Why I’m Switching Spend to SPG Cards the Next 2 Months (And a Useful Tip!)

Welp, the Marriott-Starwood merger looms nigh. On August 1st, 2018, we’ll all wake up and have a new program – with excellent deals through the end of 2018.

Also on that day is an event I’ve dubbed in my mind as “The Triplin’” – because everyone’s Starwood balance will increase by 3X!

So now’s the time to earn as much as possible to take advantage of redemption opportunities later this year.

Marriott’s award chart as of August 1st

In 2019, the new program will be dead to me. I’ve never liked Marriott hotels, and occasionally stay with Starwood. At that point, I’ll go back into my Hilton/Hyatt hole for as long as the water’s nice.

Ah, to be a fairweather traveler free agent.

5 months of great deals – under 2 months to earn with SPG card spending!

Link: SPG program changes

I’m now done with the full spending requirement to earn 100,000 British Airways Avios points. And toyed with the idea of getting the Citi American Airlines small business card, which has an incredible sign-up bonus of 70,000 American Airlines miles after spending only $4,000 in the first 4 months from account opening.

This card isn’t impacted by Citi’s application rules if you’ve only opened AA personal cards.

Mighty tempting

But then I’m like… I should rack up the Starwood points while I can. If the Citi AA small biz offer is still around next month, I will 100% pull the trigger on it.

Starting now, I’m using my Starwood cards for all my spending.

Every $1 you spend in non-bonus categories will turn into 3 points on August 1st, 2018. I currently have 40,000 Starwood points. And typically spend ~$10,000 per month on credit cards.

With the 40,000 points I have, plus 20,000 more points I could earn, I’d have 180,000 Marriott points on the first day of August. That’s enough for 3 free award nights at a Category 7 Marriott hotel – the highest category – for the remainder of 2018 (60,000 X 3 = 180,000).

Wonder what category the Sheraton Kauai will be

Or, with the 5th night free on award stays, I could pay for 4 nights at a Category 5 hotel, and get 5 nights for 140,000 points and still have some left over. We don’t yet know how the categories will shake out, but Marriott gave a preview for hotels in Bali, Dubai, the Caribbean, New York, and Paris.

There will be some great deals with fall and winter – and now is prime time to scoop up as many Starwood points as you can before The Triplin’ in August!

Change your closing date!

It would suck to spend big bucks on a card to find it closes mid-month and you’ve missed The Triplin’. So here’s what I recommend: change your closing date to the 26th or 27th of the month. Because it takes a few days for Amex to send the points to your Starwood account. Not the due date – the closing date. That’s the day a new billing cycle begins.

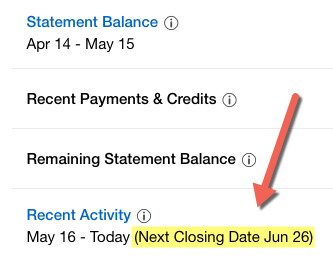

I switched my closing date to the 26th of the month to be on the safe side

My closing date was the 15th. But I changed it to the 26th. That’ll give me 11 more days to make purchases and pay bills – and have points post in time to get The Triplin’.

I couldn’t find where to do this online. So I called the number on the back of my card and the phone agent updated it instantly.

If your due date is at the beginning or middle of the month, it would give you more time to spend next month.

And if it’s beyond the 26th or 27th, you might want to move it up a couple days to make sure your points post in time (there are 31 days in July).

Bottom line

I’m hedging bets on the upcoming Marriott-Starwood cards and switching all my spending to Starwood Amex cards for the next couple of months.

And, to maximize the window of opportunity, I recommend changing your closing date to the 26th or 27th of the month to account for the few days it takes for Amex to send points to Starwood.

On August 1st, 2018, whatever’s in your Starwood account will triple – so right now you’re earning 3X points per $1 spent in anticipation of that date, and 5 solid months of excellent award redemptions.

But, as of 2019, Marriott will be a relic in my eyes. Everyone hates on Hilton, but it works for me. And as long as Hyatt’s chart stays the same, I’ll continue to transfer Chase Ultimate Rewards points to stay free at their hotels. This is my last-ditch effort to stay at some nice Starwood hotels. Do or die, now or never.

Here’s hoping for a good Category 5 hotel for a 5-night stay (with the 5th night free!) later this year.