THE BANNED NORTH KOREA INTERVIEW

This interview was taken by...

THE BANNED NORTH KOREA INTERVIEW

This interview was taken by The Penn Political Review, a publication by the University of Pennsylvania, the Alma Mater of Donald Trump and Ivanka Trump, in

October 2016.

It was not published! The publishers say it is a magazine

which includes “a wide spectrum of student, faculty, and guest opinions from

the University of Pennsylvania and beyond.” And they also explain it is “created and motivated by

freedom of speech”.

Perhaps they are not motivated by it, but Felix Abt is and that’s why the interview is now published here!

A SOBER LOOK AT BUSINESS AND INVESTMENT OPPORTUNITIES AND RISKS

IN NORTH KOREA

Penn Political Review (PPR): What are some of the most

profitable investments in North Korea?

Felix Abt: Since many consumers have risen from a

destitute level of income over the last 15 years to a level that covers basic

needs or that reaches a middle-income, or even became part of the emerging

entrepreneurial middle class, consumer-oriented businesses, from fast-moving

consumer goods to telecommunication, have seen a significant boost in sales and

profits. The mobile phone subscription by more than 3 million inhabitants of

this country of 25 million within a few years illustrates this development.

This has been rather breath-taking by North Korean standards.

As a result, the processing of products such as

cloth or leather to meet consumers’ rising demand for affordable yet more

trendy clothes, shoes and bags has made sense for small and medium-sized

Chinese and other investors. Other items currently made in North Korea by

foreign investors, which can be partly sold domestically as well as exported to

China and other Asian countries, range from artificial flowers to false teeth.

Since the manufacturing of such products is rather low tech and requires only a

6- to 7-digit USD investment, they have attracted dozens of smaller Chinese

manufacturers.

PPR: Can western companies expect these markets to

be opened soon?

Abt: North Korea has been open for foreign

investors and traders for about two decades. When I compared the Foreign Direct

Investment (FDI) laws and regulations of China and Vietnam with North Korea’s

more than a decade ago, I couldn’t notice, at least not on paper, any

significant differences. But let’s look at the bigger picture:

1. We have to keep in mind that emerging or frontier markets are

high-risk markets with a very high rate of

business failures that will decline only over many

years as all stake holders learn from a lengthy trial and error period. Prudent

investors in these markets clearly prefer to invest in smaller projects or

disburse larger amounts of capital over a long

period of time to minimize risks and even try

to keep control over key components of their North Korean manufacturing venture.

Let me illustrate this protracted process with a

concrete example: In the nineties the German chancellor and the Vietnamese

prime minister set up a German-Vietnamese dialogue forum where complaints and

issues between German (and other foreign) investors and their Vietnamese

counterparts were addressed. I was an active participant as I was then

representing a large pool of German companies in Vietnam. Over many years the

thick book full of issues became thinner. Both sides went through an important

and unavoidable learning process leading to a smoother investment and business

environment which helped Vietnam’s economy achieve extraordinarily high growth

rates.

2.

Though the long-term market potential of an emerging market may be high,

business volumes at the beginning are usually small, and so are profits.

Investors in such markets think long-term and invest in a strong market position

(that is high market shares) to harvest over-proportionally when the emerging

market gets more mature and larger. (Followers who try to avoid the risks the

‘early birds’ take enter the market at this ‘late’ stage but will then have to

pay a high market entry price as they’ll face an uphill struggle against the

established competitors)

And

3. Let’s

not forget that entrepreneurs always take risks and that most entrepreneurial

start-ups fail, and not

only in emerging markets.

PPR: How is the legal system changing to attract

foreign investment?

Abt: The legal system is following the changes in

society, and they have been quite dramatic under the surface, hardly noticed by

the outside world. Let me illustrate that: When I settled in Pyongyang advertising

was still illegal. That was truly upsetting for a foreign businessman. But I

discussed the necessity to do advertising to allow my enterprise to survive

with the authorities for quite a long time until I was allowed to start doing

advertising. And you can imagine how pleased I was when a student of the Pyongyang Business

School which I co-founded and run, officially set up North Korea’s first advertising

company.

To give you another example: Staff was at first

always allocated by the state. Thus I had not been allowed to choose from

different candidates when I hired employees. I wanted to change that too: I

once saw a very enthusiastic North Korean lady successfully selling stuff at an

exhibition. I was impressed and decided to hire her. After lengthy negotiations

we reached a deal with her employer who allowed her to quit and join us. With

such “deals” we managed to get the best suited staff from various organizations

thereafter.

PPR: In your opinion, has Western media

misrepresented the development in the country?

Abt: Western media reports contain lots of

opinions, mostly biased, and speculations, often unfounded, but few facts and

seldom an objective analysis. So as an investor in such a frontier market you

learn much more by talking to five different Chinese entrepreneurs on their

experiences in North Korea than reading all North Korea articles published by

the Wall Street Journal, the Washington Post and the Economist combined.

One example: North Korea is portrayed as the world’s

most corrupt country by the mainstream media. When I was a regional director of

a pharmaceutical multinational corporation in Africa we were often confronted

with health officials and gatekeepers who tried to use coercive ways to press

personal gains out of my company. So when, for example, we wanted to launch an

effective anti-malarial (after other anti-malarials had become ineffective due

to overuse causing high resistance), a health minister of an African country

could come up and say that he would only allow the registration, that is admission,

of this new pharmaceutical if we sponsored his son’s university studies in the

United States.

