Get $200 Matched for Opening 2 Fidelity Accounts – Including My Fave Checking Account!

Also see:

Fidelity Cash Management Account: Why It’s Great

Need a Checking Account With NO Fees, Minimums, or ATM Charges EVER? Try These.

UPDATE: Dang, this offer is already dead as a doornail! That was fast!

I’ve written about why I love my Fidelity Cash Management account. There are no fees, no minimums, and ATM fees are reimbursed worldwide as soon as the charge posts. I recommend this account to friends. And have had mine for years now.

Here’s an easy win:

Open 2 Fidelity accounts through this link (a Cash Management account and a brokerage account)

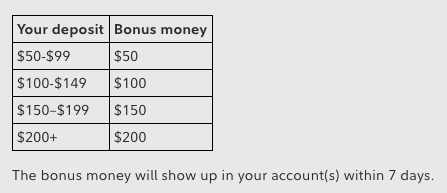

Deposit at least $200 into your accounts in any combination

Get $200 more dollars deposited free within 7 days

Easiest checking account bonus I’ve seen

If you’ve never had accounts with Fidelity, now is the perfect time to open a great free checking account and score $200 in the process.

And you can open any brokerage account – I recommend the IRA (it’s the one I use). They’re also free to open. And you don’t have to use them if you don’t want to.

Here’s a closer look at the offer – and one important “gotcha.”

Fidelity checking $200 bonus

Link: Open 2 Fidelity accounts, get $200 when you deposit $200

Thanks to the wonderful Doctor of Credit for posting about this deal (there’s a ton of useful information in the comments there).

As far as bonuses go, it doesn’t get simpler than this.

But there are a few things you should know about these Fidelity accounts.

For one, they impose low limits on new checking accounts for the first 30 days to reduce fraud. So whereas your mobile deposit limit might normally be in the $1,000s – it might be as low as $200 to $500 the first 30 days.

Also, when they show your account number, be sure to store it somewhere. They have a weird naming convention otherwise and it’s tricky to find that number again!

Finally, while ATM withdrawals are always free, you will have a 1% foreign transaction fee on purchases abroad. This shouldn’t matter because you should have a credit card without this fee and use that abroad to earn points. It comes to $1 per $100 spent, which isn’t much. However, lots of peeps get stuck on this as a “deal breaker.”

It’s there, and if it matters to you that much, don’t use it internationally. I hardly ever withdraw cash when I travel these daze and certainly don’t use debit card for purchases, so I couldn’t care less about this minor fee.

The big hitch

This is confusingly worded but… Fidelity wants you to keep a balance of at least $200 in your combined accounts for at least 9 months or they’ll claw back the bonus.

You need to keep funds in the account for 9 months!

If you open an IRA and put $200 in there, this shouldn’t matter… because you should leave that money in there for years and years. But for checking accounts, it might be best to mark your calendar for the 9-month mark before you withdraw your bonus. Or, if you use it for everyday checking, make sure to keep at least $200 in there at all times.

Easy peezy

The upshot is… open 2 accounts, add $200, get $200 within 7 days. Keep $200 in them for 9 months and you’re good to go.

It’s also a fantastic regular checking account. And a great place to start if you want to dump your bank.

What about the brokerage accounts?

Link: Best IRA Accounts: 8 Companies Compared (Self-Directed, Apps, & Roboadvisors)

To start, you don’t have to use the brokerage account. And it’s free to open.

But. If you do want to use it, know the regular brokerage account for everyday trading is fine. The fee is ~$5 per trade. And they have several no commission funds. I don’t trade stocks in this way, but you might. There are so many options out there, like Robinhood, which has free trades (including crypto). And so many others.

Many of Fidelity’s best funds have high minimums to invest

I believe nearly everyone should have an IRA account – and wrote about lots of options, including Fidelity. Lots of their funds have high minimums. Their Total Market index fund has a reasonable expense ratio of .09%, but a minimum of $2,500 to start investing.

Acorns, Stash, and even TD Ameritrade let you start investing with $1 to $5, depending on which you choose. If you really want to open an IRA, you can always open one of these in addition to Fidelity’s IRA, then roll it over once you reach Fidelity’s minimum.

Just something to note. And again, you do NOT have to use the account to get the $200 bonus, but simply need to open it.

Bottom line

Link: Fidelity $200 bonus offer

Even better, there’s only a soft pull to open these accounts.

I’m deep in the Fidelity ecosystem with the checking, IRA, and 2% cashback credit card products. They work great together – it’s easy to transfer money around your accounts once you have them open. And I’ve loved being a customer for years.

At any rate, this bonus is a great reminder that if you’re paying fees to access your money in a checking account, you should get a new one immediately.

This $200 deal is super simple – but the “gotcha” is you need to maintain a minimum balance for 9 months. I would 100% jump on this if I didn’t already have and use Fidelity products.

Will this new promotion be the kicker to get you over to Fidelity?