The yield curve inverted and some investors are scared. I never thought I'd ignore an inverted curve, but think about this. Interest rates increase before inverting and signaling a recession. Interest rates are at historic LOWS and do not curtail borrowing.

Look at these graphs from StockCharts.com. The curve inverted at a much higher rate before the stock market decline in 2000.

And again before the recession of 2007:

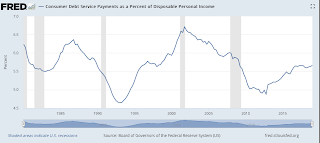

Neither the consumer nor corporations have trouble borrowing at these low rates.

The consumer will continue to drive this economy and stock market to new highs.

Buy Timing the Market at Amazon.com

Published on August 16, 2019 12:50