Ebook Publishing Infographic Analysis

Here's another nice infographic put together by The Content Wrangler sizing up the current state of the ebook industry, based on the latest detailed survey of publishing professionals done by Aptara. This is the third annual survey, and it points out a number of enormous changes that have occurred over the past few years.

Foremost among them is the statistic given in the upper right of the infographic, showing that 62% of all publishers are now producing ebooks. Among trade publishers (i.e. non-corporate or educational), that number is 76%, with another 19% saying they have plans in place to begin ebook production. In the first Aptara survey of 2009 just 50% of trade publishers were producing digital editions. Only 6% now say they have no plans to do so.

Question 4: What is your organization's current involvement with eBooks?

Other highlights of the latest survey are that nearly one in five (18%) of eBook publishers generate more than 10% of their revenue from digital editions, although three times that many (57%) pull in less than 3% from eBooks, with 14% of publishers producing eBooks making nothing from their efforts thus far. This is a "strong statistic for an early-stage market" according to the survey findings, and shows that there is still a lot of room for growth.

Another interesting tidbit is that 10% of publishers intend to produce eBooks instead of print, while 85% plan to do both. Meanwhile, 37% now produce more than three-fourths of their titles as eBooks, with 32% converting less than one fourth of their output to digital. One stat not shown on the infographic is that two out of three publishers have yet to convert the majority of their backlist into eBooks, meaning there are a lot of older titles out there still waiting to be released as eBooks.

Amazon still holds the lion's share of the eBook market, but that share is shrinking as publishers begin to sell from their own e-commerce sites.

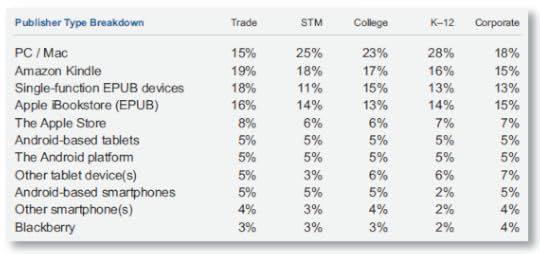

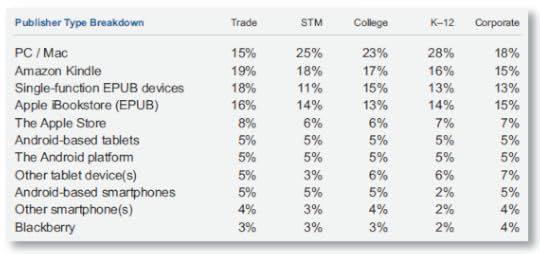

Question 8: What devices/platforms are you targeting with your eBooks?

Another interesting factoid is the battle between the Kindle format and ePub, with the latter emerging rapidly as a dominant target for eBook producers in the very near future. The chart above shows the devices and platforms eBook publishers are targeting, with the Kindle getting only 19% of the Trade market's focus while ePub makes up 34% (between the combined iBookstore and single-function devices capable of reading that format), making ePub the most heavily targeted platform. In other words, eBook publishers are looking to separate themselves from Amazon's proprietary platform, even though current sales don't justify it (see next chart below), and few (only 25%) have any strategy for moving to the ePub format. Meanwhile, the Android platform is too highly fragmented to be effective, and Blackberry has lost more ground than it is ever likely to make up, being all but out of the race at this point.

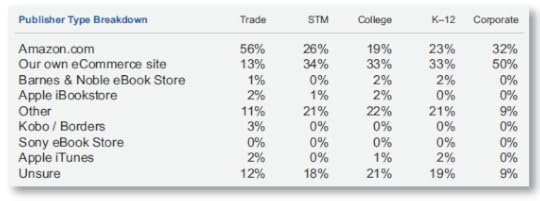

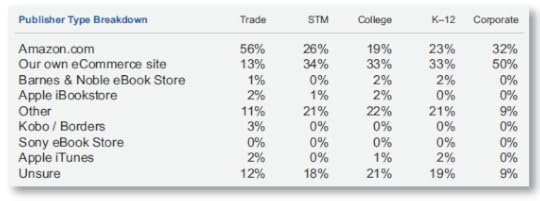

Question 10: Which channel produces the largest percentage of your eBook sales?