However, when I ran a pharmaceutical enterprise in

North Korea I was never confronted with demands to bribe anybody to get the

pharmaceuticals registered and onto the pharmacy shelves. I was involved in

other businesses in North Korea and there too I was never confronted with the nefarious

demands that I had found quite frequent in the other developing countries where

I had done business. Of course, there is corruption but at least foreign

investors are clearly less confronted with it in North Korea than in so many other

developing countries. That’s based on my private comparisons with investors in

other developing countries.

PPR: How profitable were your own ventures?

Abt: There was a good measure of business failures

for a number of reasons – and I couldn’t blame all of them on North Korea. But

overall my ventures have been profitable, albeit profits were quite moderate.

And the profit and other taxes we paid to the government would not have been large

enough to help fund the political system for a minute, let alone help finance

the country’s nuclear program…

PPR: Moving forward, what factors will determine

the development of business in the country?

Abt: At present, there is not much that drives

business forward; on the contrary, most if not all industries require at least

some products (such as so-called dual use items) for their manufacturing

processes, which are banned by sanctions. If these sanctions are enforced,

manufacturers will have a stark choice to make: manufacture either faulty

products or shut down production. Also, the country’s exports (coal, metals and

minerals) have been banned by sanctions with only a few exceptions. If they’re

enforced, the country’s hard currency income will vanish quickly and imports

cannot be paid for any longer. Numerous other products, from American lipsticks

to French cheese, to Italian salami to Swiss ski lifts and watches, considered as luxury,

are prohibited as well. Moreover, North Korea’s banking system is cut off from

the international banking system. This has become so absurd that foreign

investors have to bring money in a suitcase and have to collect their dividends

in bags in Pyongyang. And if the U.S. succeeds in persuading China to prohibit

North Korea’s state carrier to fly to China, foreign business people with

little time to waste will be forced to undertake long train journeys to and from

North Korea.

Obviously, current U.S. and South Korean government

policies are aimed at bringing the DPRK down. It means that any business

considered legitimate in other countries, are now increasingly “illegitimate”

in North Korea, as such policies tend to ostracize and criminalize all business

activities with this so-called Pariah state. And in a jungle of sanction laws

and regulations that differ from country to country, foreign business people

sourcing across the globe without always knowing the exact origin of an item

can easily be held responsible for any of the numerous sanctioned products in

any country and incur a huge reputational damage, regardless of the fact that

they’re used for civilian purposes. So doing business with North Korea makes

you prone to becoming a serious casualty in an economic war.

For these reasons I have started divesting my

financial participation in North Korean joint venture companies. Other

investors are likely to do the same and potentially new ones will shy away from

the country. Not only foreign investors, but North Korea’s middle class is also

likely to be strongly hurt and massive poverty in the hinterland may re-emerge.

Also, we should not forget that rising middle classes in formerly authoritarian

Asian countries, from Indonesia to the Philippines to Taiwan, forced their

regimes to change. It’s an illusion that sending balloons with propaganda

material to North Korea could transform it and that the domestic and foreign

entrepreneurs couldn’t. All hostile activities are doing is making the regime

feel more insecure and having it allocate more of the very scarce resources to

its self-preservation, while reforms are shelved and repression increases.

PPR: How does one get a job like yours?

Abt: The ABB Group, a global leader in power and automation

technologies, asked me to become their resident country

director in North Korea and build up their business there. I had worked

for ABB before, so they knew me. But I don’t know the exact reason why they

chose me. When they did I was reporting to a Swedish member of the Executive

Committee who had successfully set up one of the very first foreign-invested

factories in China when it opened up. That had then definitely not been a task

for the faint-hearted, but for a pioneer and change agent that he was. He

expected me to follow in his footsteps in North Korea.

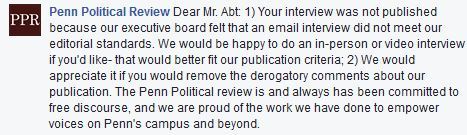

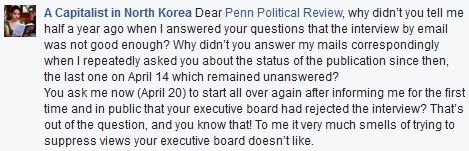

UPDATE:

Comments in reaction to this post from the Facebook page of A Capitalist in North Korea:

☆

☆

☆

☆

☆

Picture:

Felix Abt together with Dr. Jon Sung Hun

, CEO of North Korea’s Pugang Group. Pugang has been called “the North Korean equivalent of South Korea’s Samsung Group”. This North Korean business leader was repeatedly featured by the Financial Times, the Washington Post and others.

He is a great marketer of - in his own words - “cool motorbikes” and of natural products with allegedly extraordinary

health benefits, something which is very much loved by journalists in

desperate need of writing sensationalist North Korea pieces (and to attribute his personal marketing claims to the country’s leader).

This former Kim Il Sung university professor has a gregarious and

humorous personality. He wasn’t offended when Felix Abt dared to make fun of his

“miraculous” drugs. To journalists it must be

surprising (and perhaps disappointing) that Abt wasn’t sent to a Gulag or

at least instantly expelled as a consequence of challenging Dr. Jon’s claims.

☆

☆

☆

☆

☆

#NorthKorea #miraculous #drugs #pharmaceuticals #Viagra #hot #motorbikes #Pugang #interview #PennPoliticalReview @universityofpennsylvania