The End of Quantitative Easing – Perhaps Now It Will Be Inflationary?

One of the greatest monetary experiments in financial history has been the global central bank buying of government debt. This has been touted as a form of “money printing” that was supposed to produce hyperinflation, which never materialized as predicted by the perpetual pessimists. Nevertheless, the total amount of Quantitative Easing (QE) adding up the balance sheets of the Federal Reserve (Fed), the European Central Bank (ECB) and Bank of Japan (BOJ) is now around $13.5 trillion dollars, which by itself is a sum greater than that of China’s economy or the entire Eurozone for that matter.

If QE failed to produce inflation, then ending QE may actually produce the inflation people previously expected. Where’s the strange logic in that one? Well you see, it really does not matter how much money you print, if it never makes it into the economy, it will not be inflationary. Additionally, even if it makes it into the economy and the people hoard for a rainy day, it still will not be inflationary.

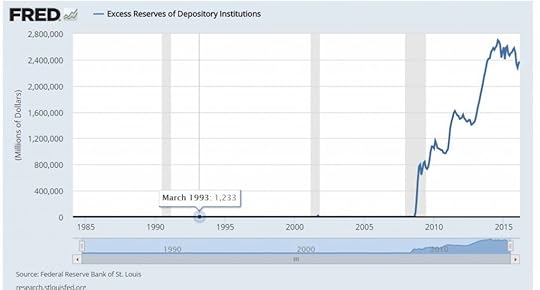

The craziest thing the Fed did was create excess reserves. The bankers complained that the Fed was buying the government debt so they would have no place to park their money. The Fed then accommodated them creating the Excess Reserves facility and paid them interest for absolutely no reason whatsoever. Almost $3 trillion was parked at the Fed collecting interest so that $4.5 trillion of “printing” money never made it out the door. Hence, there was no inflation to speak of (outside of healthcare which always rises no matter what), and people hoarded. The pundit kept calling for a crash in the stock market but overlooked the fact that retail participation was at historic lows. Why? They were hoarding their money.

…click on the above link to read the rest of the article…