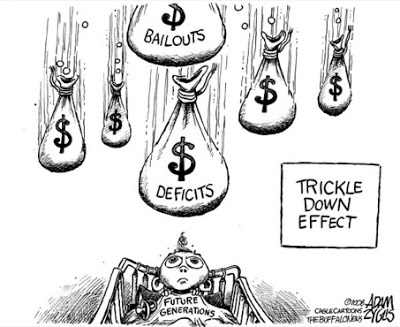

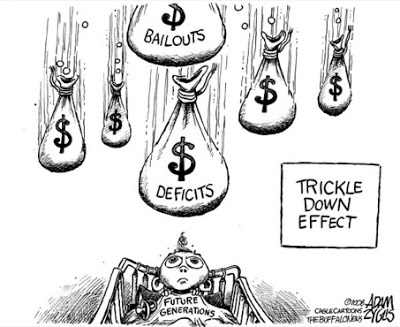

The Trickle Effect

I was talking to a good friend of mine,who lives up in theBig Bear Lake area ofCalifornia,and he asked me if I was watching theVice Presidential Debate."Sorry no,"I answered.Well,one thing led to anotherand of course the nameDonald Trumpcame up.We talked about howDonald,wants to giveBig BusinessaTax Breakfrom paying today at35%to paying only at15%.Wow,I guess he expects the failure of theRonald Reagan's Trickle Down Effect will work this time around if he implements it.Or,is it to help hisand his friend'sPocket Booksto get fatter?

Trickle-Down Economics: Four Reasons Why It Just Doesn't WorkBy Mehrun Etebari"We've all heard the claims that cutting tax rates for the richest Americans will improve the standard of living for the working class. Supposedly, top-bracket tax breaks will result in more jobs being created, higher wages for the average worker, and an overall upturn in our economy. It's at the heart of the infamous trickle-down theory. The past 40 years have seen a gradual decrease in the top bracket's income tax rate, from 91% in 1963 to 35% in 2003. It went as low as 28% in 1988 and 1989 due to legislation passed under Reagan, the trickle-down theory's most famous adherent. The Clinton years saw the top bracket hold steady at a higher rate of 39.6%, but under the younger Bush's tax-cut policies, the rich are once again paying less. The drastic change in tax policy that has taken place since the early 1960s gives us a great opportunity to study and evaluate the claims that lower taxes for the rich translate to more wealth for the average American."Cutting the top tax rate does not lead to economic growth."It is true that growth increased drastically after the 1982 tax cut, reaching as high as 7.3% in 1984. However, as the Reagan-Bush, Sr. administrations went on and taxes for the rich were slashed even further, growth fell to negative levels during 1991, at the heart of the last recession. And, two of the three years with the highest growth were during the 1950s, when the top tax rate was 91%. Overall, there seems to be no close relationship between the top tax rate and the GDP growth rate, and statistical analysis backs this up: the correlation coefficient between the two variables is 0.03, meaning that there is essentially no connection. (If tax cuts were strongly related to GDP growth, we would see a coefficient close to -1.) So much for upper-class tax cuts boosting the economy; now it's on to median income growth." Cutting the top tax rate does not lead to income growth."Again, we see inconclusive evidence for the power of tax cuts. We do see small peaks in median income growth, a good measure of how the average American household is doing, after top-bracket tax cuts in the mid-1960s and early 1980s, but we also actually see income decreases after the tax cuts of the late 1980s, and strong growth after the tax increase of 1993. It is true that in the year with the worst median income decrease (3.3% in 1974), the top tax rate was 70%. However, it was also 70% in the year with the highest median income growth (4.7% in 1972)! Once again, the lack of connection between the two measures is backed up by a correlation coefficient near zero: 0.06, to be exact. And yes, yet again, the coefficient is positive, indicating that income has gone up slightly (though negligibly) more in years with higher taxes. Two strikes. How about hourly wages?"Cutting the top tax rate does not lead to wage growth."Not surprisingly, we have mixed results yet again! Growth in average hourly wages did increase during the 1980s following the first Reagan tax cuts, albeit two years after the cuts took effect. But, just like GDP growth and median income growth, hourly wages decreased following the late 1980s tax cuts, and spiked upwards after the 1993 tax increase. Furthermore, wages grew at a level of at least 1%, and usually much more, all throughout the period when the top income tax rate was 91%. In fact, it isn't until 1972 that we see a wage growth rate of less than 1%. However, if we look at the 19 years of the study period when the top tax rate was 50% or less, we see that 8 of the years saw an increase in wages of less than 1%. Thus, it seems that hourly wages grew more when taxes were higher - indeed, the correlation coefficient is 0.34, indicating a mild positive relationship between higher taxes for the rich and higher hourly wages. This finding flies in the face of the conservative theory." "Overall, data from the past 50 years strongly refutes any arguments that cutting taxes for the richest Americans will improve the economic standing of the lower and middle classes or the nation as a whole. To be sure, the economic indicators examined in this report are dependent on a variety of factors, not just tax policy. However, what this study does show is that any attempt to stimulate economic growth by cutting taxes for the rich will do nothing -- it hasn't worked over the past 50 years, so why would it work in the future? To put it simply and bluntly, Trump's top-bracket tax cut is an ineffective attempt at stimulus that will not cause any growth -- unless, of course, if you're talking about the size of the deficit." This is,Going To Tell You Bob's Trickle Theory Tomorrow,Jim Hauenstein,And, “If a free society cannot help the many who are poor, it cannot save the few who are rich. [Inaugural Address, January 20 1961]”

- John F. Kennedy - That is my story and I am sticking to it! Like what you are reading,or do not like what you see.Set up my Blog as your Homepage,or sign up as a Follower,or leave a Comment,and I will answer you in a Post. Thanks for reading. If you haven't already,don't forget to register to Vote! You can't complain if you don't Vote!

Trickle-Down Economics: Four Reasons Why It Just Doesn't WorkBy Mehrun Etebari"We've all heard the claims that cutting tax rates for the richest Americans will improve the standard of living for the working class. Supposedly, top-bracket tax breaks will result in more jobs being created, higher wages for the average worker, and an overall upturn in our economy. It's at the heart of the infamous trickle-down theory. The past 40 years have seen a gradual decrease in the top bracket's income tax rate, from 91% in 1963 to 35% in 2003. It went as low as 28% in 1988 and 1989 due to legislation passed under Reagan, the trickle-down theory's most famous adherent. The Clinton years saw the top bracket hold steady at a higher rate of 39.6%, but under the younger Bush's tax-cut policies, the rich are once again paying less. The drastic change in tax policy that has taken place since the early 1960s gives us a great opportunity to study and evaluate the claims that lower taxes for the rich translate to more wealth for the average American."Cutting the top tax rate does not lead to economic growth."It is true that growth increased drastically after the 1982 tax cut, reaching as high as 7.3% in 1984. However, as the Reagan-Bush, Sr. administrations went on and taxes for the rich were slashed even further, growth fell to negative levels during 1991, at the heart of the last recession. And, two of the three years with the highest growth were during the 1950s, when the top tax rate was 91%. Overall, there seems to be no close relationship between the top tax rate and the GDP growth rate, and statistical analysis backs this up: the correlation coefficient between the two variables is 0.03, meaning that there is essentially no connection. (If tax cuts were strongly related to GDP growth, we would see a coefficient close to -1.) So much for upper-class tax cuts boosting the economy; now it's on to median income growth." Cutting the top tax rate does not lead to income growth."Again, we see inconclusive evidence for the power of tax cuts. We do see small peaks in median income growth, a good measure of how the average American household is doing, after top-bracket tax cuts in the mid-1960s and early 1980s, but we also actually see income decreases after the tax cuts of the late 1980s, and strong growth after the tax increase of 1993. It is true that in the year with the worst median income decrease (3.3% in 1974), the top tax rate was 70%. However, it was also 70% in the year with the highest median income growth (4.7% in 1972)! Once again, the lack of connection between the two measures is backed up by a correlation coefficient near zero: 0.06, to be exact. And yes, yet again, the coefficient is positive, indicating that income has gone up slightly (though negligibly) more in years with higher taxes. Two strikes. How about hourly wages?"Cutting the top tax rate does not lead to wage growth."Not surprisingly, we have mixed results yet again! Growth in average hourly wages did increase during the 1980s following the first Reagan tax cuts, albeit two years after the cuts took effect. But, just like GDP growth and median income growth, hourly wages decreased following the late 1980s tax cuts, and spiked upwards after the 1993 tax increase. Furthermore, wages grew at a level of at least 1%, and usually much more, all throughout the period when the top income tax rate was 91%. In fact, it isn't until 1972 that we see a wage growth rate of less than 1%. However, if we look at the 19 years of the study period when the top tax rate was 50% or less, we see that 8 of the years saw an increase in wages of less than 1%. Thus, it seems that hourly wages grew more when taxes were higher - indeed, the correlation coefficient is 0.34, indicating a mild positive relationship between higher taxes for the rich and higher hourly wages. This finding flies in the face of the conservative theory." "Overall, data from the past 50 years strongly refutes any arguments that cutting taxes for the richest Americans will improve the economic standing of the lower and middle classes or the nation as a whole. To be sure, the economic indicators examined in this report are dependent on a variety of factors, not just tax policy. However, what this study does show is that any attempt to stimulate economic growth by cutting taxes for the rich will do nothing -- it hasn't worked over the past 50 years, so why would it work in the future? To put it simply and bluntly, Trump's top-bracket tax cut is an ineffective attempt at stimulus that will not cause any growth -- unless, of course, if you're talking about the size of the deficit." This is,Going To Tell You Bob's Trickle Theory Tomorrow,Jim Hauenstein,And, “If a free society cannot help the many who are poor, it cannot save the few who are rich. [Inaugural Address, January 20 1961]”

- John F. Kennedy - That is my story and I am sticking to it! Like what you are reading,or do not like what you see.Set up my Blog as your Homepage,or sign up as a Follower,or leave a Comment,and I will answer you in a Post. Thanks for reading. If you haven't already,don't forget to register to Vote! You can't complain if you don't Vote!

Published on October 04, 2016 21:49

No comments have been added yet.