Need a Checking Account With NO Fees, Minimums, or ATM Charges EVER? Try These.

It’s been over 4 years since I first professed my love for the Fidelity Cash Management account – one of the best no fee checking accounts. And about the same amount of time since I wrote about the Aspiration Summit account.

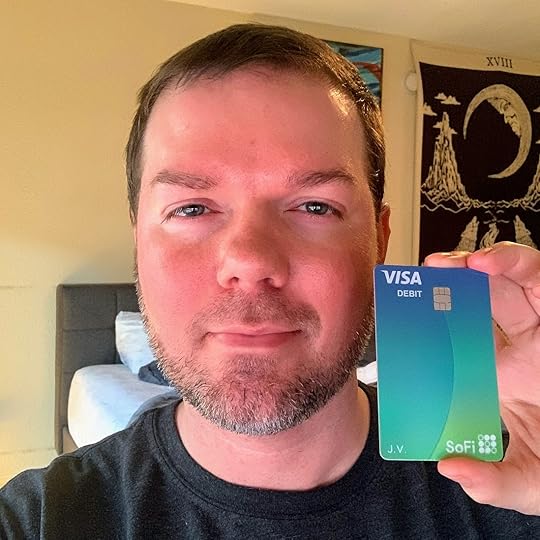

But that was before SoFi Money came on the scene. That account has no fees – but also free unlimited ATM withdrawals worldwide AND 1.6% APY on any balance you carry. It’s now the one I recommend most if you’re looking to dump your brick-and-mortar bank (and you probably should).

There’s a new sheriff in town, and it’s SoFI Money

All are fantastic checking account options because there are no fees, no minimum balances, and no direct deposit requirements. Essentially they’re free to open and keep forever, even if you never use them. Even better, these accounts reimburse ATM fees from ANY ATM in the world. And there are no hard credit pulls to open.

There are a couple of key differences. But, bottom line, you should have at least one of these accounts!

Best no fee checking accounts

1. SoFi Money

Link: Open a SoFi Money account and get $50

This one is new to the list – it launched in 2019. And if you only get one of these accounts, open this one because you get:

Unlimited, instant ATM reimbursements worldwide allowing you to use any ATM that accepts Visa – an amazing perk for travelers

1.6% APY on your balance – comparable to many high-interest savings accounts

No fees, no minimums

Sub-accounts to save for your goals, and joint accounts for your S.O.

Blazing fast sign-up – I had an account open in 2 to 3 minutes

$50 bonus when you open an account with $100+ – and it posts within a day or two

It’s basically a traveler’s dream checking account. And the $50 bonus when you open it is one of the easiest to earn. Just open and fund it and your bonus appears within a day or two. Easiest money I ever made!

King of free checking accounts and perfect for traveling

I really can’t say enough good things about this checking account. It’s simple to use, travels well, and is even good enough to be your main checking account. Plus it’s the only one that earns interest on your balance.

Here’s my full SoFi Money review.

2. Fidelity Cash Management Account

Link: Open a Fidelity Cash Management account

This was my go-to for a long time. You can use it anywhere without ATM fees. When you withdraw from a fee-bearing ATM, the fee is reimbursed the same day the charge clears your account.

Boom #donewiththose

It’s also an amazing tool for overseas travel. I transfer some cash into this account a few days before a trip. In the past, I’ve paid nasty interchange charges each time I’ve needed to access my cash. With this card, there is a 1% fee built-in by Visa but there are no additional fees. I don’t mind the 1% because it’s $1 per $100 – which is a small price, in my opinion, for all the convenience I get from this account. I love it.

I also used this account for my Airbnb business as a de facto business checking account. I let the balance build every month. Then paid the rents and bills. And transferred the rest to pay down my student loans. Rinse and repeat each month.

It’s an easy way to keep all that separate from my (other) main Chase checking account – which I wouldn’t recommend these days. I got it forever ago and don’t pay fees to have it. If I did though, I’d have zero issue dumping it for this account. Now, I like how it keeps things apart per the envelope method.

What to know before you get a Schwab checking account

The inevitable question is, “How does it compare to the Schwab Bank High Yield Investor Checking Account?”

They’re essentially the same. BUT:

Schwab uses a hard pull when you open their account

Fidelity uses a soft pull

Schwab requires you to open an investment account, although you do NOT have to use it – ever – if you don’t want to

Fidelity doesn’t require any other accounts

AND:

Both have no fees

Both reimburse all ATM fees (yes, worldwide)

Both have free bill pay

Both are great if you invest with the respective firms

I didn’t want the hard pull or an account I’d never use. Between them, the Fidelity account was better for me. And I’ve just stuck with it.

Here’s my full Fidelity Cash Management account review.

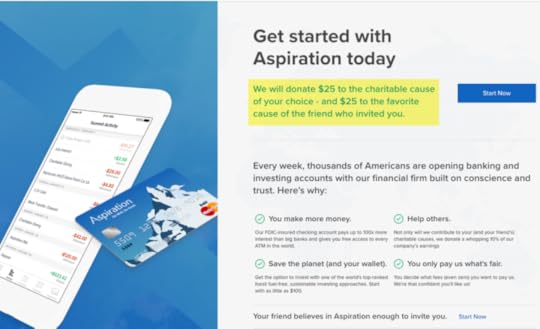

3. Aspiration Summit

Link: Open an Aspiration Summit account

So this account has several of the same features as the Fidelity account. And, it has a savings component.

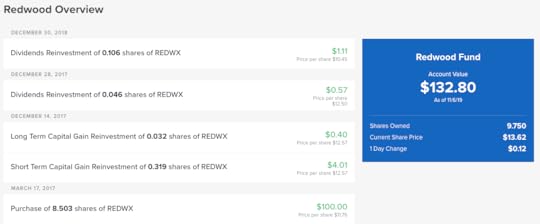

I also bought $100 of stock in Aspiration’s Redwood Fund just to see how it would perform

When you direct deposit at least $1,000 in the account each month or have $10,000+ saved, you’ll earn 1% interest on the balance, which compounds monthly. So if you’re interested in saving too, this is a great account for an emergency fund. But be aware, you can get much better rates elsewhere and without the requirements. It’s really only good for the free ATM withdrawals.

Get $25 to donate to charity – and I’ll get $25 to donate, too

You’ll also get $25 to donate to charity when you sign-up.

There are no fees, no minimums, and no requirements to keep the account free. But there’s one important difference in how ATM fees are reimbursed: it happens when your monthly statement closes instead of when the charge clears, like you get with SoFi or Fidelity. And you’re limited to 5 withdrawals per month. If you withdraw sporadically, this shouldn’t be an issue, though.

If you’re interested in a no-fee checking account with global ATM access, this one is another contender. Especially because they’re committed to helping and protecting the environment with their profits.

Here’s my full Aspiration checking account review.

Which one is best for you?

Definitely SoFi Money because you earn a little interest on your balance and ATM reimbursements are instant. By far, this one will serve the needs of most peeps just fine. Plus, the app and user experience is top-notch.

Although I personally like Fidelity for being able to link my IRA accounts. And an edge to Aspiration Summit for its versatility as a savings account and commitment to the planet. Net-net, all are excellent options.

I’d go with the Fidelity account if you:

Already have other Fidelity accounts

Want your ATM rebates back within a day or two

Have a Fidelity Visa

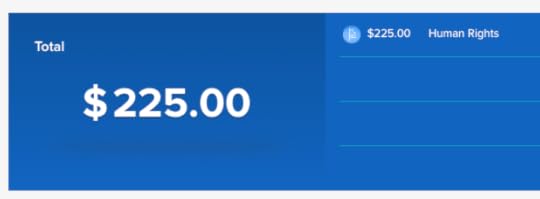

I’ve donated $225 to human rights so far because of Out and Out readers!

And recommend the Aspiration Summit account if you:

Don’t mind waiting for the ATM fee reimbursement

Like the charitable giving option

Like what the company stands for

All these accounts a stellar choice for completely free banking. I’ve used them all extensively and never had an issue. So I recommend them wholeheartedly.

And if you are paying fees to have a checking account, to keep a minimum balance, or to access your money… stop that immediately! There’s no need to pay anything.

Bottom line

Link: Open a SoFi Money account and get $50

Link: Open a Fidelity Cash Management account

Link: Open an Aspiration Summit account and get $25

I know we get caught up on credit cards in this hobby of ours. But we all need checking accounts to make our payments. There’s simply no need to pay fees to have your money in an account or to access it – no matter where you are in the world.

I’ve withdrawn cash from my Fidelity account in Ireland, Japan, Germany, Chile… and occasionally withdrawn money when I couldn’t use a credit card.

I can personally vouch for it. Although with SoFi Money on the scene, there’s a new show in town – and it’s now the best no fee checking account option.

It mainly comes down to how quickly you want your ATM fees reimbursed. And if you want a hybrid savings option.

Even if you already have a checking account you like, consider the envelope method – all are great free options for this.

Even if you only use them for international ATM withdrawals, that’s reason enough.

So now I’m curious – what’s your favorite checking account? Are there any better than these?