Honest Review: Chase Sapphire Reserve 100,000 Point Offer

For my first Honest Review, I’ll come to a card I haven’t written about yet: the Chase Sapphire Reserve. Make that THE Chase Sapphire Reserve.

I’ve avoided mentioning it because, well, most of us can’t get it because of Chase’s prohibitive 5/24 rule. But, if you’re new to the points & miles world, wow. What a great place to start.

Or, if you can manage to get yourself a pre-approval in-branch (no dice here, eff you Chase!), definitely pick it up.

You can tell if you’re really pre-approved is if Chase gives you a definite APR. If they give you a range, you’re pre-qualified, not pre-approved. You want that definite number.

The Chase Sapphire Reserve is in here, or at least you’d think judging from the publicity

Another strategy would be to say screw it and apply anyway. If you’re denied, have another Chase card waiting in the wings that isn’t covered by 5/24, which are at the time of writing:

Chase British Airways

Chase Hyatt

Chase IHG

Chase Fairmont

Chase Marriott Business

Chase Ritz-Carlton

That way the inquiries will hopefully combine and hey, at least you’ll have something.

The short

An all-around stellar travel credit card with huge rewards, an eye-popping annual fee, and a long list of perks that make it more than worth its weight in proprietary metal.

The long

Link: Apply for Card Offers

Link: Honest Reviews

In exchange for the $450 annual fee, you’ll get 4 or 5 times that amount back (or more!), depending on how you redeem your points.

This card is a game-changer because right off the bat, your points are worth 1.5 cents each when you book travel through Chase.

Good job cooking this one up in those headquarters of yours, Chase

So you’re already up to $1,500 with the sign-up bonus of 100,000 Chase Ultimate Rewards points after spending $4,000 on purchases within the first 3 months of account opening.

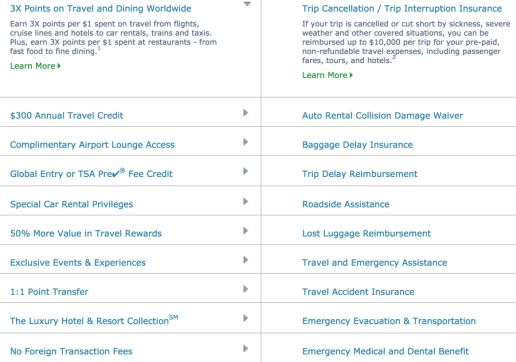

On top of that, you’ll get:

$300 annual travel credit that resets after the close of your December statement

3X Chase Ultimate rewards points on travel and dining

Priority Pass Select access with guest privileges

And lots of other bennies that might come in handy one day, like roadside assistance, emergency medical evacuation, trip delay and cancellation coverage, and 90-day price protection – for starters

Chase Sapphire Reserve travel bennies

There’s been much spilled digital ink over this card. If you want it, check your pre-approval status in branch, or perhaps throw a random application out and see what happens – if you have backup or can absorb the credit inquiry within an overall app-o-rama.

That $300 statement credit tho

If you get the card in 2016, you’ll get $300 in travel purchases credited back to your account this year. And that’ll reset after the close of your December statement.

So in early 2017, you can hit it up for another $300 in credits.

In my mind, that erases the annual fee completely the first year. And you still have that 100K sign-up bonus. With $600 in credits added in, the total value rises to $2,100 – at least.

Grade: A

Kudos, Chase. You knocked it out of the park. Everyone wants with card and you claim you didn’t even market it!

You messin’, Chase?

This card is bold, now industry-leading. 3X is a new standard for travel and dining.

And 1.5 is the new base valuation of your points. And the $300 statement credit is the highest there is (I’m looking at you Amex with $200 on the Amex Platinum Card and you Citi with $250 on the Citi Prestige).

Normally, A stands for “Are you freaking serious? Why haven’t you applied already?!”

But for Chase cards, be sure to assess your situation carefully if you’ve had a lot of cards in the recent past.

Keep or DTMFA : Keep.

Is it worth paying $450 after the sign-up bonus is used up and the $300 statement credit’s been had? I think so, if only for the 3X category.

If you spend a lot in those categories, you’ll rack up a mega amount of points throughout the year. And considering each point is worth 1.5 cents, that’s 4.5% back toward travel on those purchases.

You need to spend $10,000 in the categories to make the annual fee worth it, though.

Because 10,000 X 3 = 30,000 X 1.5 = $450 back toward toward travel booked through Chase.

$10,000 is a low figure for lots of peeps in the travel and dining categories, especially if you have a lot of paid airfare, tolls, bus and subway passes, hotel or Airbnb stays, or if you eat out a lot. In that case, you’ll earn a huge amount of points of the course a year, which makes this card a firm keep, annual fee and all.

Do you agree with my assessment? The Honest Reviews series is new, so I’d love to hear your thoughts to shape the column moving forward!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!