Indie authors should complete Schedule SE

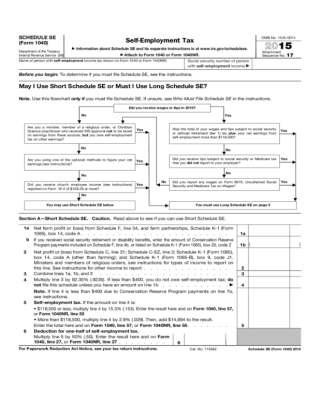

An important  federal tax form that indie authors will have to file is Schedule SE.

federal tax form that indie authors will have to file is Schedule SE.

The schedule calculates the self-employment taxes owed for Social Security and Medicare. Since you don���t earn a paycheck, the government collects your contribution to those programs via self-employment tax. The form is attached to the IRS Form 1040.

Determining your self-employment tax first requires that you know your net income from your business. That is determined by completing Schedule C.

If your income only comes through self-employed income, you likely only need to complete the short form in Schedule SE���s Section A. If you earn income in addition to being self-employed (such as if you have a day job), you���ll need to complete Section B.

The form is fairly straightforward and easy to complete ��� so long as you���ve been keeping good business records. The numbers you need to complete the form will be found in your general ledger account.

Once you���ve calculated your self-employment tax, that number is placed in two spots on your 1040.

If you���ve learned less than $400 from self-employed income, you don���t owe any self-employment tax. In addition, while the total net profit from all of your businesses is reported, only the first $106,800 is taxable for Social Security purposes.

Professional Book Editor: Having your novel, short story or nonfiction manuscript proofread or edited before submitting it can prove invaluable. In an economic climate where you face heavy competition, your writing needs a second eye to give you the edge. I can provide that second eye.

Amazon.com Widgets