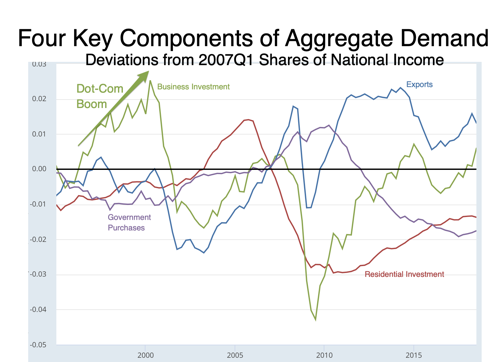

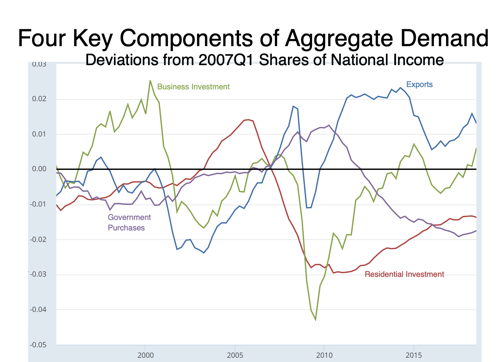

More than Two Decades of Macroeconomic History Through the Lens of Four Key Components of Aggregate Demand

It is remarkable the extent to which you can tell the story of the U.S. macroeconomy over the past twenty-five years through the reactions of four components of aggregate demand to policies and shocks:

The dot-com boom unleashed by the Clinton deficit-reduction program and high-tech innovation.

The dot-com bust.

The housing boom.

The successful rebalancing of aggregate demand���housing sits down, while exports and business investment stand up as money flows are successfully redirected.

The Fed well behind the financial-stability curve: the financial crisis and the collapse.

Inadequate recovery: The Geithner Treasury and the Obama White House's failure to do anything to promote a recovery of residential construction.

Inadequate recovery: Republican (and Obama) fiscal austerity.

Inadequate recovery: Bernanke's highly premature taper tantrum.

The Trump rebound.

Dot-Com Boom:

Dot-Com Bust:

Housing Boom:

Rebalancing Near Full Employment:

Financial Crisis and Crash:

Inadequate Recovery: Construction Stagnation:

Inadequate Recovery: Fiscal Austerity:

Inadequate Recovery: Bernanke's Taper Tantrum

Trump Rebound

#forecasting #macro #monetarypolicy #fiscalpolicy #highlighted

This File: https://www.bradford-delong.com/2019/06/recent-macroeconomic-history-through-the-lens-of-four-key-components-of-aggregate-demand.html

Edit This File: https://www.typepad.com/site/blogs/6a00e551f08003883400e551f080068834/post/6a00e551f0800388340240a4b440fa200b/edit

Forecasting: https://www.bradford-delong.com/forecasting.html

Monetary and Fiscal Policy and Theory https://www.bradford-delong.com/monetary-policy-and-theory.html

Published on June 16, 2019 07:15

No comments have been added yet.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers

J. Bradford DeLong isn't a Goodreads Author

(yet),

but they

do have a blog,

so here are some recent posts imported from

their feed.