Overall Amazon produces 38% of eBook sales, but as you can see in the chart above, they account for 56% of Trade sales, compared to the next closest at 13% (a 43% margin), that second place being taken by a combined total of all individual publisher eCommerce sites as compared to Amazon alone (that's why they're called "Amazon"). Internal corporate sales are what have skewed the figure away from Amazon in the overall picture, which is why I'm posting up this additional breakdown, since Trade sales are what are really relevant to the average consumer and independent author. The educational and professional categories also cause a lot of wobble in the figures, since STM (Science, Technical & Medical) and College/K-12 text sales are generally derived from direct distribution via sales reps and conferences, as shown in the considerably higher percentages allotted to the "Other" and "Unsure" categories in these markets.

The big shocker here is how poorly Barnes & Noble are faring in the eBook battle, with a mere 1% of digital sales both overall and in Trade books alone. Given the fact that they have both brick-and-mortar outlets as well as a line of dedicated eReaders with their own integrated online bookstore, this is an appallingly bad showing. Even Apple have done better with a combined 3% share overall and 4% in Trade between iTunes and the iBookstore. Meanwhile, Sony has lost all traction as a source of digital literature whatsoever, with no reported sales at all!

However, I have to say that I'm a bit surprised at the number of publishers who are "Unsure" as to the source of their revenue. This is either a function of the somewhat poorly reported eBook sales stats, and/or the publishers' own uncertainty as to where their digital sales are coming from due to the lack of a well-developed internal eBook accounting infrastructure. This has been a problem for some time, although there is improvement in reporting, with Amazon in particular being fairly transparent to publishers about their eBook sales. 11% for "Other" is also a pretty substantial segment, since there aren't very many significant "others" at play aside from Google, who continue to surprise me by not meriting their own breakdown (are they really faring that poorly?). Most of the "Other" category is likely made up of aggregators such as Smashwords who have their own storefronts as well as distributing to other channels.

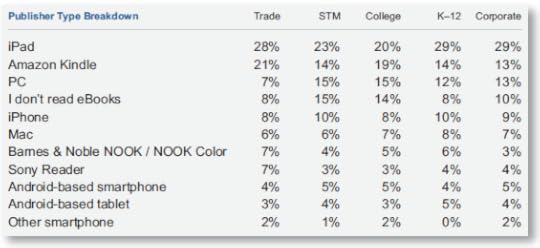

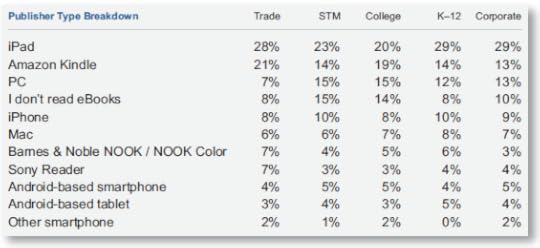

Question 20: Which of the following devices do you personally use to read eBooks?

Finally, while the views of traditional publishers as to their favored eReading device are far less relevant that that of actual eBook consumers, it is telling that the multimedia iPad is the preferred eReader over the dedicated Kindle device, even though most consumers say just the opposite, and as sales of the two eBook formats clearly show (mind you, the Kindle Fire was not yet out when the survey was taken). That an equal number of publishers prefer to read on a PC/Mac as they do a Kindle is highly questionable, and goes more to show their reluctance to support Amazon by claiming to like their device (even though there would be no eBook market without it). The breakdown above again shows that it is the non-Trade segments who are skewing these figures the most, which makes sense as a lot of professional and academic research is still done on personal computers rather than on personal reading devices.

However, the most relevant statistic is in the number of respondents who don't read eBooks at all. In the first Aptara survey of 2009 22% said they had never read an eBook, while two years later that number is down by half to 11% overall, and just 8% among Trade professionals, showing how fully the digital revolution has been embraced (or at least accepted). The final summation of the survey states the case quite clearly:

Click the image below for a high-rez version.

Foremost among them is the statistic given in the upper right of the infographic, showing that 62% of all publishers are now producing ebooks. Among trade publishers (i.e. non-corporate or educational), that number is 76%, with another 19% saying they have plans in place to begin ebook production. In the first Aptara survey of 2009 just 50% of trade publishers were producing digital editions. Only 6% now say they have no plans to do so.

Question 4: What is your organization's current involvement with eBooks?

Other highlights of the latest survey are that nearly one in five (18%) of eBook publishers generate more than 10% of their revenue from digital editions, although three times that many (57%) pull in less than 3% from eBooks, with 14% of publishers producing eBooks making nothing from their efforts thus far. This is a "strong statistic for an early-stage market" according to the survey findings, and shows that there is still a lot of room for growth.

Another interesting tidbit is that 10% of publishers intend to produce eBooks instead of print, while 85% plan to do both. Meanwhile, 37% now produce more than three-fourths of their titles as eBooks, with 32% converting less than one fourth of their output to digital. One stat not shown on the infographic is that two out of three publishers have yet to convert the majority of their backlist into eBooks, meaning there are a lot of older titles out there still waiting to be released as eBooks.

