because emails get delivered directly to your prospect’s inbox. It’s kind of like showing up in their virtual living room.

When they open an email from you, you have their undivided attention. They don’t have to fight through social media algorithms, ads, and other noise to hear what you’re trying to say.

The takeaway? An intentional, relevant email means more to your prospects and clients than a social media post they will more than likely never see.

2. Email Marketing Has An ROI Of Up To 440%

No—that’s not a typo. Studies show that for every dollar you spend on custom email marketing, you can expect to see a return of up to $44. (2)

Despite all the financial advisor digital marketing tools cropping up today, email marketing is still one of the biggest drivers of revenue—and it will be for years to come.

3. Everyone Uses Email

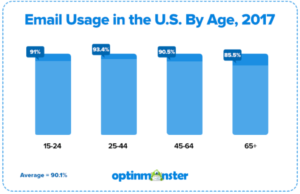

In today’s digital age, it’s nearly impossible to find someone that doesn’t have an email address. Over 90% of people aged 15 and older use email on a regular basis. Of those 90%, 99% check their email at least once a day, while some check their email as much as 20 times a day.

As you can see from the graph below, nearly every age group sends and receives emails—even retirees over age 65. No matter what age group your financial advisory firm is targeting, you can rest assured that they’re using email.

Source:

OptinMonster

Source:

OptinMonster

4. You Can Instantly Measure Email Performance

With most digital marketing tools—like ad campaigns and webinars—you have to let time pass before you can measure progress. But not with email marketing.

Email marketing is one of the only tools that lets you gauge your performance in real time. That means you can kick off a financial advisor email marketing campaign and immediately track key factors such as:

Open rate (how many people opened your email)

Click-through rate (how many people clicked on a link in your email)

Delivery rate (how many emails were successfully delivered to your subscribers)

Bounce rate (how many emails failed to be delivered)

Email sharing (how many recipients forwarded your email to their friends or shared it on social media)

Unsubscribes (how many people opted out of future emails)

All this data shines a light on what’s working for your campaign now, so you can improve future campaigns. For example, a high open rate may show that your prospects really like your subject line. But a low click-through rate may mean you need to adjust your call to action.

Most email marketing engines have A/B split testing tools, which let you try out various subject lines, calls to action, images, and more to see what your prospects like and don’t like.

If you’re looking for an email marketing engine, I recommend Mailchimp along with six other financial advisor technology tools for 2020.

5. Companies With Blogs Generate 67% More Leads

Especially in a locked-down society, blogging is the new networking. Sharing original blog posts allows you to start conversations and inform your network on important issues. Blogs are a great way to showcase your services to clients and prospects, establish yourself as an industry leader, and improve your online presence. All these factors help you generate more leads. In fact, studies show that businesses who actively blog generate 67% more leads than those who don’t. (3)

6. Blogs Boost Your SEO

Every financial advisor wants their firm to rank on the first page of Google. It’s how clients find you. It’s how you get more traffic to your website. But how do you get there? Search engine-optimized blog posts are one way to make that happen.

Google loves websites that are regularly updated with relevant content. So if you’re really trying to win the Google battle for keywords like “financial planning for medical device reps,” creating content on related subjects each week can catapult you to the top of the list.

If you’re looking for more tips on how to boost SEO, check out How to Improve Your SEO for Financial Advisors.

7. Blogs Are Evergreen

Ads go away the moment you stop paying for them. But blogs stick around forever and show up in search results. With custom blog posts, your prospects and clients will still find your words helpful five years from now.

Plus, blogs are a tried-and-true way of increasing website traffic. Studies show that one in 10 blog posts compound over time—meaning traffic increases as the post ages. Over time, these compounding blog posts can account for as much as 38% of your financial advisory firm’s website traffic. (4)

8. Blogs & Emails Keep You Top-Of-Mind

Did you know that the average time between when someone becomes aware of you and when they actually become a client is a full year? It takes a long time to build trust and create rapport with prospects online.

But blogging on a regular basis can speed up this process. It establishes you as an industry expert and keeps you top-of-mind. The next time a client or prospect has a question, they’ll be more likely to reach out to you (or your blog) for an answer.

9. Blogs & Emails Work For Every Stage Of The Sales Funnel

The moment someone hears of your financial advisory firm, they become part of your sales funnel. Whether someone is in the awareness stage, the interest stage, or the decision stage, you can use blogs and emails to nudge them through the buyer’s journey and speed up the process.

Here’s a breakdown of how your content may vary by stage:

Awareness stage (This is the introductory stage where you explain to prospects who you are and what you do.)

Interest stage (Now that your prospects are aware of your financial advisory firm, you can drive home what makes your firm unique.)

Decision stage (This is where you offer complimentary consultations, free reports, or anything else that will call them to action.)

The Most Important Marketing Strategy Bottom Line

Content marketing and email marketing are the two most powerful tools every financial advisor should invest in to attract quality clients and increase their AUMs. The key is to create a personalized message that resonates with your prospects and keeps you top-of-mind. So ignore all the noise about social media, and focus on these tools as the most important marketing strategy for financial advisors.

If you’re looking to boost your digital marketing game this year, I invite you to check out our webinar, The Truth About Marketing for Financial Advisors. In this webinar we break down the only two ways advisors really get new clients, how much you should budget for marketing, and more.

__________________

(1) https://optinmonster.com/is-email-marketing-dead-heres-what-the-statistics-show/

(2) https://www.campaignmonitor.com/company/annual-report/2016/

(3) https://www.stateofinbound.com/?__hstc=20629287.6b54d625a84dc9939482923b8f3a14d5.1472206093678.1490182003805.1490213202871.5&__hssc=20629287.2.1490213202871&__hsfp=2010045186

(4) https://blog.hubspot.com/marketing/compounding-blog-posts-what-they-are-and-why-they-matter

The post The #1 Most Important Marketing Strategy for Financial Advisors appeared first on Indigo Marketing Agency.