CORPORATE GOVERNANCE – MODULE OUTLINE

This module is intended for advanced undergraduates in business and management, accounting, finance, or economics, and Master students. The module is delivered over a total of 24 hours of lectures with a flexible format including traditional lectures, class discussions of the end-of-chapter questions in Goergen (2018) and the multiple choice questions (see below). AIMS OF THE MODULEThis module aims to introduce you to recent developments in the theory and practice of corporate governance. The module adopts an international perspective by comparing the main corporate governance systems across the world. LEARNING OUTCOMES OF THE MODULEOn completion of the module you should be able to: Evaluate the current state of corporate governance in an international context; describe differences in corporate control and managerial power across the world; assess the potential conflicts of interests that may arise in various corporate governance environments; critically evaluate the effectiveness of the main corporate governance mechanisms and their impact on firm value; explain the potential consequences of weak corporate governance as well as behavioural biases on corporate decision making and firm value; analyse the development of corporate social responsibility. SYLLABUS CONTENTDefining corporate governance and key theoretical modelsCorporate control across the world – Control versus ownership rightsTaxonomies of corporate governance systemsBoards of directorsThe disciplining of badly performing managers under different systems of corporate governance Corporate governance regulation in an international contextCorporate governance in emerging marketsBehavioural biases and corporate governanceCorporate social responsibility and socially responsible investment READINGGoergen, M. (2018), Corporate Governance. A Global Perspective. Andover: Cengage EMA, ISBN 978-1-473-75917-6.

Defining corporate governance and key theoretical modelsGoergen (2018), chapter 1.

Corporate control across the world Control versus ownership rightsGoergen (2018), chapters 2-3.

Taxonomies of corporate governance systemsGoergen (2018), chapter 4.

Boards of directorsGoergen (2018), chapter 7.Incentivising managers and disciplining badly performing managersGoergen (2018), chapter 8.

Corporate governance regulation in an international contextGoergen (2018), chapter 6.

Further resources

An extensive library covering most national and international codes of corporate governance can be found on the website of the European Corporate Governance Institute (ECGI): http://www.ecgi.global/content/codes Corporate governance in emerging marketsGoergen (2018), chapter 9.

Behavioural biases and corporate governanceGoergen (2018), chapter 12.

Corporate social responsibility and socially responsible investmentGoergen (2018), chapter 13.

ADDITIONAL MODULE RESOURCESPowerPoint Slides

100 multiple choice questions

End-of-chapter discussion questions and exercises – Instructor’s manual

European Corporate Governance Institute (ECGI)

Andrei Shleifer’s dataset website with investor protection and anti-director rights indices

Social Sciences Research Network

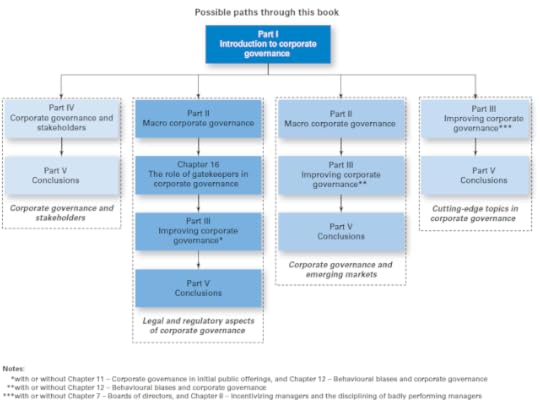

NOTEThe above module outline is just one of the many paths through Goergen (2018). There are others, some of which are depicted in the diagram below.

Defining corporate governance and key theoretical modelsGoergen (2018), chapter 1.

Corporate control across the world Control versus ownership rightsGoergen (2018), chapters 2-3.

Taxonomies of corporate governance systemsGoergen (2018), chapter 4.

Boards of directorsGoergen (2018), chapter 7.Incentivising managers and disciplining badly performing managersGoergen (2018), chapter 8.

Corporate governance regulation in an international contextGoergen (2018), chapter 6.

Further resources

An extensive library covering most national and international codes of corporate governance can be found on the website of the European Corporate Governance Institute (ECGI): http://www.ecgi.global/content/codes Corporate governance in emerging marketsGoergen (2018), chapter 9.

Behavioural biases and corporate governanceGoergen (2018), chapter 12.

Corporate social responsibility and socially responsible investmentGoergen (2018), chapter 13.

ADDITIONAL MODULE RESOURCESPowerPoint Slides

100 multiple choice questions

End-of-chapter discussion questions and exercises – Instructor’s manual

European Corporate Governance Institute (ECGI)

Andrei Shleifer’s dataset website with investor protection and anti-director rights indices

Social Sciences Research Network

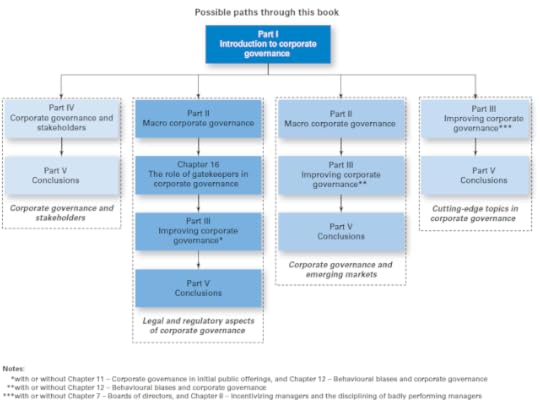

NOTEThe above module outline is just one of the many paths through Goergen (2018). There are others, some of which are depicted in the diagram below.

Published on May 08, 2018 12:25

No comments have been added yet.