The very sharp Mohamed A. El-Erian misses one important...

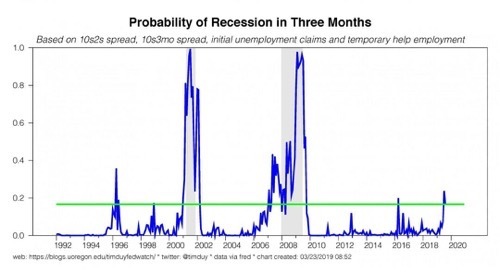

The very sharp Mohamed A. El-Erian misses one important thing here: almost always, recessions are much deeper than any naive computation of the size of the initial shock minus the sum of monetary and fiscal offset would predict. Why? Because businesses and investors are forward-looking, and take recession signals seriously. As Tim Duy says: everyone's "recession indicator... probability models... [are] raising red flags". It's a multiple-equiibrium thing. So while a recession in the next year is not certain and may not be probable it is not unlikely: Mohamed A. El-Erian: Inverted Yield Curve Doesn't Necessarily Mean Recession Is Nigh: "This rather benign economic outlook conflicts with the traditional signal of an inverted curve for four main reasons.... [1] Europe... puts downward pressure on U.S. yields.... [2] The Fed... a remarkable and rapid U-turn.... Other segments of the bond market are not signaling a major economic slowdown.... The erosion in inflationary expectations may... [be a] realization that many of the underlying drivers are structural.... This curve inversion is unlikely to be the traditional signal of a U.S. recession...

#noted #forecasting

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers