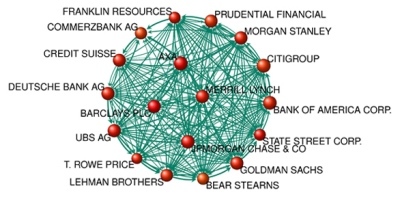

Power and ownership get concentrated into a few hands. This is clearly shown in the TED talk of James B. Glattfelder: ‘Who controls the world?‘. In this 2012 talk, he shows by analyzing the ownership links between various global companies how a limited number of financial institutions control most of the economy.

This is not surprising and is the natural consequence of the evolution of the complex, increasingly inter-related economic system. We should not be surprised and still it is an issue from the governance and political perspective.

This is not surprising and is the natural consequence of the evolution of the complex, increasingly inter-related economic system. We should not be surprised and still it is an issue from the governance and political perspective.

“It turns out that the 737 top shareholders have the potential to collectively control 80 percent of the Trans National Companies (TNCs)’ value. Now remember, we started out with 600,000 nodes, so these 737 top players make up a bit more than 0.1 percent. They’re mostly financial institutions in the U.S. and the U.K. And it gets even more extreme. There are 146 top players in the core, and they together have the potential to collectively control 40 percent of the TNCs’ value.”

This kind of studies produced the concept of “systemic” or “too big to fail” institutions. We may take regulatory measures to limit the phenomenon, but it is intrinsic to the increased complexity of the world. So my view is that we should rather learn how to deal with it.

Published on October 27, 2016 04:30