St. Louis Fed Promotes the Mathematically Impossible

It’s bad enough when economic writers are clueless about how markets work. It’s worse when Fed economists are clueless.

Check out this Tweet by @StLoiusFed.

St. Louis Fed

@stlouisfed

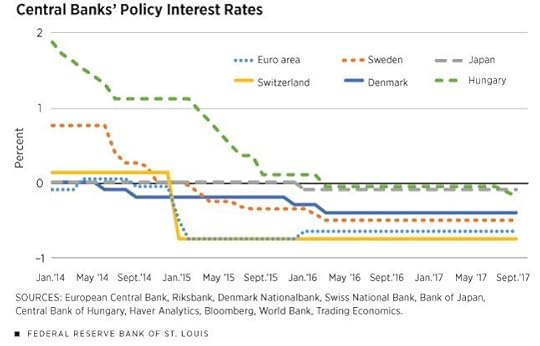

Negative interest rates may seem ludicrous, but not if they succeed in pushing people to invest in something more stimulating to the economy than government bonds http://bit.ly/2ASFrRz

10:00 PM – Dec 15, 2017

170 people liked this Tweet.

Understanding the Math

Negative interest rates cannot push people into more stimulating investments.

No matter how negative the rate, someone has to hold every treasury bond and someone has to hold every dollar in circulation.

In the equity markets, for every buyer of stocks, there is a seller, thus the sideline cash argument fails as well.

It’s bad enough when analysts fail to understand basic economics, but even Fed economists are clueless about how markets work.

Negative rates cannot possibly do what the Fed suggests, but they can foster an artificial wealth effect when people borrow or spend more than they should.

Any economic gain spurred on by reckless borrowing will all be taken back and then some, in the next recession.

Zombie Corporations

Negative real rates also foster zombie corporations. The BIS defines Zombie firms as those with a ratio of earnings before interest and taxes to interest expenses below one, with the firm aged 10 years or more.

As it sits, 10% of corporations are zombies, unable to make interest payments from profits.They need cheap money to survive.

For discussion, please see Zombie Corporations: 10% of Companies Depend on Cheap Central Bank Money.

If the St. Louis Fed economists see a sustainable benefit from spurring zombie corporations, they are wrong about that too.