Business Cube updated by InterTrade Ireland – SeedCorn Competition 2019

I have said for years that the best investor ready business plan preparation guide is the Business Cube Methodology published by InterTrade Ireland the organisors of the SeedCorn Investor Readiness Competition. So I was delighted to see that a modernised edition, now referred to as Business Cube, has been published in 2019. It is a free guide and I trust that SeedCorn won’t mind that I am making it available to download here.

Download InterTrade Ireland’s Business Cube – Updated 2019

A business planning tool – Business Cube

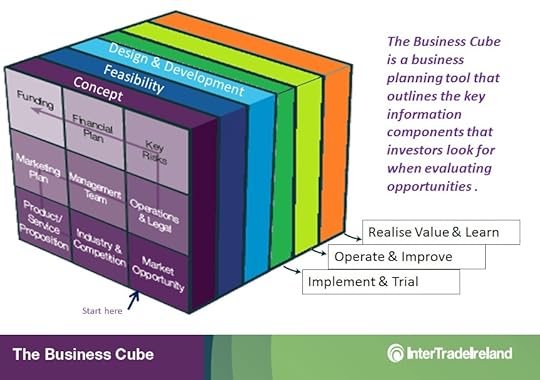

The Business Cube lists 9 factors starting with Customers & Market Opportunity throught to financial plan and funding (see list below) with each one evolving within 6 stages of the business startup journey from concept to feasibilty to market launch and growth. It is at this final (orange) stage referred to as ‘Realise Value & Learn’ that seed VCs investors in Ireland will take an interest – what Lean Startup would refer to as ‘Product-Market’ fit.

1. Customers, Market Opportunity & Traction

2. Product or Service Proposition

3. Industry & Competition

4. Strategic Fit, Business Model & Marketing Plan to include Route to Market

5. Management Team, Key Hires & Advisors

6. Financials & Funding

7. Operations & Legal to include Intellectual Property

8. Risks & Constraints

9. Financial Plan & Funding (Investment Required, Use of Funds & Exit Strategy) – Implementation

The Business Cube emphasises that business plans are to be updated as part of the business planning process with a focus on demonstrating to investors that business results can be achieved – customer, products, market, marketing, building a team and achieving appropriate financial metrics. The headings above form the generic template for a business plan.

Seedcorn Business Plan Pointers

Having had the priviledge of being involved with SeedCorn for the last 3 years, and having written a few business plans in my time, here are 6 key tips for making the Regional shortlist in 2020…

A. Get the story and business message across

The story or message of the business is that there is an identified problem and that a brilliant solution has been developed with a defined beach head customer base. It is important to show traction by listing strategic customers very early in the plan.

B. Present the case for investment

The financial forecasts are a critical part of the plan. Consideration should be given as to how each piece of information in the plan affects

the plausibility of the forecasts. p.4 Business Cube.

The company must clearly state how much investment is required and what the funds will be spent on. Comprehensive financial projections need to be presented being 3 year cashflow, P&L and Balance Sheets and ideally target revenue in 5 and 10 years with a concise summary in the Executive Summary. The metrics need to be right i.e. the business must show a need for the investment and also a growth trajectory such that the investment provides a solid return in the form of net profit margins.

C. Quantify the market

Secondary research must support the story outlined in the business plan. The market opportunity must be properly quantified by reference to research reports such as those by Frost & Sullivan or Gartner. Many business plans feature DIY calculations of the value of a market based on potential customer numbers by price of the good or service. Personally I reject this methodology as it doesn’t quantify true demand. Another trap is to list Facts and figures that may sound good but again are not evidence of demand. At the same time idnetifying trends is important as they can answer the important question of ‘why now?’ for the investor.

D. Route to Market

Presenting a strong route to market is a great sign of traction. Make sure the financials work for these partners. This will frame the Marketing plan which will form basis of a customer acquistion strategy – always great to show a strong sales pipeline as it reduces the risk for investors.

E. Team

A strong team with functional, technical and interpersonal skills is required with strong domain knowledge and experience. It is important to list Advisors and have a plan for recruitment as the business grows. Outsourced partners who provide key resources are important elements of the team.

F. Exit Strategy

An Exit Strategy is an important element of a business plan for investors to signify the commitment of the promoters to ensuring that a return is generated on the investment.

Overall, the reader is looking for a consistency and logic between each section of the business plan and particularly that everything fits within the numbers. As the Busines Cubes states, ‘a considerable amount of information is required in a business plan‘ so it is important to balance the requirement to be concise with that of being comprehensive and persuasive.

Finally, it is easy to write a super business plan for a brilliant business so focus more on making a brilliant business than creating the perfect document – spend time with customers, working on the Techology or Secret Sauce of your business, building the right Team and making the financial model work. The business plan document can easily follow!

24 Seedcorn Regional Finalists 2019

Congratulations to the businesses selected as Regional Finalists in 2019.

CONNACHT & LEINSTER – NEW START

CONNACHT & LEINSTER – EARLY STAGE

Trust Vet, Atlantic Photonic Solutions,

SealSpear

Venari Medical, FeelTect, NUA Medical

DUBLIN – NEW START

DUBLIN – EARLY STAGE

Thriftify, Organise Media,

My Live Medical

Senoptica Technologies, Head Diagnostics,

Output Sports

MUNSTER – NEW START

MUNSTER – EARLY STAGE

Micanotech, Ezi Vein, Miura RegTech

Pinpoint Innovations, AudioSourcRE,

Bilberry Innovations T/a Mobimetrix

NORTHERN IRELAND – NEW START

NORTHERN IRELAND – EARLY STAGE

Osteoblast, Trussbuddy, IIMAGene

Waterworx Robotics, Jetpack Learning,

Reynold Sports

Update November 2019 via Silicon Republic – Limerick start-up Tracworx wins top prize of €100,000 at Seedcorn 2019

As always I hope that you found this blogpost useful. Comments and social shares welcome.

Best regards

donncha (@donnchadhh on twitter)

p.s if you have a really excellent business and want a brilliantly written business plan because you need investment but don’t have the time or skills to write it yourself, feel free to send me an email to arrange a chat.

NEW FOR 2020 – Writing your Business Plan Online Training

A 150 minute video based online training programme that shows you how to write your business plan. Includes a business plan template, sample business business plan, template for 2 page investor brief and videos which break down each section of the business plan. See full blogpost to watch the promo video and then check out the free preview.

A 150 minute video based online training programme that shows you how to write your business plan. Includes a business plan template, sample business business plan, template for 2 page investor brief and videos which break down each section of the business plan. See full blogpost to watch the promo video and then check out the free preview.

Related PostsA view of crowdfunding in Ireland (2014) (Apr 19, 2014)

I don't claim to be an expert on Crowdfunding but I am lucky enough to know Olive O'Connor, a ...

Please support MediStori’s Crowdfunding Campaign (Apr 7, 2014)

Today, I made a modest financial contribution as part of a Crowdfunding campaign to MediStori and I ...

Six key tips for tendering (Apr 30, 2011)

I was talking last week about what makes a good tender and how a start up company should approach ...

The post Business Cube updated by InterTrade Ireland – SeedCorn Competition 2019 appeared first on Donncha Hughes, Business Trainer, Advisor & Mentor. Thanks for signing up to my feed regards donncha p.s why not also check out my other website www.startupwebtraining.com

Blog of Donncha Hughes

- Donncha Hughes's profile

- 4 followers