How to Prepare and Submit a NYC Co-op Application

New York City co-op boards are notoriously discerning in approving aspiring applicants. While laws, such as those barring discrimination, cannot be broken, the board has wide latitude in accepting applicants. While part of the package includes an REBNY financial statement, other key components should be presented. We are going to go through the application step-by-step for you to have a thorough understanding.

Organization your Coop application is key

The application is more than a batch of papers. Think of it as you would a presentation at work. Whether the board is filled with those with old-fashioned ideas or you are facing a younger, hipper audience, an easy to follow presentation is always appreciated. It should be well-organized and easy to follow. A table of contents with different sections is a good idea. The information should be correct and consistent. Proofread your work. Then, have others review the information.

Image by / Flazingo Photos

A management company may require a specific way the application should be bound. In any event, using blue pages subtitled based on the table of contents is the perfect way to package it clearly, with each section properly noted in the same order. Remember, neatness counts.

Example of Coop Application Table of Contents:

1. Purchase application (attached)

2. Fully Executed Contract of Sale

3. Landlord/managing agent reference letter

4. A letter from the prospective purchaser’s employer verifying annual salary, a position held & length of employment. If self-employed please provide a letter from your accountant detailing the same.

5. Letter from bank(s) stating types of account, and amounts on deposit. Please include account numbers.

6. Statement of Financial Condition showing all personal assets and liabilities with documentation (brokerage statements, bank statements, etc.) supporting all assets listed for the most recent two months (attached)

7. Three personal reference letters

8. Submission of the preceding two (2) years Federal Income Tax returns (complete with schedules and W-2’s).9. Three (3) recent and consecutive pay stubs

9. Three (3) recent and consecutive pay stubs

10. Consent Form (attached)

11. Two (2) forms of personal identification must be submitted with this application

12. Fully executed certificate of foreign status

13. Lead Based Disclosure Form

14. Window Guard Form

15. Door Protocol form

16. Emergency Contact Information

An overview

Needless to say, your application should also be complete. Any missing information could delay or even kill your chances of getting the co-op unit. Remember, your buyer’s agent can be an immense help. He or she has helped many people compile and complete board applications and knows what information to highlight. Your agent will sit down with you and walk you through the package, asking for the documentation. He or she enters the data by typing into a pdf, and forwards for your signature. This is a time-consuming process, but your agent is on your side and will get you through the process.

Although it varies by the co-op board, there are typically a lot of sections to fill out, which is why an organization is a key to making your life easier. There will likely be a purchase application. This includes basic information, such as your name, the unit number, number of shares, contact information, employment information, housing history, mortgage information, educational history, and your business and personal reference contact information. A contract of sale should be part of your package.

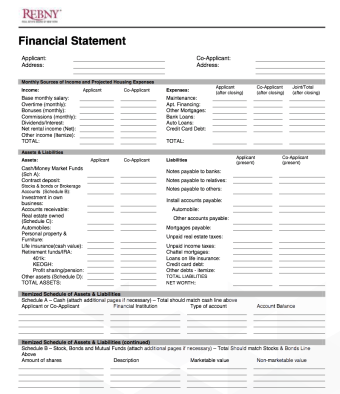

An REBNY financial statement is a crucial component. The financial statement should have all the necessary backup documentation needed for verification following the statement in order of data entries. This includes bank/brokerage statement. On the subject of financials, the board will need to see a copy of the loan commitment letter, if financing.

An REBNY financial statement is a crucial component. The financial statement should have all the necessary backup documentation needed for verification following the statement in order of data entries. This includes bank/brokerage statement. On the subject of financials, the board will need to see a copy of the loan commitment letter, if financing.

You also need three originals of a Recognition Agreement. Two are kept by the lending bank, and the building’s property manager retains the other. This is a three-way agreement between you, the bank, and the board. The co-op pledges to alert the bank if you fail to pay the maintenance fees, along with other items, such as if you seek to sublet or sell your apartment.

A letter from your employer verifying your employment is also needed. This should include how long you’ve worked there and your compensation history. All employment and reference letters should be on letterhead and contain signatures and contact information.

You are also going to need copies of your tax return.

You likely need business and personal references. Many boards require you to include photo identification with your package.

The nuts & bolts

Using a real life example should illustrate the application process better. The first two sections are the purchase application (which we discussed previously) and the fully executed contract of sale. These should be straightforward.

Next, come reference letters from your landlord/managing agent. Again, remember this should be on official letterhead and signed. The letter should discuss the type of tenant you have been and how long you have been at the residence. This board requires a letter from your employer verifying your salary, the position you hold, and the length of employment. If you are self-employed, a letter from your accountant should provide the same information. However, since your earnings may be more volatile, we suggest providing more information, such as a description of your business, several years worth of profit/loss statements, and major clients. A letter from your bank showing the types of accounts, including account numbers, and the amount of the deposit is also required. Bank letters can be obtained by asking the branch manager.

The sixth item is a Statement of Financial Condition. This shows your assets and liabilities, and you need to provide back-up documentation (e.g. brokerage and bank statements) supporting the amount shown for the past two months.

You should have three personal references for this building (sometimes only two are needed. These should not be overlooked. The personal letters should be detailed and include the length of time you have known each other, and character traits with examples.

Personal Reference Letter Sample

This board also seeks to check your past earnings history, requiring your federal income tax returns for the prior two years. You need to include the full return, with schedules and W-2 statements. Remember, if it was filed with the IRS, the board wants to see it.

A co-op board also wants to see three consecutive pay stubs, ensuring you remain gainfully employed. Many employers have online statements, making this easy to obtain. Otherwise, make copies of your paystubs. If necessary, ask your payroll department.

The next section calls for a consent form. It is easy to forget, but in this example, you need two forms of personal identification to be submitted with your application? Why two. Remember, an incomplete application delays your purchase.

Sections 12-16 are a fully executed certificate of foreign status (if applicable) along with a lead based disclosure form, window guard form, door protocol form, and emergency contact information.

Coop Application Fees

New York City is not cheap, and the board typically applies fees to review your application. This includes those for processing your application, a credit check, and a criminal background check. There is not much you can do about these fees, but at least you should know what to expect ahead of time.

The fees vary by building, but using the same real life example provides a basis for what you can expect. There is a $125 credit report fee, a $600 application fee, and a $1,000 move in fee plus a $1,000 move in deposit. Once you are approved, there are payments due at closing. There is a $300 Recognition Agreement fee, and, if you are closing after the 15th of the month, you are required to pay the following month’s maintenance fee.

How long does this take?

Once you put this together, your agent likely will take a final look. Typically, the board will contact you in two to three weeks to schedule an interview. This varies widely, however. If you want the apartment, you are going to have to be patient and let the process run its course. While waiting for hopefully for an interview it would be prudent to prepare yourself for the questions that may be asked.

Coop Board Application Sample

Subscribe to our newsletter and get a 127 page Home Buyers eBook for free!

Email Address

First Name

Last Name

Subscribe now

The post How to Prepare and Submit a NYC Co-op Application appeared first on - Elika Real Estate.