Local Idiot: Tax The Poor!

In a letter entitled Rhoades At It Again in The Pilot (where my weekly column appears), local idiot Jack Jakucyk once again raises that old discredited argument that it's not the rich, but the poor who aren't paying their fair share. In reference to this column, he starts off with the name-calling right wingers claim to despise, unless they're engaging in it:

Dusty, with his degree from the Karl Marx School of Economics, suggests that the rich not only don't create jobs, they also don't pay their "fair share" of taxes.

Then he goes on to parrot one of the more egregiously stupid arguments of the American Right:

At the other end of the spectrum, the bottom half (71 million returns) contributed only 3 percent of total tax revenues. And 51.8 million of the 142 million returns from your fellow Americans had no income tax liabilities due to deductions, tax credits, etc. This may seem counterintuitive, but I wonder if it's a good thing for our society when half the population pays essentially no taxes. They have no dog in the fight. But Dusty Rhoades is on their side.

They don't pay taxes because they're poor, doofus. It's the old "lucky duckies" argument that was so roundly mocked when the WSJ first floated it. Take, for example, this article by Noble Prize laureate Paul Krugman which points out that:

The Journal considers a hypothetical ducky who earns only $12,000 a year ? some guys have all the luck! ? and therefore, according to the editorial, "pays a little less than 4% of income in taxes." Not surprisingly, that statement is a deliberate misrepresentation; the calculation refers only to income taxes. If you include payroll and sales taxes, a worker earning $12,000 probably pays well over 20 percent of income in taxes. But who's counting?

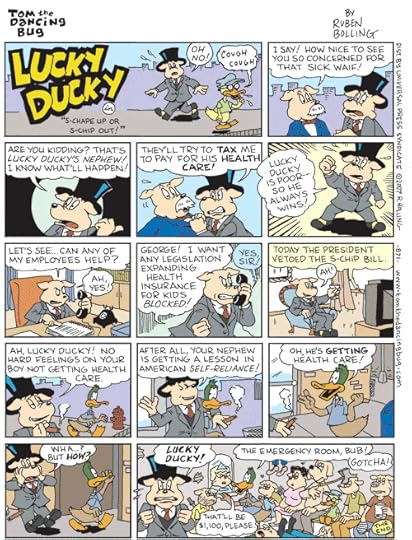

Or then there's Reuben Bolling, who brilliantly skewered the whole idea with his character "Lucky Ducky":

It's such a persistent fallacy of the Right that I thought it merited being addressed for a wider audience.

Just keep in mind, every time someone raises this claptrap about how "some people at the bottom don't pay any taxes, and that's not fair" that:

(a) it's a deliberate misrepresentation; and

(b) what they're really demanding is more taxes on the poor.

As Jonathan Chait wrote:

One of the things that has fascinated me about The Wall Street Journal editorial page is its occasional capacity to rise above the routine moral callousness of hack conservative punditry and attain a level of exquisite depravity normally reserved for villains in James Bond movies.

So I guess we we can say that Mr. Jakucyk studied at the Blofeld School of Economics.

Oh, and he conveniently fails to address the statistics showing that tax rates don't affect job creation. Wonder why that is? Maybe because he can't...Fox News hasn't told him how.

Dusty, with his degree from the Karl Marx School of Economics, suggests that the rich not only don't create jobs, they also don't pay their "fair share" of taxes.

Then he goes on to parrot one of the more egregiously stupid arguments of the American Right:

At the other end of the spectrum, the bottom half (71 million returns) contributed only 3 percent of total tax revenues. And 51.8 million of the 142 million returns from your fellow Americans had no income tax liabilities due to deductions, tax credits, etc. This may seem counterintuitive, but I wonder if it's a good thing for our society when half the population pays essentially no taxes. They have no dog in the fight. But Dusty Rhoades is on their side.

They don't pay taxes because they're poor, doofus. It's the old "lucky duckies" argument that was so roundly mocked when the WSJ first floated it. Take, for example, this article by Noble Prize laureate Paul Krugman which points out that:

The Journal considers a hypothetical ducky who earns only $12,000 a year ? some guys have all the luck! ? and therefore, according to the editorial, "pays a little less than 4% of income in taxes." Not surprisingly, that statement is a deliberate misrepresentation; the calculation refers only to income taxes. If you include payroll and sales taxes, a worker earning $12,000 probably pays well over 20 percent of income in taxes. But who's counting?

Or then there's Reuben Bolling, who brilliantly skewered the whole idea with his character "Lucky Ducky":

It's such a persistent fallacy of the Right that I thought it merited being addressed for a wider audience.

Just keep in mind, every time someone raises this claptrap about how "some people at the bottom don't pay any taxes, and that's not fair" that:

(a) it's a deliberate misrepresentation; and

(b) what they're really demanding is more taxes on the poor.

As Jonathan Chait wrote:

One of the things that has fascinated me about The Wall Street Journal editorial page is its occasional capacity to rise above the routine moral callousness of hack conservative punditry and attain a level of exquisite depravity normally reserved for villains in James Bond movies.

So I guess we we can say that Mr. Jakucyk studied at the Blofeld School of Economics.

Oh, and he conveniently fails to address the statistics showing that tax rates don't affect job creation. Wonder why that is? Maybe because he can't...Fox News hasn't told him how.

Published on August 26, 2011 05:24

No comments have been added yet.