Amazon still holds the lion's share of the eBook market, but that share is shrinking as publishers begin to sell from their own e-commerce sites.

Question 8: What devices/platforms are you targeting with your eBooks?

Another interesting factoid is the battle between the Kindle format and ePub, with the latter emerging rapidly as a dominant target for eBook producers in the very near future. The chart above shows the devices and platforms eBook publishers are targeting, with the Kindle getting only 19% of the Trade market's focus while ePub makes up 34% (between the combined iBookstore and single-function devices capable of reading that format), making ePub the most heavily targeted platform. In other words, eBook publishers are looking to separate themselves from Amazon's proprietary platform, even though current sales don't justify it (see next chart below), and few (only 25%) have any strategy for moving to the ePub format. Meanwhile, the Android platform is too highly fragmented to be effective, and Blackberry has lost more ground than it is ever likely to make up, being all but out of the race at this point.

Question 10: Which channel produces the largest percentage of your eBook sales?

Overall Amazon produces 38% of eBook sales, but as you can see in the chart above, they account for 56% of Trade sales, compared to the next closest at 13% (a 43% margin), that second place being taken by a combined total of all individual publisher eCommerce sites as compared to Amazon alone (that's why they're called "Amazon"). Internal corporate sales are what have skewed the figure away from Amazon in the overall picture, which is why I'm posting up this additional breakdown, since Trade sales are what are really relevant to the average consumer and independent author. The educational and professional categories also cause a lot of wobble in the figures, since STM (Science, Technical & Medical) and College/K-12 text sales are generally derived from direct distribution via sales reps and conferences, as shown in the considerably higher percentages allotted to the "Other" and "Unsure" categories in these markets.

The big shocker here is how poorly Barnes & Noble are faring in the eBook battle, with a mere 1% of digital sales both overall and in Trade books alone. Given the fact that they have both brick-and-mortar outlets as well as a line of dedicated eReaders with their own integrated online bookstore, this is an appallingly bad showing. Even Apple have done better with a combined 3% share overall and 4% in Trade between iTunes and the iBookstore. Meanwhile, Sony has lost all traction as a source of digital literature whatsoever, with no reported sales at all!

However, I have to say that I'm a bit surprised at the number of publishers who are "Unsure" as to the source of their revenue. This is either a function of the somewhat poorly reported eBook sales stats, and/or the publishers' own uncertainty as to where their digital sales are coming from due to the lack of a well-developed internal eBook accounting infrastructure. This has been a problem for some time, although there is improvement in reporting, with Amazon in particular being fairly transparent to publishers about their eBook sales. 11% for "Other" is also a pretty substantial segment, since there aren't very many significant "others" at play aside from Google, who continue to surprise me by not meriting their own breakdown (are they really faring that poorly?). Most of the "Other" category is likely made up of aggregators such as Smashwords who have their own storefronts as well as distributing to other channels.

Question 20: Which of the following devices do you personally use to read eBooks?

Finally, while the views of traditional publishers as to their favored eReading device are far less relevant that that of actual eBook consumers, it is telling that the multimedia iPad is the preferred eReader over the dedicated Kindle device, even though most consumers say just the opposite, and as sales of the two eBook formats clearly show (mind you, the Kindle Fire was not yet out when the survey was taken). That an equal number of publishers prefer to read on a PC/Mac as they do a Kindle is highly questionable, and goes more to show their reluctance to support Amazon by claiming to like their device (even though there would be no eBook market without it). The breakdown above again shows that it is the non-Trade segments who are skewing these figures the most, which makes sense as a lot of professional and academic research is still done on personal computers rather than on personal reading devices.

However, the most relevant statistic is in the number of respondents who don't read eBooks at all. In the first Aptara survey of 2009 22% said they had never read an eBook, while two years later that number is down by half to 11% overall, and just 8% among Trade professionals, showing how fully the digital revolution has been embraced (or at least accepted). The final summation of the survey states the case quite clearly:

Publishers couldn't ask for a better position: the ground floor of an early-stage market experiencing exponential sales growth. The downside to being at the starting gate is the growing pains; the upside is the untapped revenue potential that lies ahead. Publishers still face distribution channel, quality, pricing, and DRM issues, but these concerns have gradually diminished over the past two years—a sign of an eBook market that is starting to mature.

Click the image below for a high-rez version.

Published on December 11, 2011 12:28

No comments have been added yet.