These Are The Top Geopolitical Risks According To The World’s Largest Asset Manager

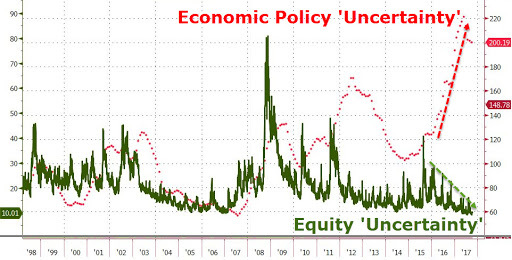

Like many others, the world‘s largest money manager with $5.9 trillion in (ETF) investments, BlackRock, is not too worried about a market which no matter what, promptly rebounds from any and every selloff, and seems to close at all time highs day after day as if by magic. To be sure, BlackRock’s employees are delighted: the less the volatility, and the higher the S&P goes, the more likely retail investors are to hand over their cash to BlackRock. So far so good. Still, not even Blackrock can state that after looking at this chart, which unveils unprecedented economic policy uncertainty at a time when equity uncertainty has never been lower…

… that everything is ok.

And it doesn’t: in a blog post by BlackRock’s Isabelle Mateos y Lago, Blackrock’s chief multi-asset strategist writes that while markets may be a sea of calm, geopolitics are anything but. As a result, the world’s biggest ETF administrator has its eyes on 10 geopolitical risks and is tracking their likelihood and potential market impact, as it wrote recently in the firm’s Global Investment Outlook Q4 2017.

The “world of risk” map below is a quick snapshot of all

Among the Top risks tracked by Blackrock are:

North American trade negotiations

Russia-NATO conflict

South China Sea conflict

US-China tensions

Escalations in Syria and Iraq

North Korea conflict

Fragmentation in Europe

Gulf conflicts

Of the risks listed above, which are the ones BlackRock is most worried about? According to Mateos y Lago, the top three right now: North American trade negotiations, a North Korea conflict and U.S.-China tensions, with the second and third particularly interrelated.

…click on the above link to read the rest of the article…