Recapturing The Romance Of Monetary Policy

I had a frustrating back and forth (here and here) with Corey Robin about monetary policy. He's a writer whose work I really enjoy. This 2004 Boston Review piece on neoconservatives is seminal, and his book Fear: The History of a Political Idea is great. But I felt like there was just a disconnect. I'd been asked to write something for The Atlantic, so I wrote something couched in technocratic language, and Robin was really objecting to me on thematic/ideological grounds and I wasn't doing a good job of rephrasing in the right mode of discourse.

Mike Konczal offers perhaps a better tack, noting that engagement with monetary issues has historically been at the heart of American politics:

But going back to the Cross of Gold speech, through Franklin Roosevelt's abandonment of the gold standard and aggressive price targeting, progressives and liberals have had a long-tradition with monetary battles. These battles have disappeared from the agenda, but it needs to come back as we have the right answer: money is a social creation, one that the government has a responsibility to use to stabilizing growth, prices and full employment with a view towards building a future without overheating the system or letting it choke to death from a lack of oxygen.

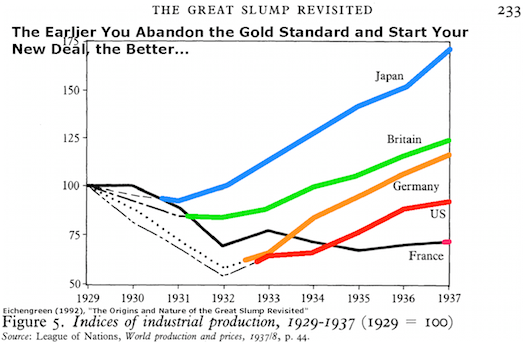

And this goes back. Both the Washington and Jackson administrations were dominated by what amounted to disputes over monetary policy. Part of what I think goes wrong in the contemporary left's understanding of this is that people have a kind of romance with the idea of the Works Progress Administration. The WPA not only helped as a relief and recovery measure, but it also instantiates progressive values about social solidarity and the importance of public investment. It's important to understand, however, that lurking behind this fiscal measure is a monetary one. Under the fiscal system that prevailed between the wars, the government's ability to spend money on public works was limited by its ability to get its hand on gold. This is why leaving the gold standard is so crucial, both here and abroad, to launching recovery from the Depression:

Here in the contemporary United States, meanwhile, it's important to understand that any demand-side solution to mass unemployment necessarily involves the central bank tolerating more inflation. That's because even in an economy with lots of excess capacity, lots of unemployed workers, etc. we still have some objective scarcities. If more people had jobs, they'd have higher incomes, and they'd try to buy more stuff. Some of that "stuff" would be things that are objectively scarce (gasoline, e.g.) and prices would go up. This would be a small price to pay for a huge reduction in human misery. But if the central bank isn't willing to pay the price, it won't work. Strict inflation targeting would mandate cutting the recovery off. It's interesting to speculate as to whether more aggressive targeting on the part of the central bank would be sufficient as well as necessary, but it's unquestionably necessary.

So to go back to the romance. Separate from and prior to the ideologically freighted question about how exactly the government should try to bolster aggregate demand is the question of whether this should be done at all. Because we've turned monetary policy over to "technocrats," it's become a question that's treated as "technical." But unless the answer is "yes," then you can't make any of these other projects work. But historically in the United States, the monetary question hasn't been treated as a technical one. And in the contemporary United States, the right seems to have recaptured an understanding of it as an ideological one. Michele Bachmann is the populist right-wing hero du jour and Paul Ryan is the technocratic right-wing hero du jour, and they're both pounding the pavement for "sound money" and a "strong dollar." What this looks like is already playing out in Europe. If you want more real output without any increase in prices, the only way to achieve that is to make things cheaper — lower wages and deregulation, or else lower taxes and reduced services.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers